A savings account offers a secure way to grow your money with interest while maintaining easy access to funds. It is ideal for building an emergency fund or saving for short-term goals without risking principal. Explore the article to discover the best savings account options and how to maximize your returns.

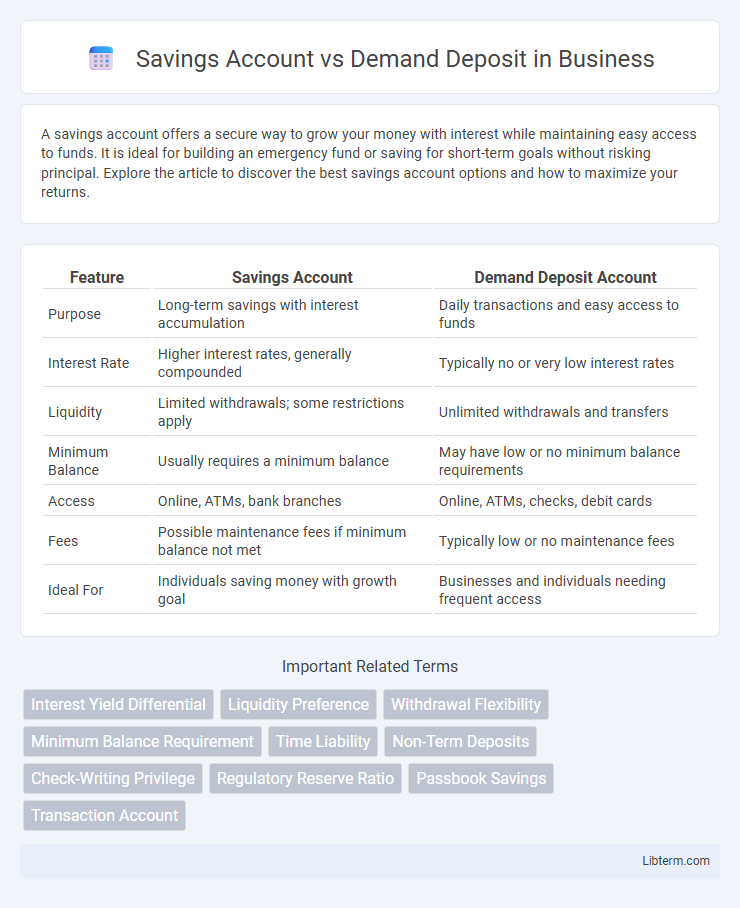

Table of Comparison

| Feature | Savings Account | Demand Deposit Account |

|---|---|---|

| Purpose | Long-term savings with interest accumulation | Daily transactions and easy access to funds |

| Interest Rate | Higher interest rates, generally compounded | Typically no or very low interest rates |

| Liquidity | Limited withdrawals; some restrictions apply | Unlimited withdrawals and transfers |

| Minimum Balance | Usually requires a minimum balance | May have low or no minimum balance requirements |

| Access | Online, ATMs, bank branches | Online, ATMs, checks, debit cards |

| Fees | Possible maintenance fees if minimum balance not met | Typically low or no maintenance fees |

| Ideal For | Individuals saving money with growth goal | Businesses and individuals needing frequent access |

Introduction to Savings Accounts and Demand Deposits

Savings accounts are financial instruments designed to help individuals accumulate funds over time while earning interest, typically offering limited transaction capabilities to encourage saving. Demand deposits, commonly known as checking accounts, provide immediate access to funds with unlimited transactions, allowing for everyday spending through checks, debit cards, and electronic transfers. Both account types are fundamental banking products, but savings accounts prioritize interest growth and fund retention, whereas demand deposits emphasize liquidity and ease of access.

Key Features of Savings Accounts

Savings accounts typically offer interest earnings, limited transaction capabilities, and require a minimum balance, making them ideal for growing funds over time. They provide easy access to money while encouraging financial discipline through withdrawal limits and lower fees compared to demand deposits. Unlike demand deposit accounts that prioritize liquidity for frequent transactions, savings accounts focus on accumulating savings with regulated access and interest benefits.

Key Features of Demand Deposit Accounts

Demand deposit accounts offer immediate access to funds without withdrawal restrictions, making them ideal for daily transactions and bill payments. These accounts typically do not earn interest or provide minimal returns compared to savings accounts, which are designed for longer-term savings with limited withdrawals. Demand deposits often feature unlimited transactions, easy check writing, and debit card access, enhancing liquidity and convenience for account holders.

Differences in Accessibility and Withdrawal Options

Savings accounts typically limit the number of monthly withdrawals to promote saving, often requiring users to visit a branch or use specific electronic methods for access. Demand deposit accounts, commonly known as checking accounts, provide immediate access to funds with unlimited withdrawals through checks, ATMs, and electronic transfers. The accessibility of demand deposits favors frequent transactions, while savings accounts prioritize restricted access to encourage fund retention.

Interest Rates Comparison

Savings accounts typically offer higher interest rates compared to demand deposit accounts, making them more advantageous for earning passive income over time. Demand deposit accounts, often linked to checking accounts, provide lower or negligible interest rates due to their high liquidity and frequent access features. Investors seeking better returns with moderate access to funds generally prefer savings accounts for their superior interest rate benefits.

Account Requirements and Minimum Balances

Savings accounts typically require a minimum opening deposit often ranging from $25 to $100 and may enforce a minimum monthly balance to avoid fees, usually around $300 to $500. Demand deposit accounts, also known as checking accounts, generally have lower or no minimum balance requirements, providing more flexibility for daily transactions and withdrawals. Banks may impose fees or restrictions if the required minimum balance is not maintained in either account type, impacting account holders differently based on account features.

Suitability for Different Financial Goals

Savings accounts are ideal for individuals aiming to build an emergency fund or save for medium-term goals due to their interest-earning potential and withdrawal limitations. Demand deposits, such as checking accounts, provide high liquidity suitable for daily transactions and short-term financial needs without earning significant interest. Selecting between these accounts depends on whether the priority is accessibility for frequent use or growth through interest accumulation.

Fees and Charges Overview

Savings accounts typically impose lower fees with limited withdrawal charges, encouraging long-term deposits and offering interest accumulation. Demand deposit accounts often have minimal or no maintenance fees but may include charges for excessive transactions or overdrafts due to higher liquidity and frequent access. Understanding specific fee structures, such as monthly service fees, ATM charges, and minimum balance penalties, is crucial for selecting the right account type based on usage and financial goals.

Security and Insurance Coverage

Savings accounts and demand deposits both offer security through federal insurance by the FDIC or NCUA, protecting deposits up to $250,000 per account holder. Savings accounts typically have limits on monthly withdrawals, reducing the risk of unauthorized or excessive transactions, while demand deposits provide immediate access to funds with potentially higher exposure to frequent transactions. Both account types maintain strong regulatory safeguards, but savings accounts generally emphasize long-term security through restricted liquidity and interest accumulation.

Which Account Should You Choose?

Savings accounts typically offer higher interest rates compared to demand deposit accounts, making them ideal for growing your funds over time while maintaining liquidity. Demand deposit accounts, such as checking accounts, provide unlimited transactions and easier access to funds for daily expenses and bill payments. Choose a savings account if your priority is earning interest with limited withdrawals; opt for a demand deposit account if you require frequent, flexible access to your money.

Savings Account Infographic

libterm.com

libterm.com