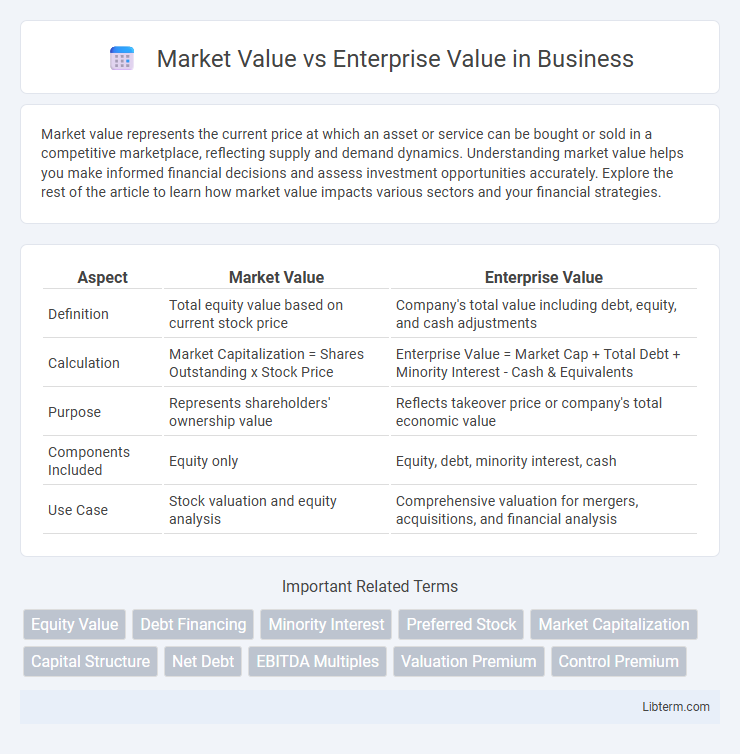

Market value represents the current price at which an asset or service can be bought or sold in a competitive marketplace, reflecting supply and demand dynamics. Understanding market value helps you make informed financial decisions and assess investment opportunities accurately. Explore the rest of the article to learn how market value impacts various sectors and your financial strategies.

Table of Comparison

| Aspect | Market Value | Enterprise Value |

|---|---|---|

| Definition | Total equity value based on current stock price | Company's total value including debt, equity, and cash adjustments |

| Calculation | Market Capitalization = Shares Outstanding x Stock Price | Enterprise Value = Market Cap + Total Debt + Minority Interest - Cash & Equivalents |

| Purpose | Represents shareholders' ownership value | Reflects takeover price or company's total economic value |

| Components Included | Equity only | Equity, debt, minority interest, cash |

| Use Case | Stock valuation and equity analysis | Comprehensive valuation for mergers, acquisitions, and financial analysis |

Introduction to Market Value and Enterprise Value

Market Value represents the total value of a company's outstanding shares of stock, reflecting investor perception and market conditions. Enterprise Value provides a comprehensive valuation by including Market Value, debt, minority interests, preferred shares, and subtracting cash and cash equivalents. Understanding the distinction between Market Value and Enterprise Value is crucial for accurate financial analysis and investment decision-making.

Defining Market Value: Key Components

Market value represents the total dollar value of a company's outstanding shares of stock, calculated by multiplying the current share price by the number of shares outstanding. Key components of market value include equity capitalization, share price volatility, and market perception of the company's future growth potential. Market value fluctuates based on investor sentiment, supply and demand, and overall market conditions, reflecting the company's perceived worth at a given time.

Explaining Enterprise Value: Core Elements

Enterprise Value (EV) represents a company's total value by combining market capitalization, total debt, and minority interest while subtracting cash and cash equivalents. This measure reflects the true cost to acquire a business, capturing both equity and debt holders' claims. EV offers a comprehensive view of a firm's financial health and is crucial for comparing companies with different capital structures.

Market Value vs Enterprise Value: Core Differences

Market Value represents the total equity value of a company based on its current stock price multiplied by outstanding shares, reflecting investor perception and market sentiment. Enterprise Value (EV) provides a comprehensive valuation by including Market Value plus total debt, minority interest, and preferred shares, minus cash and cash equivalents, offering a clearer picture of a company's total capital structure. Core differences include Market Value capturing only equity portion, while EV accounts for all sources of capital, making EV a more accurate metric for takeover or acquisition analysis.

How to Calculate Market Value

Market value is calculated by multiplying the company's current stock price by its total outstanding shares, reflecting the equity value investors assign to the firm. This figure represents the market capitalization, providing a snapshot of what the market perceives the company's equity to be worth. Unlike enterprise value, market value does not account for debt, cash, or other financial obligations, focusing solely on ownership equity.

Calculating Enterprise Value: A Step-by-Step Guide

Calculating enterprise value (EV) begins with market capitalization, which is the total market value of a company's outstanding shares. Add total debt--including short-term and long-term debt--and subtract cash and cash equivalents to account for the company's net debt position. Incorporating preferred stock and minority interest provides a comprehensive valuation reflecting the company's total economic value beyond just equity.

Importance of Market Value in Financial Analysis

Market value reflects the current stock price multiplied by outstanding shares, providing a real-time snapshot of a company's equity worth as perceived by investors. It is crucial in financial analysis for assessing investor sentiment, valuing equity, and making investment decisions. Investors rely on market value to determine the company's market capitalization and compare it with enterprise value for a comprehensive evaluation of financial health and capital structure.

The Role of Enterprise Value in Investment Decisions

Enterprise value (EV) offers a comprehensive measure of a company's total value by including market capitalization, debt, and cash, making it crucial for investors assessing acquisition targets or comparing firms with different capital structures. Unlike market value, which only reflects equity price, EV provides insight into the true cost to buy a company, capturing both equity and debt obligations. This holistic valuation metric helps investors make informed decisions by evaluating profitability and financial leverage on an apples-to-apples basis.

Practical Examples: Comparing Companies

Market value represents the total equity value of a company determined by its current stock price multiplied by outstanding shares, illustrating investor perception of company worth. Enterprise value (EV) includes market value plus debt, minority interest, and preferred shares, minus cash, offering a comprehensive measure for comparing companies with different capital structures. For example, Company A with a market value of $500 million and $200 million in debt has an EV of $700 million, while Company B with a market value of $600 million but $100 million in cash has an EV of $500 million, making EV a more practical tool for assessing overall company value and acquisition prices.

Which Metric Matters Most? Choosing Between Market Value and Enterprise Value

Market value represents a company's equity value based on current stock price multiplied by outstanding shares, reflecting investor sentiment and market perception. Enterprise value provides a comprehensive valuation by including debt, minority interest, and cash, offering a clearer picture of a company's total worth for acquisition purposes. Investors prioritize market value for shareholder perspectives while analysts and buyers focus on enterprise value to assess true acquisition costs and operational value.

Market Value Infographic

libterm.com

libterm.com