Over-the-counter (OTC) products are medications and treatments available without a prescription, designed for easy access and self-care. Understanding the benefits and risks of OTC options helps you make informed decisions about your health. Explore the rest of the article to learn how to choose the right OTC products safely and effectively.

Table of Comparison

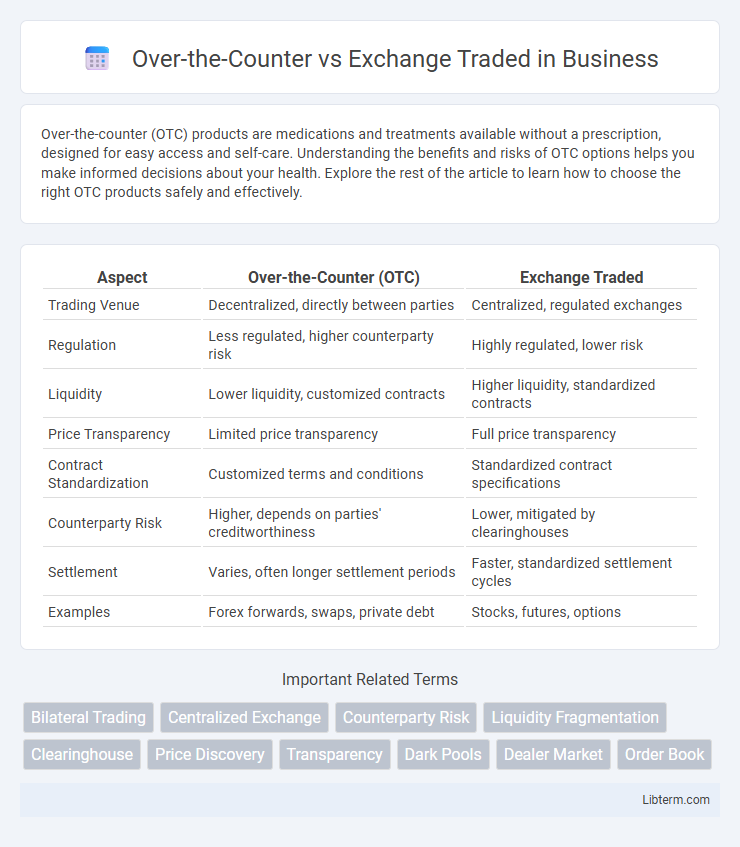

| Aspect | Over-the-Counter (OTC) | Exchange Traded |

|---|---|---|

| Trading Venue | Decentralized, directly between parties | Centralized, regulated exchanges |

| Regulation | Less regulated, higher counterparty risk | Highly regulated, lower risk |

| Liquidity | Lower liquidity, customized contracts | Higher liquidity, standardized contracts |

| Price Transparency | Limited price transparency | Full price transparency |

| Contract Standardization | Customized terms and conditions | Standardized contract specifications |

| Counterparty Risk | Higher, depends on parties' creditworthiness | Lower, mitigated by clearinghouses |

| Settlement | Varies, often longer settlement periods | Faster, standardized settlement cycles |

| Examples | Forex forwards, swaps, private debt | Stocks, futures, options |

Introduction to Over-the-Counter (OTC) and Exchange-Traded Markets

Over-the-Counter (OTC) markets facilitate direct trading of securities between parties without a centralized exchange, offering flexibility in contract terms and a wider range of instruments such as derivatives and bonds. Exchange-traded markets operate through regulated platforms like the New York Stock Exchange (NYSE) or Nasdaq, ensuring standardized contracts, greater transparency, and liquidity. OTC trading suits customized financial products, while exchange-traded markets prioritize security, price discovery, and regulatory oversight.

Defining Over-the-Counter Transactions

Over-the-counter (OTC) transactions occur directly between two parties without the supervision of an exchange, allowing for customized contracts tailored to specific needs. These OTC deals often involve trading in assets like derivatives, bonds, and currencies, providing flexibility but less transparency compared to exchange-traded products. The lack of a centralized marketplace in OTC trades means counterparty risk is higher, demanding thorough credit assessment and risk management.

Understanding Exchange-Traded Markets

Exchange-traded markets offer standardized contracts and centralized trading through regulated exchanges like the NYSE or NASDAQ, ensuring greater transparency and liquidity compared to over-the-counter (OTC) markets. These markets facilitate price discovery and risk management by providing real-time pricing and clearinghouse guarantees that reduce counterparty risk. The structured environment of exchange-traded markets makes them ideal for investors seeking regulated, efficient platforms for trading equities, options, and futures.

Key Differences Between OTC and Exchange-Traded

Over-the-counter (OTC) markets involve direct trading between parties without a centralized exchange, leading to less transparency and higher counterparty risk, while exchange-traded markets operate through formal exchanges offering standardized contracts and greater liquidity. OTC trading allows customization of contract terms but lacks the regulatory oversight and price discovery mechanisms typical of exchange-traded instruments. Exchange-traded products benefit from strict regulation and centralized clearing, minimizing default risk and enhancing market efficiency compared to the more informal and decentralized OTC environment.

Pros and Cons of Over-the-Counter Trading

Over-the-counter (OTC) trading offers greater flexibility as it allows customized contracts between parties without strict exchange regulations, facilitating access to a broader range of financial instruments. However, OTC markets have less transparency and lower liquidity compared to exchange-traded markets, increasing counterparty risk and price volatility for traders. The decentralized nature of OTC trading can result in wider bid-ask spreads and potentially higher transaction costs due to limited market participants.

Advantages and Disadvantages of Exchange-Traded Platforms

Exchange-traded platforms offer high liquidity and transparent pricing due to centralized trading on regulated exchanges, enhancing investor confidence and market efficiency. However, these platforms often have higher transaction costs and stricter regulatory requirements compared to over-the-counter (OTC) markets, which may limit flexibility. The standardized contracts on exchange-traded platforms reduce counterparty risk but can restrict customization options available in OTC markets.

Regulatory Considerations for OTC vs Exchange-Traded

OTC markets operate with less stringent regulatory oversight compared to exchange-traded markets, which are subject to strict regulations by entities such as the SEC or CFTC. Exchange-traded instruments benefit from standardized contracts, centralized clearinghouses, and transparent pricing, reducing counterparty risk and enhancing market integrity. In contrast, OTC transactions often involve customized contracts negotiated directly between parties, increasing exposure to default risk and requiring robust risk management practices.

Liquidity and Transparency: A Comparative Overview

Over-the-counter (OTC) markets typically offer lower liquidity compared to exchange-traded markets due to decentralized trading and fewer participants. Exchange-traded instruments benefit from higher transparency with standardized contracts and real-time pricing on regulated platforms. Enhanced liquidity and transparency in exchange-traded markets reduce counterparty risk and improve price discovery for investors.

Risk Factors in OTC and Exchange-Traded Markets

OTC markets carry higher counterparty risk due to the absence of centralized clearinghouses, increasing the potential for default between participants. Exchange-traded markets benefit from standardized contracts and regulatory oversight, significantly reducing credit risk and enhancing market transparency. However, OTC products offer flexibility and customization, which can introduce complexity and valuation challenges compared to the standardized nature of exchange-traded instruments.

Choosing the Right Market: OTC or Exchange-Traded?

Choosing the right market between over-the-counter (OTC) and exchange-traded depends on factors like liquidity, transparency, and regulatory oversight. OTC markets offer customized contracts and flexibility but generally involve higher counterparty risk and less price transparency compared to exchange-traded markets. Exchange-traded markets provide standardized contracts, greater liquidity, and stricter regulations, making them suitable for investors seeking more security and clear pricing.

Over-the-Counter Infographic

libterm.com

libterm.com