Partnerships create powerful collaborations that combine strengths and resources to achieve common goals efficiently. Establishing clear communication and shared values is essential for long-term success in any partnership. Discover how to build and maintain effective partnerships by exploring the insights in the rest of this article.

Table of Comparison

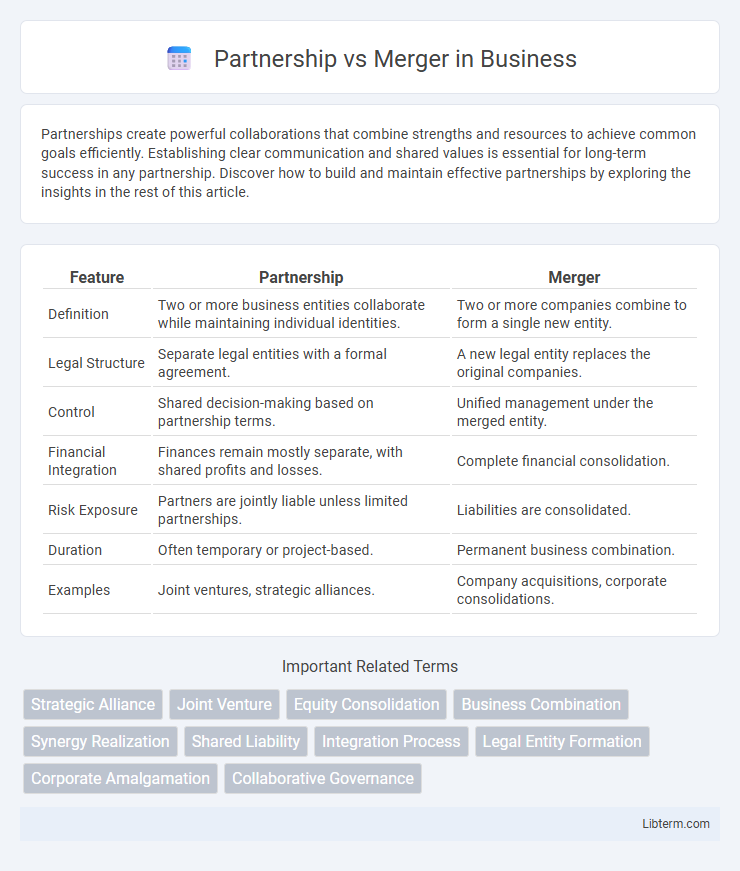

| Feature | Partnership | Merger |

|---|---|---|

| Definition | Two or more business entities collaborate while maintaining individual identities. | Two or more companies combine to form a single new entity. |

| Legal Structure | Separate legal entities with a formal agreement. | A new legal entity replaces the original companies. |

| Control | Shared decision-making based on partnership terms. | Unified management under the merged entity. |

| Financial Integration | Finances remain mostly separate, with shared profits and losses. | Complete financial consolidation. |

| Risk Exposure | Partners are jointly liable unless limited partnerships. | Liabilities are consolidated. |

| Duration | Often temporary or project-based. | Permanent business combination. |

| Examples | Joint ventures, strategic alliances. | Company acquisitions, corporate consolidations. |

Understanding Partnerships: Definition and Key Features

A partnership is a business structure where two or more individuals share ownership, profits, and liabilities, enabling collaborative decision-making and resource pooling. Key features include mutual agency, where each partner can bind the business, shared financial commitment, and joint responsibility for debts and obligations. Partnerships often emphasize flexibility in roles and profit distribution, tailored to the partners' agreement rather than strict corporate formalities.

What is a Merger? Core Concepts Explained

A merger is the legal consolidation of two or more companies into a single entity, combining assets, liabilities, and operations to foster growth, efficiency, and competitive advantage. Core concepts of a merger include synergy realization, unified management structure, and shared financial and operational control. Unlike partnerships which maintain separate identities while collaborating, mergers result in a completely new organizational framework with integrated resources and objectives.

Legal Structures: Partnership vs Merger

Partnerships operate under distinct legal structures where two or more individuals share ownership, liabilities, and profits based on partnership agreements, often regulated by state partnership laws. In contrast, mergers involve the legal consolidation of two or more entities into a single new entity or absorption of one company by another, governed by corporate law and requiring compliance with securities regulations, shareholder approvals, and due diligence. Legal implications differ significantly, as partnerships maintain separate legal identities of partners while mergers result in a unified corporate entity that assumes all assets and liabilities.

Control and Decision-Making Differences

In a partnership, control and decision-making are typically shared among partners based on ownership percentages or agreed terms, allowing each partner to influence business operations directly. In contrast, a merger consolidates two companies into a single entity where control is restructured, often resulting in centralized decision-making by a new or combined leadership team. This centralization can streamline strategic direction but may reduce the individual influence of original owners compared to the more collaborative control seen in partnerships.

Financial Implications: Cost, Revenue, and Profit Sharing

Partnerships often involve shared financial responsibilities where costs, revenues, and profits are distributed according to the partnership agreement, allowing flexibility but potential personal liability for debts. Mergers consolidate financial statements, resulting in unified cost structures, combined revenues, and integrated profit sharing, which can increase economies of scale but may require complex financial integration. Understanding these differences is crucial for managing tax obligations, financing strategies, and stakeholder expectations in both business structures.

Taxation: How Partnerships and Mergers Are Taxed

Partnerships are generally taxed on a pass-through basis, meaning profits and losses flow directly to partners' individual tax returns, avoiding corporate income tax. Mergers often trigger taxable events, including potential capital gains and transfer taxes, depending on the structure such as asset or stock acquisitions. Tax implications vary significantly based on whether the merger qualifies as a tax-free reorganization under IRS codes, influencing liability, carryover of tax attributes, and depreciation schedules.

Liability Risks: Comparing Partnerships and Mergers

In partnerships, liability risks are typically shared among partners, meaning each partner can be personally responsible for business debts and legal obligations, exposing personal assets to risk. Mergers often create a new legal entity or absorb one company into another, limiting liability exposure for individual shareholders while consolidating risks at the corporate level. Understanding the distinct liability frameworks is crucial for businesses evaluating whether to enter a partnership or pursue a merger.

Exit Strategy and Dissolution Process

In a partnership, the exit strategy typically involves buy-sell agreements or mutual consent for withdrawal, with an often straightforward dissolution process governed by the partnership agreement and local laws. In contrast, a merger entails integrating two companies into a single entity, making exit strategies complex due to shareholder rights and regulatory approvals, while dissolution usually involves legal procedures to unwind combined assets and liabilities. Understanding these distinctions is crucial for businesses planning future transitions or organizational changes.

Ideal Scenarios: When to Choose Partnership or Merger

Partnerships are ideal when businesses seek to maintain distinct identities while collaborating on specific projects or sharing resources, allowing flexibility and limited liability without full integration. Mergers are optimal when companies aim for complete consolidation to maximize synergies, streamline operations, and enhance market share, typically favored in highly competitive industries requiring unified strategy. Choosing between partnership and merger depends on goals such as control retention, risk tolerance, integration depth, and long-term growth plans.

Key Takeaways: Partnership vs Merger at a Glance

Partnerships involve two or more entities collaborating while maintaining separate legal identities, offering flexibility and shared management responsibilities. Mergers combine companies into a single entity, streamlining operations but often requiring complex integration processes. Key differences include ownership structure, liability, tax implications, and control, making partnerships preferable for collaborative projects and mergers ideal for full business consolidation.

Partnership Infographic

libterm.com

libterm.com