Green Bonds and Climate Bonds are financial instruments designed to fund projects with positive environmental impacts, such as renewable energy, energy efficiency, and sustainable agriculture. These bonds provide investors with the opportunity to support climate change mitigation while potentially earning competitive returns. Discover how these investment tools can align with your sustainability goals by exploring the rest of the article.

Table of Comparison

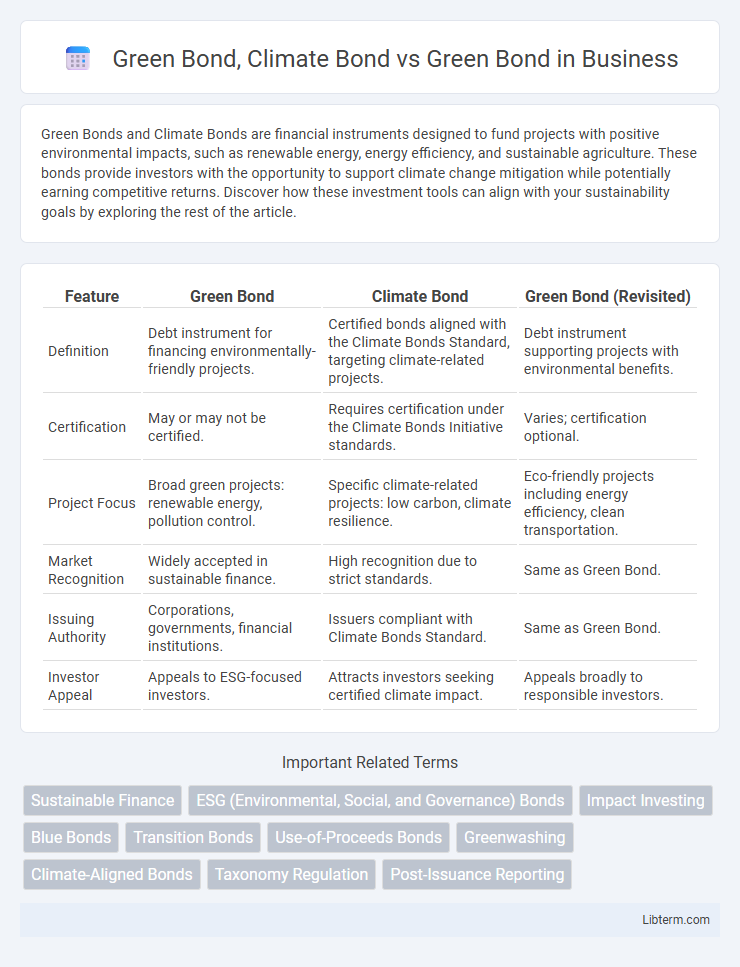

| Feature | Green Bond | Climate Bond | Green Bond (Revisited) |

|---|---|---|---|

| Definition | Debt instrument for financing environmentally-friendly projects. | Certified bonds aligned with the Climate Bonds Standard, targeting climate-related projects. | Debt instrument supporting projects with environmental benefits. |

| Certification | May or may not be certified. | Requires certification under the Climate Bonds Initiative standards. | Varies; certification optional. |

| Project Focus | Broad green projects: renewable energy, pollution control. | Specific climate-related projects: low carbon, climate resilience. | Eco-friendly projects including energy efficiency, clean transportation. |

| Market Recognition | Widely accepted in sustainable finance. | High recognition due to strict standards. | Same as Green Bond. |

| Issuing Authority | Corporations, governments, financial institutions. | Issuers compliant with Climate Bonds Standard. | Same as Green Bond. |

| Investor Appeal | Appeals to ESG-focused investors. | Attracts investors seeking certified climate impact. | Appeals broadly to responsible investors. |

Introduction to Green Bonds

Green Bonds are fixed-income financial instruments specifically designed to raise capital for projects that have positive environmental or climate benefits. Climate Bonds, a subset of Green Bonds, specifically target projects aligned with climate change mitigation and adaptation efforts. Both instruments promote sustainable investing by channeling funds into renewable energy, clean transportation, and resource efficiency initiatives.

Understanding Climate Bonds

Climate Bonds are a specific subset of Green Bonds, designed to fund projects that directly address climate change mitigation and adaptation. While Green Bonds encompass a broad range of environmentally beneficial projects, Climate Bonds emphasize investments aligned with rigorous climate science criteria, often certified by the Climate Bonds Initiative (CBI). Understanding Climate Bonds requires recognizing their role in supporting renewable energy, low-carbon transportation, and climate-resilient infrastructure with transparency and accountability standards.

Key Differences: Green Bonds vs Climate Bonds

Green Bonds are debt securities issued to fund projects with environmental benefits, covering a broad range of initiatives such as renewable energy, pollution prevention, and sustainable agriculture. Climate Bonds, a subset of Green Bonds, specifically target projects that contribute directly to climate change mitigation or adaptation, following rigorous certification standards like the Climate Bonds Standard. The key difference lies in Climate Bonds' exclusive focus on climate-related goals and stricter verification processes, ensuring alignment with global climate change objectives.

Objectives and Impacts of Green Bonds

Green Bonds are financial instruments designed to raise capital specifically for projects that have positive environmental benefits, such as renewable energy, energy efficiency, and sustainable agriculture, directly supporting climate change mitigation and adaptation efforts. Climate Bonds are a subset of Green Bonds, strictly adhering to internationally recognized standards like the Climate Bonds Initiative's Certification Scheme, ensuring proceeds fund projects with verified climate-related impacts, primarily targeting greenhouse gas reductions and climate resilience. The core objective of Green Bonds is to drive sustainable investment by directing funds into environmentally friendly projects, with measurable impacts including reduced carbon emissions, enhanced biodiversity, and increased sustainability of natural resources, fostering long-term environmental and social benefits.

Certified Standards: Climate Bonds Initiative

Green Bonds certified by the Climate Bonds Initiative (CBI) meet strict criteria ensuring projects contribute to climate change mitigation and adaptation, enhancing investor confidence. The CBI's Climate Bond Standard provides a robust framework for transparency, accountability, and environmental integrity, distinguishing Climate Bonds from general Green Bonds without certification. Certification through the CBI facilitates market growth by aligning with international climate goals and supporting sustainable investment portfolios.

Eligible Projects for Green Bonds

Green Bonds fund projects that deliver environmental benefits such as renewable energy, energy efficiency, pollution prevention, and sustainable water management. Climate Bonds, often a subset of Green Bonds, strictly finance projects that directly contribute to climate change mitigation or adaptation, such as low-carbon transport and climate-resilient infrastructure. Eligible projects for Green Bonds also extend to biodiversity conservation and sustainable agriculture, aligning with global environmental standards and climate goals.

Market Trends: Growth of Green and Climate Bonds

Green Bonds and Climate Bonds have seen rapid market growth, with Green Bonds reaching over $500 billion in cumulative issuance by 2023, driven by increasing corporate and sovereign commitments to sustainability. Climate Bonds, certified under the Climate Bonds Standard, focus more specifically on projects directly addressing climate change mitigation and adaptation, attracting investors seeking targeted environmental impact. The expanding market reflects heightened regulatory support and investor demand for transparency, fueling sustained annual issuance growth exceeding 50% since 2020.

Investor Perspectives: Risks and Returns

Investors view Green Bonds and Climate Bonds as sustainable financing tools with varying risk and return profiles, where Green Bonds broadly support environmental projects and Climate Bonds specifically target climate change mitigation and adaptation initiatives. Climate Bonds often carry stringent certification standards by the Climate Bonds Initiative, enhancing investor confidence but potentially limiting project eligibility and yield. Risk considerations include regulatory changes, project performance, and market liquidity, with Green Bonds generally offering competitive returns aligned with conventional bonds while providing positive environmental impact.

Regulatory Frameworks and Taxonomies

Green bonds are debt instruments specifically earmarked to fund projects with environmental benefits, guided by regulatory frameworks such as the EU Green Bond Standard and Climate Bonds Initiative (CBI) taxonomy, which provide criteria for transparency and impact reporting. Climate bonds represent a subset of green bonds focused exclusively on climate change mitigation and adaptation projects, often adhering to more stringent requirements under frameworks like the Climate Bond Taxonomy used by the CBI. Regulatory frameworks and taxonomies play a critical role in standardizing definitions, enhancing market integrity, and attracting investors by ensuring funds support genuine environmental and climate objectives.

Future Outlook for Sustainable Bond Markets

Green Bonds and Climate Bonds are pivotal financial instruments designed to fund environmentally sustainable projects, with Climate Bonds specifically aligned with climate change mitigation and adaptation criteria under the Climate Bonds Initiative certification. The future outlook for sustainable bond markets indicates robust growth driven by increasing regulatory support, investor demand for ESG-compliant assets, and the global push towards achieving net-zero emissions by 2050. Innovations in green finance, expanded taxonomy frameworks, and enhanced transparency standards are expected to further catalyze market expansion and investor confidence in these sustainable debt instruments.

Green Bond, Climate Bond Infographic

libterm.com

libterm.com