A purchase order is a formal document issued by a buyer to a seller, specifying the products or services required, quantities, and agreed prices. It serves as a legally binding agreement that helps streamline procurement and ensures clarity between both parties. Discover how understanding purchase orders can optimize Your business transactions by reading the rest of the article.

Table of Comparison

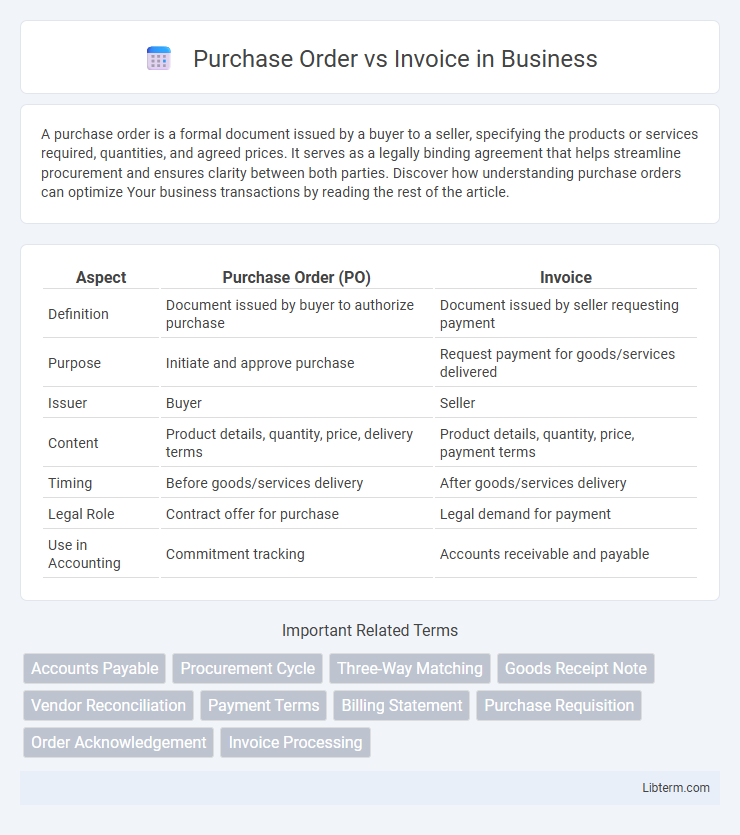

| Aspect | Purchase Order (PO) | Invoice |

|---|---|---|

| Definition | Document issued by buyer to authorize purchase | Document issued by seller requesting payment |

| Purpose | Initiate and approve purchase | Request payment for goods/services delivered |

| Issuer | Buyer | Seller |

| Content | Product details, quantity, price, delivery terms | Product details, quantity, price, payment terms |

| Timing | Before goods/services delivery | After goods/services delivery |

| Legal Role | Contract offer for purchase | Legal demand for payment |

| Use in Accounting | Commitment tracking | Accounts receivable and payable |

Introduction to Purchase Orders and Invoices

Purchase orders are formal documents issued by buyers to authorize the purchase of goods or services, detailing quantities, descriptions, and agreed prices. Invoices are bills sent by sellers to request payment for delivered products or services, including transaction specifics, payment terms, and due dates. Both documents play critical roles in procurement and accounting workflows, ensuring clear communication and financial accuracy between buyers and suppliers.

Definition of Purchase Order

A purchase order (PO) is a formal document issued by a buyer to a supplier, specifying the types, quantities, and agreed prices for products or services. It serves as an official offer to purchase and helps organizations manage procurement processes effectively. Unlike an invoice, which requests payment, a purchase order authorizes the transaction and initiates the supply chain fulfillment.

Definition of Invoice

An invoice is a detailed document issued by a seller to a buyer, specifying the products or services provided, their quantities, prices, and payment terms. It serves as a formal request for payment and acts as a record for accounting and financial tracking. Unlike a purchase order, which is created by the buyer to authorize a purchase, an invoice confirms the transaction and initiates the payment process.

Key Differences Between Purchase Order and Invoice

A purchase order (PO) is a buyer-generated document outlining the items, quantities, and agreed prices for products or services requested from a supplier, serving as an official offer to purchase. An invoice is a seller-issued document requesting payment, detailing the products or services provided along with their prices, payment terms, and due date. Key differences include the PO initiating the buying process, acting as an authorization, while the invoice confirms delivery and requests payment.

Purpose and Function of Purchase Orders

Purchase orders serve as formal requests issued by buyers to suppliers, outlining specific products or services, quantities, and agreed prices, ensuring clear communication and authorization before procurement. Their primary function is to control purchasing processes, prevent unauthorized spending, and establish contractual obligations for accurate order fulfillment. Unlike invoices, which request payment, purchase orders initiate the buying cycle and provide a documented basis for matching received goods and services against payments.

Purpose and Function of Invoices

Invoices serve as official financial documents that request payment for goods or services provided, detailing quantities, prices, and terms of sale. They function as a record for both buyer and seller to confirm the transaction, ensuring accurate payment processing and accounting reconciliation. Unlike purchase orders, which initiate procurement, invoices finalize the transaction by documenting the owed amount and payment instructions.

Workflow: From Purchase Order to Invoice

The workflow from purchase order to invoice begins with the buyer issuing a purchase order detailing the products, quantities, and agreed prices. Upon order fulfillment, the supplier generates an invoice referencing the purchase order number, ensuring accurate billing and payment processing. This sequential process enhances financial control, minimizes discrepancies, and streamlines accounts payable and receivable operations.

Importance of Purchase Orders and Invoices in Business

Purchase orders establish clear terms and expectations before a transaction, ensuring accurate order fulfillment and budget control, while invoices serve as formal requests for payment and provide essential documentation for accounting and auditing processes. Both documents are critical in maintaining transparency, preventing disputes, and streamlining the procurement-to-payment cycle in businesses. Proper management of purchase orders and invoices enhances financial accuracy, vendor relationships, and regulatory compliance.

Common Mistakes with Purchase Orders and Invoices

Common mistakes with purchase orders and invoices include mismatched information such as incorrect quantities, pricing errors, and inconsistent terms between documents. Failure to properly verify purchase order numbers on invoices can lead to delayed payments and accounting discrepancies. Overlooking approval workflows and neglecting to update changes in purchase orders often causes confusion and audit challenges in procurement processes.

Best Practices for Managing Purchase Orders and Invoices

Effective management of purchase orders and invoices hinges on accurate matching of purchase orders, receipts, and invoices to prevent discrepancies and ensure smooth payment processing. Implementing automated tracking systems enhances visibility and control, while standardized workflows and clear communication between procurement and finance departments reduce errors and delays. Regular audits and timely approvals further optimize cash flow and strengthen vendor relationships.

Purchase Order Infographic

libterm.com

libterm.com