Merchant Cash Advance offers businesses quick access to funds by advancing capital based on future credit card sales, providing flexible repayment tied to daily revenue. This financial solution helps improve cash flow without the constraints of traditional loans, making it ideal for businesses with fluctuating income. Discover how a Merchant Cash Advance can support your business growth by reading the rest of this article.

Table of Comparison

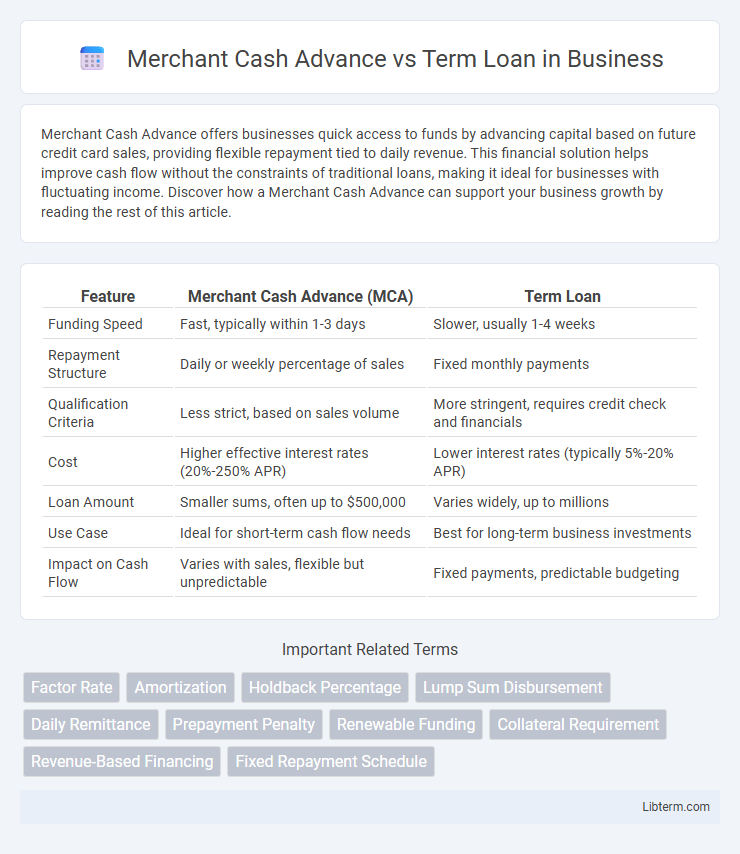

| Feature | Merchant Cash Advance (MCA) | Term Loan |

|---|---|---|

| Funding Speed | Fast, typically within 1-3 days | Slower, usually 1-4 weeks |

| Repayment Structure | Daily or weekly percentage of sales | Fixed monthly payments |

| Qualification Criteria | Less strict, based on sales volume | More stringent, requires credit check and financials |

| Cost | Higher effective interest rates (20%-250% APR) | Lower interest rates (typically 5%-20% APR) |

| Loan Amount | Smaller sums, often up to $500,000 | Varies widely, up to millions |

| Use Case | Ideal for short-term cash flow needs | Best for long-term business investments |

| Impact on Cash Flow | Varies with sales, flexible but unpredictable | Fixed payments, predictable budgeting |

Introduction to Merchant Cash Advance vs Term Loan

Merchant Cash Advance provides businesses with upfront capital based on future sales, offering flexible repayment tied to daily credit card transactions, while Term Loans involve borrowing a fixed amount with scheduled repayments over a specified period and typically lower interest rates. MCA suits businesses with fluctuating revenue needing quick access to funds, whereas Term Loans are preferable for stable cash flow cycles and longer-term financing needs. Understanding these distinctions helps businesses choose the optimal financing solution tailored to their operational cash flow and growth objectives.

Understanding Merchant Cash Advances

Merchant Cash Advances (MCAs) provide businesses with upfront capital based on future credit card sales, offering flexible repayment tied directly to daily revenue, unlike fixed monthly payments of term loans. MCAs are ideal for companies needing quick access to funds without strict credit requirements, as repayment adjusts with cash flow. This alternative financing suits businesses with fluctuating income seeking fast approval and minimal collateral, contrasting with the structured nature of traditional term loans.

What is a Term Loan?

A term loan is a fixed amount of financing provided by a lender that is repaid over a set period with predetermined interest rates, making it suitable for businesses seeking predictable monthly payments and long-term funding. Unlike merchant cash advances, term loans offer structured repayment schedules and typically lower overall costs, with terms ranging from one to ten years. Small and medium-sized enterprises often use term loans for equipment purchases, expansion, or working capital needs due to their stability and reliability.

Key Differences Between MCA and Term Loan

Merchant Cash Advances (MCA) provide businesses with upfront cash in exchange for a percentage of future credit card sales, offering flexible repayments tied to daily revenue, unlike term loans which require fixed monthly payments. Term loans involve borrowing a lump sum to be repaid over a set period with a fixed or variable interest rate, often necessitating good credit and collateral. Key differences include repayment structure, eligibility requirements, and cost, with MCAs typically having higher fees but faster access to funds compared to the more structured and lower-interest term loans.

Eligibility and Approval Process

Merchant cash advances offer flexible eligibility criteria, typically requiring a minimum monthly revenue and a few months of business history, making them accessible to businesses with lower credit scores. Term loans generally demand stronger credit profiles, comprehensive financial documentation, and longer operational history due to their structured repayment schedules. Approval for merchant cash advances is faster, often within days, while term loans involve a more rigorous underwriting process, extending approval times to weeks.

Repayment Structures Compared

Merchant Cash Advances (MCAs) offer repayments based on a percentage of daily credit card sales, resulting in flexible daily payments that fluctuate with revenue, while term loans require fixed monthly payments over a set period. MCAs typically have shorter repayment durations, often under a year, whereas term loans can span several years, providing predictable cash flow planning. The variable repayment schedule of MCAs suits businesses with inconsistent income, whereas term loans fit those seeking stable, long-term financing.

Costs and Interest Rates Analysis

Merchant Cash Advances typically involve higher effective interest rates compared to term loans, often exceeding 30% APR due to factoring fees and rapid repayment structures. Term loans offer more predictable costs with fixed or variable interest rates ranging from 5% to 30%, depending on creditworthiness and loan duration. Understanding the total cost of capital, including origination fees and prepayment penalties, is essential when comparing these financing options for business cash flow management.

Pros and Cons of Merchant Cash Advance

Merchant Cash Advance (MCA) offers fast access to capital based on future sales, with flexible repayment tied to daily credit card receipts, making it suitable for businesses with fluctuating revenues. However, MCAs tend to have higher costs compared to term loans, with effective annual percentage rates (APR) often exceeding 70%, and can strain cash flow due to aggressive daily or weekly repayments. Lack of regulatory oversight and potential for debt cycles are significant drawbacks compared to traditional term loans with fixed interest rates and predictable payment schedules.

Pros and Cons of Term Loan

Term loans offer predictable repayment schedules and generally lower interest rates compared to merchant cash advances, making them suitable for businesses with strong credit and stable cash flow. However, they require collateral and involve a lengthy approval process, which can limit accessibility for startups or businesses with fluctuating revenue. The fixed repayment terms can also strain cash flow during slower periods, presenting a risk for companies without consistent income streams.

Which Financing Option is Right for Your Business?

Choosing between a Merchant Cash Advance and a Term Loan depends on your business's cash flow and repayment flexibility needs. Merchant Cash Advances offer quick access to funds by advancing a lump sum in exchange for a percentage of future sales, ideal for businesses with irregular revenue streams. Term Loans provide structured repayment schedules and lower interest rates, making them better suited for established businesses with steady cash flow seeking predictable costs.

Merchant Cash Advance Infographic

libterm.com

libterm.com