Debt financing allows businesses to raise capital by borrowing funds that must be repaid with interest over time, providing an alternative to equity financing. It enables companies to maintain ownership control while accessing necessary resources for growth or operations. Explore the article to understand how debt financing can impact your financial strategy and business success.

Table of Comparison

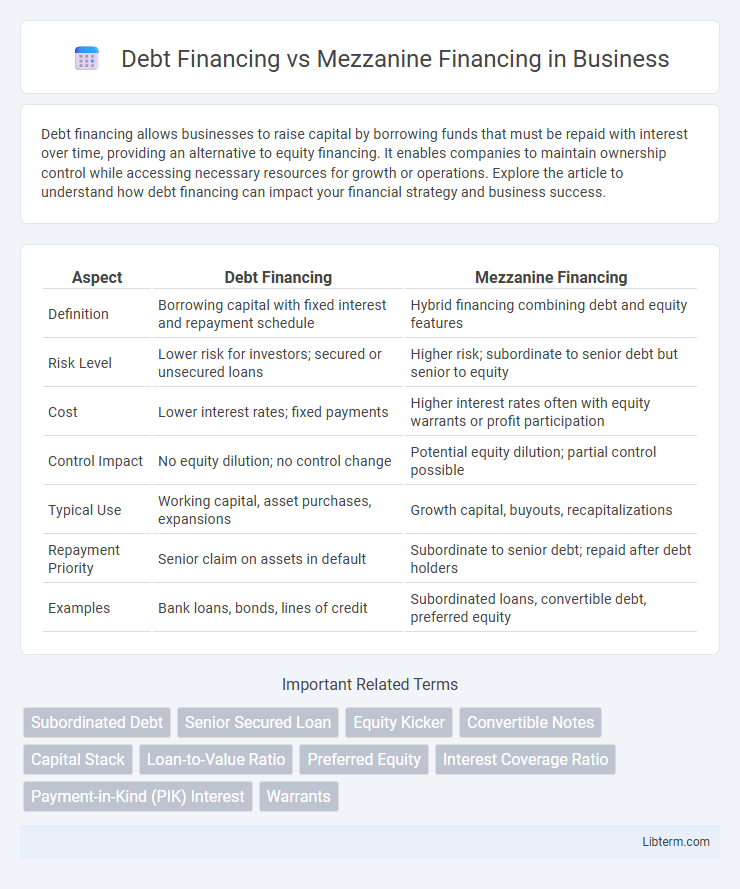

| Aspect | Debt Financing | Mezzanine Financing |

|---|---|---|

| Definition | Borrowing capital with fixed interest and repayment schedule | Hybrid financing combining debt and equity features |

| Risk Level | Lower risk for investors; secured or unsecured loans | Higher risk; subordinate to senior debt but senior to equity |

| Cost | Lower interest rates; fixed payments | Higher interest rates often with equity warrants or profit participation |

| Control Impact | No equity dilution; no control change | Potential equity dilution; partial control possible |

| Typical Use | Working capital, asset purchases, expansions | Growth capital, buyouts, recapitalizations |

| Repayment Priority | Senior claim on assets in default | Subordinate to senior debt; repaid after debt holders |

| Examples | Bank loans, bonds, lines of credit | Subordinated loans, convertible debt, preferred equity |

Introduction to Financing Options

Debt financing involves borrowing funds with an obligation to repay principal and interest, often secured by assets and offering predictable cash flow impact. Mezzanine financing blends debt and equity features, typically unsecured and subordinated, providing flexible capital with higher interest rates and potential equity participation. Both options serve distinct roles in capital structure, balancing risk, cost, and control for businesses seeking growth or acquisition funding.

What is Debt Financing?

Debt financing involves borrowing funds from external lenders, such as banks or bondholders, to be repaid over time with interest. This method allows businesses to access capital without diluting ownership but requires regular interest payments and adherence to loan covenants. Common forms include term loans, revolving credit facilities, and corporate bonds, which provide predictable repayment schedules and typically lower costs compared to equity financing.

What is Mezzanine Financing?

Mezzanine financing is a hybrid form of capital that bridges the gap between debt and equity, typically used by companies seeking growth capital without diluting ownership significantly. It consists of subordinated debt that is junior to senior loans but senior to common equity, often accompanied by warrants or conversion options to enhance returns. This financing structure offers higher yields for lenders due to increased risk and is commonly employed in leveraged buyouts, expansion projects, or recapitalizations.

Key Differences Between Debt and Mezzanine Financing

Debt financing involves borrowing money with a fixed repayment schedule and priority claim on assets in case of default, typically secured by collateral and lower interest rates. Mezzanine financing combines elements of debt and equity, offering higher interest rates with subordinated claims and often includes equity warrants or options, leading to greater risk but potential upside for lenders. Key differences include repayment hierarchy, risk level, cost of capital, and involvement in ownership structure.

Advantages of Debt Financing

Debt financing offers lower borrowing costs compared to mezzanine financing, as interest rates are typically fixed and more favorable due to its secured nature. This form of financing allows businesses to retain full ownership without diluting equity, maintaining control over operations and decision-making. Furthermore, debt financing provides predictable repayment schedules and potential tax benefits through interest expense deductions, enhancing cash flow management.

Advantages of Mezzanine Financing

Mezzanine financing offers the advantage of flexible capital structure by combining debt with equity features, allowing businesses to access funds without immediate dilution of ownership. It provides higher leverage compared to traditional debt financing, enabling companies to finance growth or acquisitions with less stringent collateral requirements. The subordinated nature of mezzanine debt also allows for interest expense tax deductions while giving lenders potential equity upside, aligning incentives between investors and borrowers.

Risks and Challenges of Debt Financing

Debt financing carries inherent risks such as the obligation to make fixed interest payments regardless of business performance, which can strain cash flow and increase the likelihood of default. Borrowers face potential asset forfeiture if they fail to meet loan covenants or repayment schedules, highlighting the inflexibility of debt structures. High leverage from debt financing amplifies financial risk, potentially leading to reduced credit ratings and limited future borrowing capacity.

Risks and Challenges of Mezzanine Financing

Mezzanine financing carries higher risks compared to traditional debt due to its subordinated position in the capital structure, making it more vulnerable in case of company default. The interest rates and equity warrants often attached increase the cost of capital and potential dilution for existing shareholders. Limited liquidity and stricter covenant requirements pose challenges for businesses seeking flexible financing solutions.

Choosing the Right Financing Option

Choosing the right financing option depends on a company's risk tolerance, capital structure, and growth strategy. Debt financing offers lower cost and predictable repayments but often requires collateral and strict covenants, making it suitable for businesses with stable cash flow. Mezzanine financing, combining debt and equity features, provides flexible capital without immediate dilution but comes at a higher cost and is ideal for companies seeking growth capital with moderate risk tolerance.

Conclusion: Debt vs Mezzanine Financing

Debt financing offers lower cost capital with fixed repayment schedules and priority claims on assets, making it ideal for businesses with stable cash flow and strong creditworthiness. Mezzanine financing combines debt and equity features, providing flexible capital with higher interest rates and potential equity participation, suitable for companies seeking growth without immediate dilution of ownership. Choosing between debt and mezzanine financing depends on the borrower's risk tolerance, cash flow stability, and strategic growth objectives.

Debt Financing Infographic

libterm.com

libterm.com