Pac-Man Defense is a strategic corporate tactic used by a target company to prevent a hostile takeover by attempting to acquire the aggressor instead. This defensive maneuver creates a complex situation that deters the initial bidder by turning the tables and forcing them to defend themselves. Explore this article to understand how the Pac-Man Defense works and its implications for your business strategy.

Table of Comparison

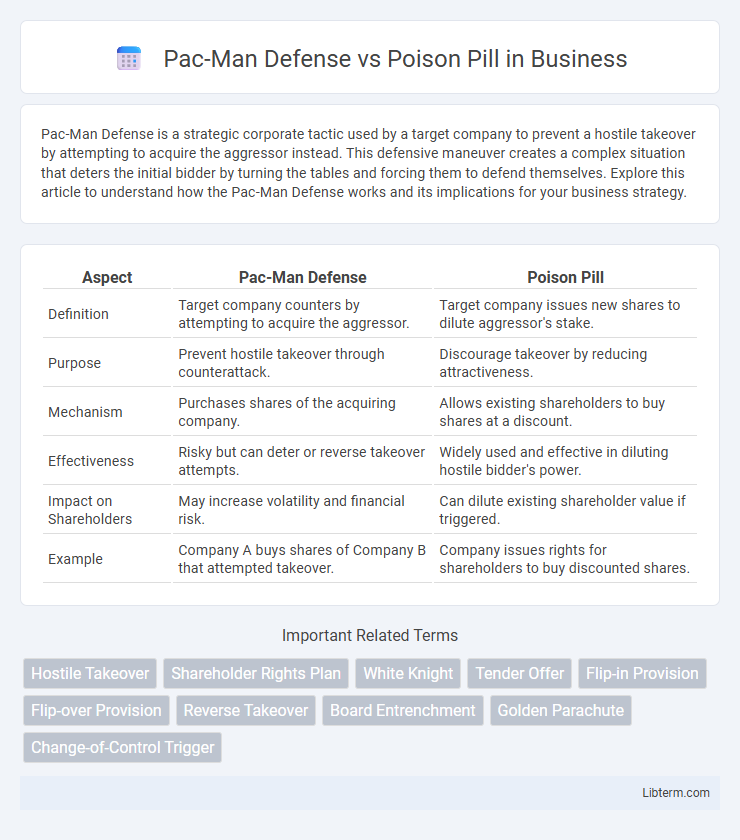

| Aspect | Pac-Man Defense | Poison Pill |

|---|---|---|

| Definition | Target company counters by attempting to acquire the aggressor. | Target company issues new shares to dilute aggressor's stake. |

| Purpose | Prevent hostile takeover through counterattack. | Discourage takeover by reducing attractiveness. |

| Mechanism | Purchases shares of the acquiring company. | Allows existing shareholders to buy shares at a discount. |

| Effectiveness | Risky but can deter or reverse takeover attempts. | Widely used and effective in diluting hostile bidder's power. |

| Impact on Shareholders | May increase volatility and financial risk. | Can dilute existing shareholder value if triggered. |

| Example | Company A buys shares of Company B that attempted takeover. | Company issues rights for shareholders to buy discounted shares. |

Introduction to Pac-Man Defense and Poison Pill

Pac-Man Defense and Poison Pill are two strategic anti-takeover mechanisms used by companies facing hostile bids. Pac-Man Defense involves the target company turning the tables by attempting to acquire the aggressor, creating a mutual threat that deters the takeover. Poison Pill, on the other hand, enables shareholders to purchase additional shares at a discount, diluting the acquirer's stake and making the takeover prohibitively expensive.

Historical Background of Antitakeover Strategies

Pac-Man Defense and Poison Pill emerged in the late 20th century as pivotal antitakeover strategies during hostile merger attempts, with Pac-Man Defense first notably used in the 1982 Nabisco-RJR Nabisco battle. The Pac-Man Defense involves the target company launching a counter-tender offer to acquire the hostile bidder, while the Poison Pill grants existing shareholders rights to purchase additional shares at a discount, diluting the potential acquirer's stake. These tactics reflect evolving corporate governance techniques developed to protect company value and shareholder interests amid increasing takeover threats in the 1980s and 1990s.

Core Principles of Poison Pill Tactics

Poison Pill tactics involve issuing new shares or rights to existing shareholders, designed to dilute the stake of a potential acquirer and make a hostile takeover prohibitively expensive. This strategy empowers current shareholders to purchase additional shares at a discount, effectively thwarting unwanted acquisition attempts by raising the cost or decreasing the attractiveness of the takeover bid. By contrast, Pac-Man Defense directly counters an acquirer by attempting a takeover of the aggressor, whereas Poison Pill focuses on shareholder rights and equity dilution to safeguard company control.

Mechanism and Execution of Pac-Man Defense

Pac-Man Defense involves the target company launching a counter-tender offer to acquire the hostile bidder, reversing the takeover attempt and putting pressure on the aggressor's financial resources. This mechanism relies on rapid mobilization of capital and shareholder support to buy a significant stake in the bidder, complicating the original acquisition. Execution requires strategic negotiation and financial readiness to maintain control and protect against the hostile takeover.

Key Differences Between Pac-Man Defense and Poison Pill

The Pac-Man Defense involves the target company turning the tables by attempting to acquire the hostile bidder, whereas the Poison Pill strategy allows the target to issue new shares or rights to existing shareholders, diluting the bidder's stake. Pac-Man Defense is an aggressive counterattack tactic relying on financial strength for a takeover bid, while Poison Pill acts as a deterrent by making the acquisition prohibitively expensive or complicated. Key differences lie in Pac-Man Defense's offensive nature versus Poison Pill's protective mechanism engineered to preserve control.

Advantages and Disadvantages of Each Strategy

Pac-Man Defense allows a targeted company to counterattack by attempting to acquire the hostile bidder, creating a strong deterrent effect and often boosting stock prices. However, it requires substantial financial resources and risks escalating the takeover battle, potentially harming both companies' value. Poison Pill strategy dilutes shares or imposes financial penalties to thwart takeovers, effectively deterring hostile bids without immediate financial risk, but it can frustrate shareholders and might be viewed negatively by the market or regulators.

Notable Case Studies and Real-World Examples

Pac-Man Defense was notably employed by Bendix Corporation in its 1982 hostile takeover attempt of Martin Marietta, where Bendix attempted to acquire Marietta, but Marietta countered by trying to buy Bendix instead, effectively warding off the takeover. In contrast, the Poison Pill strategy saw a high-profile example in 1985 when T. Boone Pickens used this tactic to fend off a hostile bid from Gulf Oil, allowing the target company to issue new shares that inflated the takeover price and diluted the bidder's stake. These cases demonstrate how Pac-Man Defense involves an aggressive counter-bid to regain control, while Poison Pill deterrents manipulate share structure to make acquisitions prohibitively expensive for the pursuer.

Legal and Regulatory Considerations

Pac-Man Defense and Poison Pill strategies involve complex legal and regulatory considerations, particularly under securities laws and antitrust regulations. Corporate boards must ensure compliance with the Securities Exchange Act of 1934 when implementing Poison Pills, as improper issuance can lead to shareholder litigation and SEC scrutiny. Pac-Man Defenses, involving counter-tender offers, require careful adherence to disclosure rules and fair dealing standards to avoid regulatory sanctions and maintain shareholder trust.

Impact on Shareholders and Corporate Governance

Pac-Man Defense empowers shareholders by enabling management to counter hostile takeovers through aggressive share repurchases, potentially preserving existing corporate control but risking asset depletion. Poison Pill mechanisms dilute the acquirer's stake by issuing convertible securities to existing shareholders, deterring takeovers but possibly entrenching current management and limiting shareholder value. Both strategies significantly influence corporate governance by balancing takeover deterrence with shareholder rights and long-term value preservation.

Future Trends in Antitakeover Defenses

Pac-Man Defense, where a target company counters a hostile takeover by attempting to acquire the aggressor, contrasts with the Poison Pill strategy that dilutes shares to make takeovers cost-prohibitive. Future trends in antitakeover defenses emphasize technological integration, such as blockchain for transparent shareholder voting, and increasing reliance on environmental, social, and governance (ESG) criteria to influence shareholder support. Innovations in AI-driven risk assessment and regulatory adaptations are shaping more sophisticated and dynamic defense mechanisms beyond traditional Pac-Man and Poison Pill tactics.

Pac-Man Defense Infographic

libterm.com

libterm.com