Public equity represents shares of a company that are traded on public stock exchanges, providing investors with opportunities to buy ownership stakes in established businesses. This form of investment offers liquidity, transparency, and the potential for capital growth, making it a popular choice for diversifying your portfolio. Explore the rest of the article to understand how public equity can impact your financial strategy.

Table of Comparison

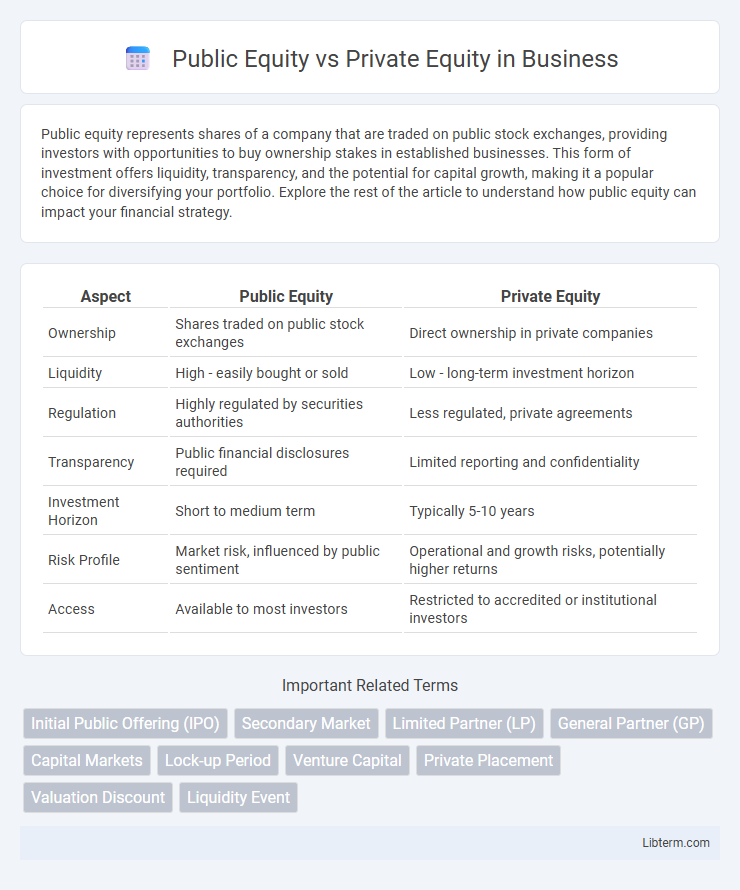

| Aspect | Public Equity | Private Equity |

|---|---|---|

| Ownership | Shares traded on public stock exchanges | Direct ownership in private companies |

| Liquidity | High - easily bought or sold | Low - long-term investment horizon |

| Regulation | Highly regulated by securities authorities | Less regulated, private agreements |

| Transparency | Public financial disclosures required | Limited reporting and confidentiality |

| Investment Horizon | Short to medium term | Typically 5-10 years |

| Risk Profile | Market risk, influenced by public sentiment | Operational and growth risks, potentially higher returns |

| Access | Available to most investors | Restricted to accredited or institutional investors |

Introduction to Public Equity and Private Equity

Public equity refers to shares of companies traded on stock exchanges, offering liquidity and transparency to investors through regulated markets like the NYSE and NASDAQ. Private equity involves investments in privately held companies or buyouts, typically requiring longer investment horizons and offering greater control but less liquidity. Key distinctions include accessibility for retail investors in public markets versus institutional and accredited investors dominating private equity.

Key Differences Between Public and Private Equity

Public equity involves shares traded on stock exchanges, offering liquidity and access to a broad investor base, whereas private equity consists of investments in privately held companies, typically requiring longer investment horizons and limited liquidity. Public equity markets are regulated with stringent disclosure requirements, ensuring transparency, while private equity investments are less regulated, allowing for more operational control and strategic involvement by investors. Valuation methods differ as public equity prices are determined by market supply and demand, whereas private equity valuations rely on financial metrics, comparable company analyses, and negotiations.

Investment Structures and Accessibility

Public equity involves purchasing shares in companies listed on stock exchanges, offering high liquidity and accessibility to individual investors through regulated markets and brokerage accounts. Private equity consists of investments in privately held companies or buyouts, typically structured as limited partnerships with longer lock-up periods and limited liquidity, accessible mainly to institutional investors and accredited individuals. The differences in investment structures impact risk exposure, return potential, and investor participation, with public equity favoring transparency and ease of entry, while private equity emphasizes active management and value creation over extended time horizons.

Liquidity and Exit Strategies

Public equity offers high liquidity due to its trading on stock exchanges, enabling investors to buy or sell shares quickly with transparent pricing. Private equity involves lower liquidity, as investments are typically locked in for extended periods and shares are not publicly traded, making exit options more complex. Exit strategies in private equity often rely on mergers, acquisitions, or initial public offerings (IPOs), whereas public equity provides immediate liquidity through open market transactions.

Risk Profiles and Return Potential

Public equity offers higher liquidity and lower entry barriers, resulting in moderate risk and steady returns driven by market volatility and economic cycles. Private equity involves longer investment horizons with limited liquidity but the potential for higher returns through active management and operational improvements in portfolio companies. Risk profiles in private equity tend to be elevated due to less transparency and market exposure, while public equity risks are closely tied to market fluctuations and regulatory changes.

Regulatory Environment and Transparency

Public equity markets are subject to stringent regulatory frameworks imposed by entities such as the Securities and Exchange Commission (SEC), requiring comprehensive disclosures, regular financial reporting, and adherence to strict corporate governance standards. Private equity operates under a less regulated environment, often exempt from many public disclosure requirements, allowing for greater operational flexibility but with reduced transparency for investors. This regulatory disparity influences investment risk profiles, with public equity offering higher transparency and liquidity, while private equity emphasizes confidentiality and long-term strategic value creation.

Valuation Methods in Public vs Private Markets

Public equity valuation primarily relies on market-driven metrics such as price-to-earnings (P/E) ratios, market capitalization, and enterprise value, reflecting real-time investor sentiment and liquidity. Private equity valuation often uses discounted cash flow (DCF) analysis, comparable company multiples, and precedent transactions due to limited market data and less liquidity. The inherent opacity and infrequent transactions in private markets necessitate adjustments for control premiums and illiquidity discounts absent in public market valuations.

Typical Investors and Capital Sources

Public equity primarily attracts institutional investors such as mutual funds, pension funds, and retail investors, with capital sourced from public stock exchanges through the buying and selling of shares. Private equity involves investments from accredited investors, sovereign wealth funds, and private equity firms, sourcing capital via private placements and dedicated funds targeting unlisted companies. Both capital sources differ significantly in liquidity, regulatory requirements, and investor access.

Performance Metrics and Benchmarks

Public equity performance metrics commonly rely on stock price appreciation, earnings per share (EPS), and price-to-earnings (P/E) ratios, benchmarked against indices such as the S&P 500 or MSCI World Index to gauge relative returns. Private equity performance is typically measured by internal rate of return (IRR), multiple on invested capital (MOIC), and cash-on-cash return, with benchmarks including Cambridge Associates Private Equity Index or Preqin benchmarks to assess fund performance. Differences in liquidity, valuation frequency, and reporting standards create challenges in directly comparing public equity with private equity performance metrics.

Choosing Between Public and Private Equity

Choosing between public equity and private equity depends on factors such as liquidity preferences, risk tolerance, and investment horizon. Public equity offers higher liquidity and market transparency with shares traded on stock exchanges, whereas private equity involves investing in non-public companies with potential for higher returns but longer lock-in periods and less regulatory oversight. Investors seeking flexibility and quick exits often prefer public equity, while those aiming for strategic control and value creation may choose private equity.

Public Equity Infographic

libterm.com

libterm.com