Term loans provide businesses or individuals with a lump sum of money repaid over a fixed period, typically with a set interest rate, making them ideal for significant investments or capital expenditures. These loans offer predictable monthly payments, helping you manage your finances and plan for the future effectively. Discover how term loans can support your financial goals by reading the rest of this article.

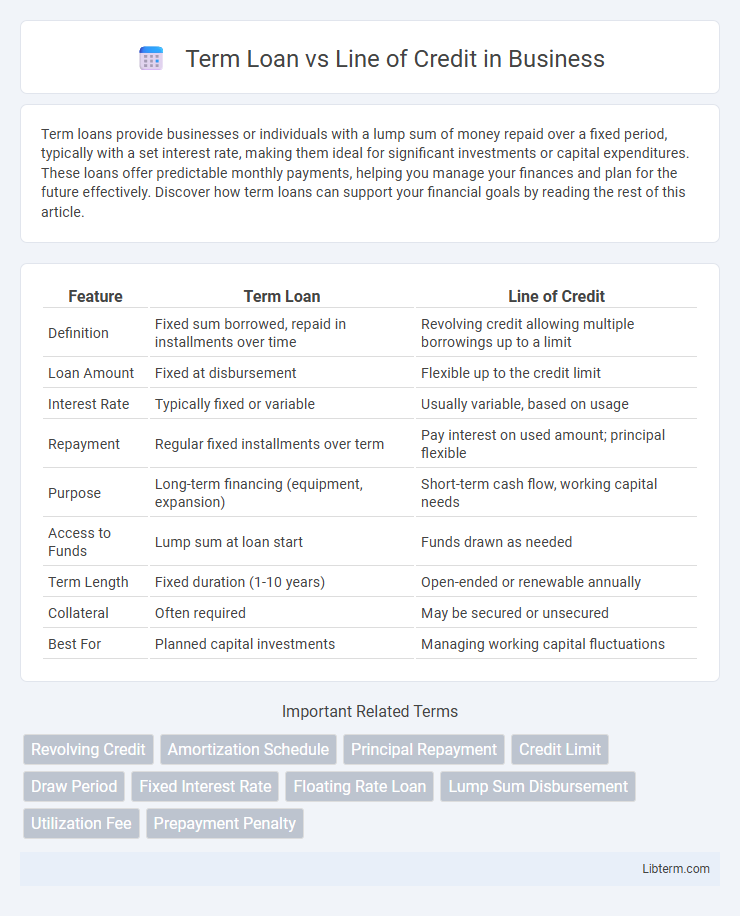

Table of Comparison

| Feature | Term Loan | Line of Credit |

|---|---|---|

| Definition | Fixed sum borrowed, repaid in installments over time | Revolving credit allowing multiple borrowings up to a limit |

| Loan Amount | Fixed at disbursement | Flexible up to the credit limit |

| Interest Rate | Typically fixed or variable | Usually variable, based on usage |

| Repayment | Regular fixed installments over term | Pay interest on used amount; principal flexible |

| Purpose | Long-term financing (equipment, expansion) | Short-term cash flow, working capital needs |

| Access to Funds | Lump sum at loan start | Funds drawn as needed |

| Term Length | Fixed duration (1-10 years) | Open-ended or renewable annually |

| Collateral | Often required | May be secured or unsecured |

| Best For | Planned capital investments | Managing working capital fluctuations |

Introduction to Term Loans and Lines of Credit

Term loans provide borrowers with a fixed amount of capital upfront, repaid over a specified period with regular installments, often suited for long-term investments or significant purchases. Lines of credit offer flexible access to funds up to a predetermined limit, allowing borrowers to draw, repay, and redraw as needed, which is ideal for managing short-term cash flow fluctuations. Understanding these financing options helps businesses and individuals choose between structured repayment schedules or revolving credit facilities based on their financial needs.

Key Differences Between Term Loans and Lines of Credit

Term loans provide a fixed amount of capital with a predetermined repayment schedule, making them ideal for financing large, one-time investments. Lines of credit offer flexible, revolving access to funds, allowing borrowers to draw and repay repeatedly up to a set credit limit, suitable for managing ongoing working capital needs. Key differences include repayment structure, borrowing flexibility, and typical use cases, with term loans emphasizing structured financing and lines of credit prioritizing liquidity management.

How Term Loans Work

Term loans provide borrowers with a fixed lump sum amount repaid over a predetermined period through regular installments, often with fixed or variable interest rates. These loans typically have set maturity dates and require monthly or quarterly payments, ensuring predictable cash flow management for businesses or individuals. The structured repayment schedule and defined loan term distinguish term loans from revolving credit lines, which offer ongoing access to funds up to a credit limit.

How Lines of Credit Operate

Lines of credit provide flexible access to funds up to a predetermined limit, allowing borrowers to withdraw money as needed and repay over time with interest only charged on the amount utilized. Interest rates on lines of credit are typically variable, and borrowers can reuse the credit limit as they repay, making it ideal for managing cash flow fluctuations. Unlike term loans, there is no fixed repayment schedule, offering ongoing financial agility for businesses or individuals.

Pros and Cons of Term Loans

Term loans offer fixed interest rates and predictable monthly payments, providing stability for long-term financial planning. However, they come with inflexible repayment schedules and potential prepayment penalties, which can limit cash flow management. The fixed loan amount also means businesses must accurately forecast funding needs to avoid borrowing more or less than necessary.

Advantages and Disadvantages of Lines of Credit

Lines of credit offer flexible access to funds, allowing borrowers to withdraw money up to a predetermined limit and repay it as needed, which helps manage cash flow effectively. Interest is typically charged only on the amount borrowed, providing cost savings compared to fixed-term loans with preset repayment schedules. However, lines of credit may have variable interest rates and can lead to overspending, resulting in potential financial strain if not managed carefully.

Best Use Cases for Term Loans

Term loans are ideal for businesses seeking fixed capital for specific, long-term investments such as purchasing equipment, real estate, or funding expansion projects. These loans provide predictable repayment schedules and fixed interest rates, making budgeting easier for substantial one-time financing needs. Unlike lines of credit, term loans are less suited for covering fluctuating operational costs or short-term cash flow gaps.

Ideal Scenarios for Using Lines of Credit

Lines of credit are ideal for businesses requiring flexible access to funds for managing short-term cash flow fluctuations or unexpected expenses. They offer ongoing borrowing capacity up to a set credit limit, making them suitable for covering seasonal inventory purchases or bridging gaps in accounts receivable. Unlike term loans, lines of credit provide repeated access to capital without renegotiating terms, supporting dynamic operational needs.

Factors to Consider When Choosing

Evaluating factors such as loan purpose, repayment flexibility, and interest rates is crucial when choosing between a term loan and a line of credit. Term loans provide fixed amounts with scheduled payments, ideal for large, one-time expenses, while lines of credit offer revolving access to funds suited for ongoing cash flow needs. Consider credit score requirements, collateral demands, and borrowing costs to determine the best financing solution for business or personal financial goals.

Which Option Is Right for Your Business?

Choosing between a term loan and a line of credit depends on your business's specific financial needs and cash flow patterns. A term loan provides a lump sum with fixed repayments, ideal for funding large, one-time investments like equipment or expansion projects. In contrast, a line of credit offers flexible access to funds up to a limit, allowing for ongoing working capital management and short-term expenses.

Term Loan Infographic

libterm.com

libterm.com