A third market refers to the over-the-counter trading of exchange-listed securities, allowing institutional investors to buy and sell outside traditional exchanges. This market enhances liquidity and offers more flexible trading options, often leading to better execution prices. Explore the rest of the article to understand how the third market can benefit your investment strategy.

Table of Comparison

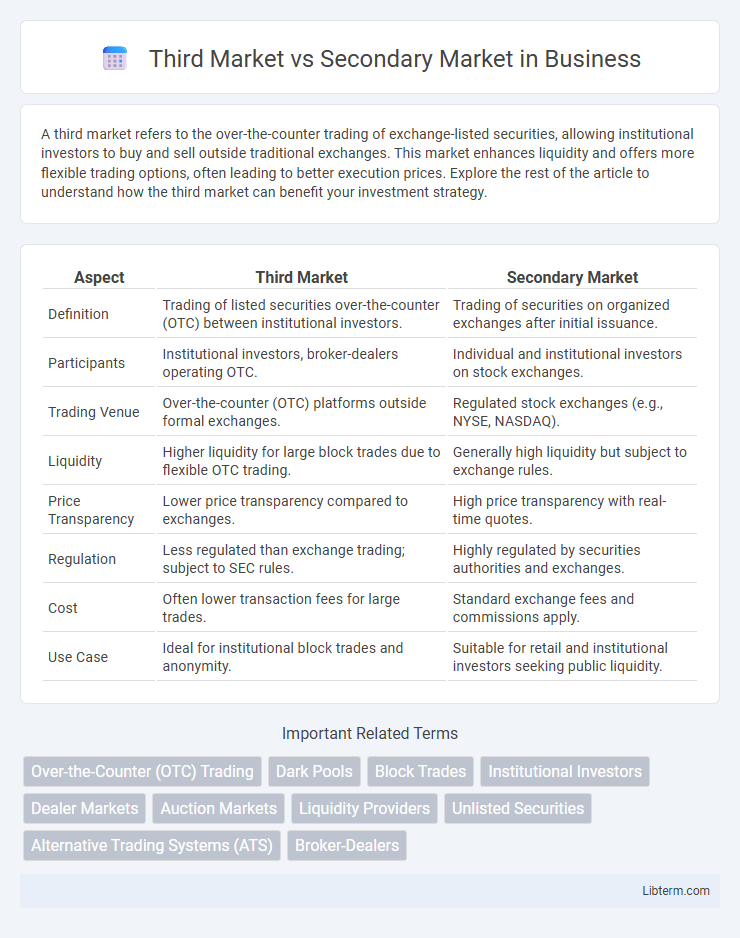

| Aspect | Third Market | Secondary Market |

|---|---|---|

| Definition | Trading of listed securities over-the-counter (OTC) between institutional investors. | Trading of securities on organized exchanges after initial issuance. |

| Participants | Institutional investors, broker-dealers operating OTC. | Individual and institutional investors on stock exchanges. |

| Trading Venue | Over-the-counter (OTC) platforms outside formal exchanges. | Regulated stock exchanges (e.g., NYSE, NASDAQ). |

| Liquidity | Higher liquidity for large block trades due to flexible OTC trading. | Generally high liquidity but subject to exchange rules. |

| Price Transparency | Lower price transparency compared to exchanges. | High price transparency with real-time quotes. |

| Regulation | Less regulated than exchange trading; subject to SEC rules. | Highly regulated by securities authorities and exchanges. |

| Cost | Often lower transaction fees for large trades. | Standard exchange fees and commissions apply. |

| Use Case | Ideal for institutional block trades and anonymity. | Suitable for retail and institutional investors seeking public liquidity. |

Understanding the Basics: Third Market vs Secondary Market

The third market refers to the trading of exchange-listed securities in the over-the-counter (OTC) market between institutional investors, while the secondary market involves the buying and selling of securities on organized exchanges like the NYSE or NASDAQ after the initial public offering (IPO). Third market trading offers greater flexibility and often lower transaction costs, enabling large block trades without impacting market prices significantly. In contrast, the secondary market provides liquidity and price transparency through centralized trading platforms accessible to a broad range of investors.

Definition of the Third Market

The Third Market refers to the trading of exchange-listed securities in the over-the-counter (OTC) market, allowing institutional investors to buy and sell large blocks of stocks without going through the formal stock exchanges. It provides greater liquidity and price negotiation flexibility compared to the Secondary Market, where securities are traded on established exchanges like the NYSE or NASDAQ. The Third Market is essential for enhancing market efficiency by facilitating off-exchange transactions between large market participants.

What Constitutes the Secondary Market?

The secondary market encompasses platforms where previously issued securities are bought and sold, including stock exchanges like the NYSE and NASDAQ. It facilitates liquidity by allowing investors to trade shares among themselves after the initial public offering (IPO) in the primary market. Unlike the third market, which involves OTC trading of exchange-listed securities between institutional investors, the secondary market includes all formal and informal avenues for post-IPO transactions.

Key Differences Between Third Market and Secondary Market

The third market involves the trading of exchange-listed securities over-the-counter (OTC) between institutional investors and broker-dealers, while the secondary market refers to all trading of securities after the initial public offering (IPO), including exchanges and OTC venues. Third market transactions occur off-exchange, providing flexibility and potentially lower transaction costs for large block trades, whereas secondary market trading happens on public exchanges with regulated price discovery. Regulatory oversight differs, as the third market operates under less stringent exchange rules but must comply with SEC regulations, unlike the fully regulated secondary market exchanges such as NYSE or NASDAQ.

Major Participants in Third and Secondary Markets

Major participants in the third market include institutional investors, such as mutual funds and pension funds, and broker-dealers who trade large blocks of exchange-listed securities over-the-counter. In contrast, the secondary market primarily involves retail investors, market makers, and stock exchanges facilitating the buying and selling of securities among the public. Third market trades often provide liquidity and price improvement for large transactions outside the centralized exchanges typical of the secondary market.

Trading Mechanisms: Third Market vs Secondary Market

The Third Market involves the trading of exchange-listed securities over-the-counter (OTC) between institutional investors, enabling large blocks to be executed privately without influencing the public exchange price. In contrast, the Secondary Market encompasses transactions that occur on centralized exchanges like the NYSE or NASDAQ, where individual investors buy and sell securities with price discovery through public order books. Third Market trading offers greater flexibility and anonymity, while Secondary Market trading ensures transparency and centralized regulation.

Benefits of Third Market Trading

Third market trading offers institutional investors enhanced liquidity by enabling over-the-counter transactions of exchange-listed securities, which often leads to tighter bid-ask spreads and reduced market impact costs. This platform provides greater flexibility, allowing large block trades to occur discreetly without influencing the primary exchange prices. Access to extended trading hours further benefits participants by facilitating timely transactions beyond standard market sessions.

Risks and Challenges in both Markets

Third market transactions carry risks such as lower liquidity compared to primary exchanges, potential pricing inefficiencies, and limited regulatory oversight, which can lead to increased counterparty risk. Secondary market trading involves challenges like market volatility, price manipulation, and the risk of trading in illiquid securities that may result in large bid-ask spreads. Both markets require effective risk management strategies to navigate these complexities and protect investor interests.

Regulatory Environment: Third Market vs Secondary Market

The regulatory environment for the third market involves over-the-counter (OTC) trading of exchange-listed securities, subject to less stringent oversight compared to the secondary market, which operates under strict exchange regulations and compliance standards. Third market transactions often bypass traditional exchange rules, leading to differing reporting and disclosure requirements, while secondary market trades are fully regulated by organizations like the SEC and national exchanges. This distinction impacts transparency, investor protection, and market surveillance between third market and secondary market activities.

Choosing the Right Market for Your Investment Strategy

Selecting between the third market and the secondary market depends on your investment strategy's liquidity and market access needs. The third market offers opportunities to trade large blocks of securities over-the-counter, often providing better pricing and reduced market impact for institutional investors. In contrast, the secondary market delivers higher transparency and regulatory oversight, ideal for retail investors seeking standardized transactions and immediate execution.

Third Market Infographic

libterm.com

libterm.com