A franchise is a business model where an individual or group (franchisee) gains the rights to operate under the trademark and systems of an established company (franchisor). This setup allows you to benefit from a proven brand, ongoing support, and a structured path to business success. Explore the rest of the article to understand how franchising can be the key to your entrepreneurial journey.

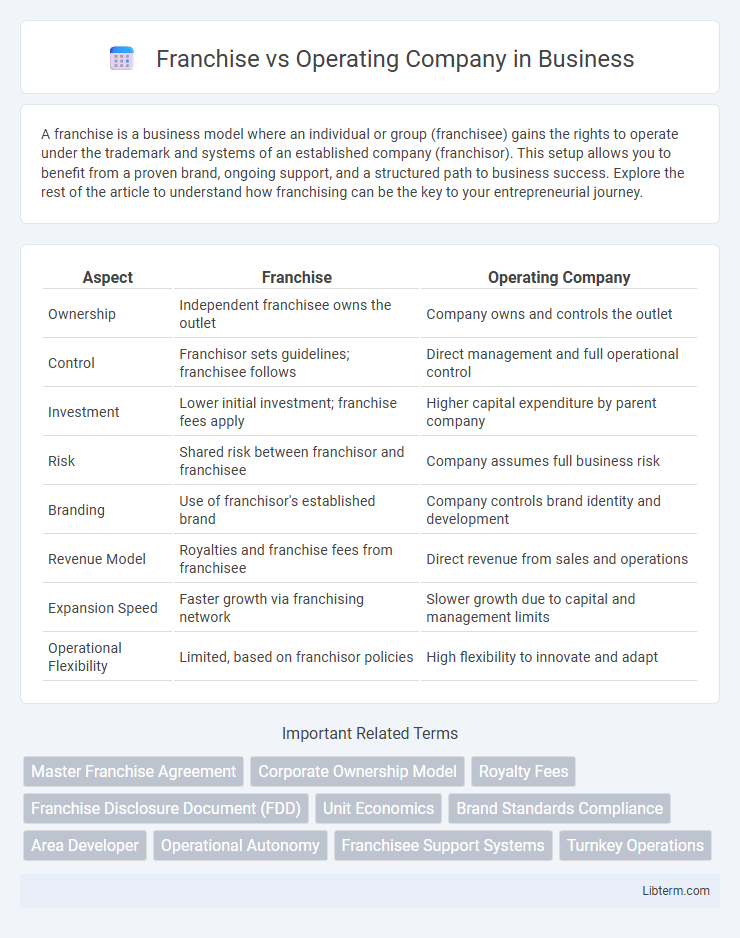

Table of Comparison

| Aspect | Franchise | Operating Company |

|---|---|---|

| Ownership | Independent franchisee owns the outlet | Company owns and controls the outlet |

| Control | Franchisor sets guidelines; franchisee follows | Direct management and full operational control |

| Investment | Lower initial investment; franchise fees apply | Higher capital expenditure by parent company |

| Risk | Shared risk between franchisor and franchisee | Company assumes full business risk |

| Branding | Use of franchisor's established brand | Company controls brand identity and development |

| Revenue Model | Royalties and franchise fees from franchisee | Direct revenue from sales and operations |

| Expansion Speed | Faster growth via franchising network | Slower growth due to capital and management limits |

| Operational Flexibility | Limited, based on franchisor policies | High flexibility to innovate and adapt |

Introduction: Franchise vs Operating Company

A franchise is a business model where an individual or group obtains the rights to operate using an established brand's name, products, and business methods in exchange for fees or royalties. An operating company, on the other hand, directly manages and owns its business operations without licensing its brand or systems to external operators. Understanding the differences between franchising and operating companies is crucial for entrepreneurs evaluating control, risk, and growth strategies.

Defining Franchises and Operating Companies

Franchises are business models where franchisees operate under the franchisor's brand and system, paying fees for the right to use trademarks, products, and ongoing support. Operating companies own and manage business units directly, assuming full control and financial risk without relying on third-party brand operators. The distinction lies in franchising's reliance on independent operators versus the centralized ownership and management of operating companies.

Business Model Comparison

Franchise business models rely on franchisors granting licenses to franchisees to operate under established brand names and systems, minimizing capital investment and operational risks for the franchisor. Operating companies maintain full ownership and control of all business locations, assuming complete responsibility for operational expenses and direct management decisions. Franchise models enable rapid market expansion with consistent brand standards, whereas operating companies emphasize centralized control and uniformity in business processes across all units.

Investment and Startup Costs

Franchise businesses typically require a lower initial investment compared to operating companies, with startup costs including franchise fees, equipment, and initial inventory, often range from $50,000 to $500,000 depending on the brand. Operating companies demand higher capital due to expenses related to building infrastructure, hiring staff, and developing brand presence from scratch, which can exceed $1 million. Franchise models provide a proven business plan and support system that can reduce financial risk, whereas operating companies bear the entire cost and responsibility for market entry and growth.

Revenue and Profit Potential

Franchise models typically generate revenue through franchise fees and ongoing royalties, offering steady income with lower operational risk, but profit margins can be constrained by franchisor-imposed fees and limited control over pricing strategies. Operating companies retain full control over revenue streams, enabling higher profit potential through direct management of sales, expenses, and operational efficiencies, yet they face greater risks and capital requirements. Evaluating revenue and profit potential between franchises and operating companies involves balancing predictable royalty income against the autonomy to maximize profitability through strategic decision-making.

Risk and Liability Factors

Franchise businesses face risk primarily through contractual obligations and brand reputation, with liability often limited to individual franchise locations, whereas operating companies bear broader financial and legal risks tied directly to overall corporate operations. Franchisees assume responsibility for local compliance, employee management, and operational risks, while franchisors mainly face risks related to brand consistency and franchisee adherence to standards. Operating companies hold full liability for debts, lawsuits, and regulatory issues, increasing exposure compared to the distributed risk model in franchising.

Operational Control and Flexibility

Franchise models offer limited operational control to franchisees as they must adhere to strict brand guidelines and standardized procedures established by the franchisor, ensuring consistency across locations. Operating companies enjoy greater flexibility, allowing them to tailor operations, marketing strategies, and product offerings to local market demands without needing external approval. This flexibility in operating companies can lead to faster innovation and adaptation, whereas franchises benefit from proven systems but face constraints on autonomy.

Branding and Marketing Strategies

Franchise models leverage the established brand reputation and centralized marketing campaigns of the parent company, ensuring consistent brand messaging across all locations. Operating companies maintain full control over branding and marketing, allowing for tailored strategies that align closely with local market preferences. This centralized branding in franchises often results in higher brand recognition, while operating companies benefit from agility in marketing adaptations.

Growth and Expansion Opportunities

Franchises offer rapid growth potential through leveraging local entrepreneurs' investments, minimizing capital risk while expanding brand presence across diverse markets. Operating companies retain full control over operations and branding, enabling consistent quality and strategic alignment but require substantial capital and management resources for expansion. Franchise models excel in scalability with lower financial barriers, whereas operating companies optimize growth through centralized decision-making and direct market influence.

Choosing the Right Model for Your Goals

Selecting between a franchise and an operating company depends on your entrepreneurial goals, level of control, and investment capacity. Franchises offer proven business models and brand recognition with support systems, making them ideal for those seeking lower risk and established operational frameworks. Operating companies provide greater autonomy and potential for innovation but require comprehensive management skills and bear higher operational responsibilities.

Franchise Infographic

libterm.com

libterm.com