Understanding demand elasticity allows you to gauge how sensitive consumer demand is to price changes, influencing your pricing strategies and revenue projections. It measures the percentage change in quantity demanded relative to a percentage change in price, helping businesses anticipate customer behavior under different market conditions. Explore the rest of this article to master demand elasticity and optimize your business decisions effectively.

Table of Comparison

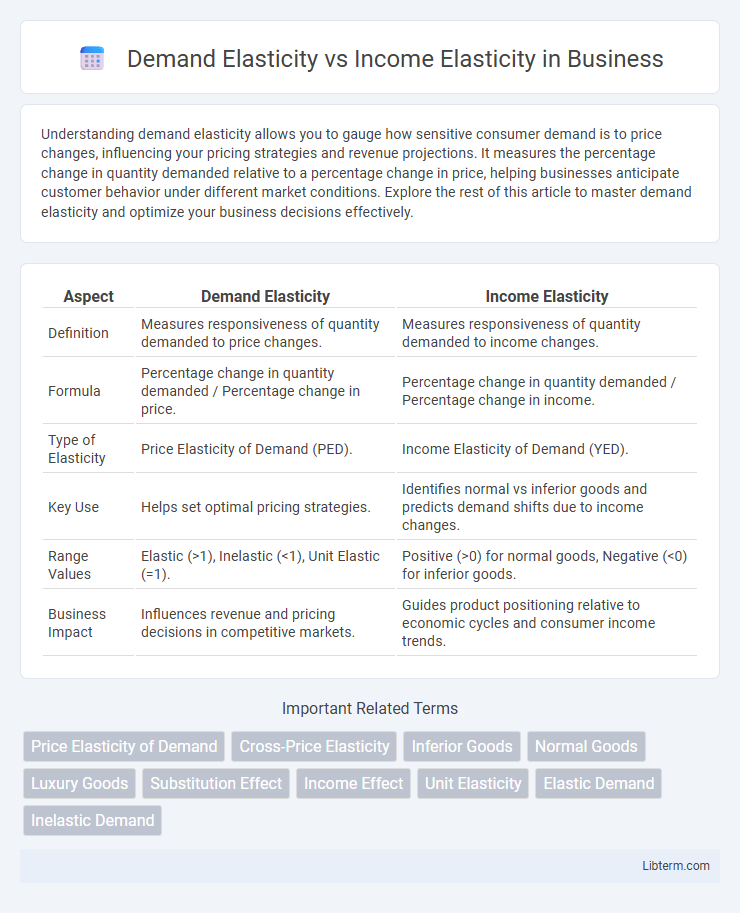

| Aspect | Demand Elasticity | Income Elasticity |

|---|---|---|

| Definition | Measures responsiveness of quantity demanded to price changes. | Measures responsiveness of quantity demanded to income changes. |

| Formula | Percentage change in quantity demanded / Percentage change in price. | Percentage change in quantity demanded / Percentage change in income. |

| Type of Elasticity | Price Elasticity of Demand (PED). | Income Elasticity of Demand (YED). |

| Key Use | Helps set optimal pricing strategies. | Identifies normal vs inferior goods and predicts demand shifts due to income changes. |

| Range Values | Elastic (>1), Inelastic (<1), Unit Elastic (=1). | Positive (>0) for normal goods, Negative (<0) for inferior goods. |

| Business Impact | Influences revenue and pricing decisions in competitive markets. | Guides product positioning relative to economic cycles and consumer income trends. |

Understanding Elasticity: Definitions and Key Concepts

Demand elasticity measures the responsiveness of quantity demanded to changes in price, quantified by the price elasticity of demand formula. Income elasticity of demand indicates how quantity demanded varies with consumer income, reflecting normal and inferior goods through positive or negative elasticity values. Understanding these concepts helps analyze consumer behavior, market trends, and pricing strategies in economic contexts.

What is Demand Elasticity?

Demand elasticity measures the responsiveness of the quantity demanded of a good or service to changes in its price, indicating how sensitive consumers are to price fluctuations. It quantifies the percentage change in demand resulting from a one percent change in price, with high elasticity signifying strong sensitivity and low elasticity indicating weak sensitivity. Understanding demand elasticity helps businesses and economists predict consumer behavior, optimize pricing strategies, and forecast revenue impacts.

What is Income Elasticity of Demand?

Income elasticity of demand measures the responsiveness of the quantity demanded of a good to changes in consumer income, reflecting how demand varies as income rises or falls. It is calculated as the percentage change in quantity demanded divided by the percentage change in income, indicating whether a good is a normal good (positive elasticity) or an inferior good (negative elasticity). Understanding income elasticity helps businesses and economists predict consumption patterns and adjust pricing strategies based on economic cycles.

Core Differences Between Demand and Income Elasticity

Demand elasticity measures how the quantity demanded of a good responds to changes in its price, indicating price sensitivity. Income elasticity assesses how demand varies with changes in consumer income, revealing whether a good is normal or inferior. The core difference lies in demand elasticity focusing on price impact, while income elasticity centers on income fluctuations affecting consumption.

Factors Influencing Demand Elasticity

Demand elasticity is primarily influenced by factors such as the availability of substitutes, necessity versus luxury status of the good, and the proportion of income spent on the product, which determine how sensitive consumers are to price changes. Income elasticity, on the other hand, depends on changes in consumer income levels, the type of good (normal or inferior), and consumer preferences that affect demand responsiveness to income fluctuations. Understanding these factors is crucial for businesses to predict consumer behavior and adjust pricing or marketing strategies accordingly.

Determinants of Income Elasticity

Income elasticity of demand measures how consumer demand changes in response to income variations, primarily influenced by factors such as the nature of the good (necessity, luxury, or inferior), consumer preferences, and the proportion of income spent on the good. Necessities typically have low income elasticity, indicating minimal demand change with income fluctuations, while luxury goods exhibit high income elasticity due to significant demand sensitivity to income changes. Additionally, demographic factors and economic conditions also play crucial roles in determining income elasticity, affecting overall consumer behavior patterns.

Graphical Representation: Demand vs Income Elasticity

Demand elasticity measures the responsiveness of quantity demanded to changes in price, typically represented by a downward-sloping demand curve on a graph. Income elasticity, on the other hand, illustrates how quantity demanded varies with changes in consumer income, often depicted through shifts in the demand curve rather than movements along it. Graphically, price elasticity is shown by the slope and curvature of the demand curve, while income elasticity is indicated by parallel shifts of the entire demand curve either to the right (normal goods) or left (inferior goods).

Real-World Applications in Business and Economics

Demand elasticity measures how consumer demand for a product changes with price fluctuations, essential for pricing strategies and revenue optimization in retail and manufacturing. Income elasticity assesses how demand varies with consumer income shifts, helping businesses forecast sales during economic cycles and tailor product offerings for luxury versus necessity goods. Both elasticities inform inventory management, marketing campaigns, and policy-making by anticipating consumer behavior under different economic conditions.

Implications for Pricing Strategies and Revenue

Demand elasticity measures how quantity demanded responds to price changes, guiding pricing strategies to optimize revenue by identifying price-sensitive products. Income elasticity indicates how demand shifts with consumer income fluctuations, enabling firms to forecast revenue changes during economic growth or downturns. Understanding both elasticities helps businesses tailor pricing and product offerings to maximize profitability under varying market conditions.

Conclusion: Choosing the Right Elasticity Metric

Selecting the appropriate elasticity metric depends on the specific economic context and the type of consumer response being analyzed. Demand elasticity measures sensitivity to price changes, crucial for pricing strategies and market competition analysis, while income elasticity evaluates changes in demand relative to income variations, essential for forecasting consumer behavior during economic shifts. Understanding these distinctions allows businesses and policymakers to make data-driven decisions that optimize revenue and address consumer needs effectively.

Demand Elasticity Infographic

libterm.com

libterm.com