Cooperative organizations empower members to collaborate and achieve common economic, social, and cultural goals through shared ownership and democratic control. These entities prioritize member benefits over profits, fostering trust and community development while promoting sustainable practices. Discover how your involvement in a cooperative can enhance both personal and collective success by reading the rest of the article.

Table of Comparison

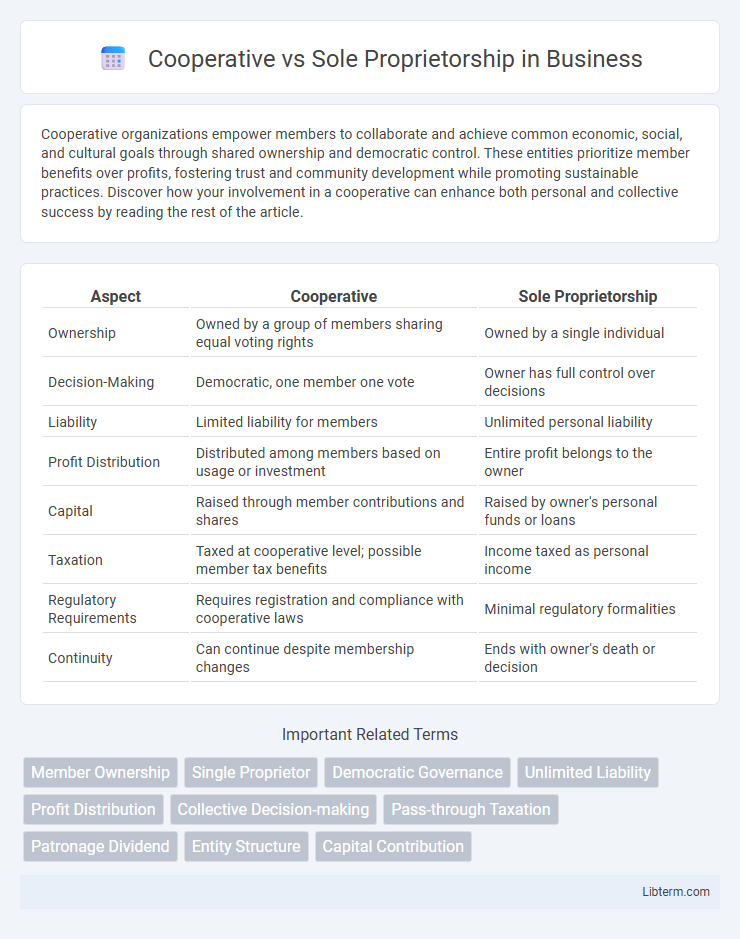

| Aspect | Cooperative | Sole Proprietorship |

|---|---|---|

| Ownership | Owned by a group of members sharing equal voting rights | Owned by a single individual |

| Decision-Making | Democratic, one member one vote | Owner has full control over decisions |

| Liability | Limited liability for members | Unlimited personal liability |

| Profit Distribution | Distributed among members based on usage or investment | Entire profit belongs to the owner |

| Capital | Raised through member contributions and shares | Raised by owner's personal funds or loans |

| Taxation | Taxed at cooperative level; possible member tax benefits | Income taxed as personal income |

| Regulatory Requirements | Requires registration and compliance with cooperative laws | Minimal regulatory formalities |

| Continuity | Can continue despite membership changes | Ends with owner's death or decision |

Overview of Cooperative and Sole Proprietorship

A cooperative is a member-owned business entity designed to meet common economic, social, and cultural needs, emphasizing shared decision-making and profit distribution among members. Sole proprietorship is a business owned and operated by a single individual, offering complete control but unlimited personal liability. Cooperatives prioritize collective benefits, while sole proprietorships prioritize individual ownership and responsibility.

Definition and Core Principles

A cooperative is a legally recognized organization owned and operated by members for their mutual benefit, emphasizing democratic control, member participation, and shared profits. A sole proprietorship is an unincorporated business owned by a single individual who assumes full control, responsibility, and profits, with minimal regulatory requirements. Core principles of cooperatives include voluntary and open membership, economic participation, autonomy, education, cooperation among cooperatives, and concern for community, whereas sole proprietorships prioritize individual decision-making and unlimited liability.

Ownership Structure

In a cooperative, ownership is shared equally among members who jointly make decisions and share profits based on their participation, promoting democratic control and collective responsibility. Sole proprietorship features a single individual who owns and controls the business entirely, assuming all profits, losses, and risks. The cooperative structure fosters collaboration and member benefits, while sole proprietorship provides complete autonomy and simpler management.

Management and Decision-Making

In a cooperative, management is typically democratic, with decisions made collectively by members based on one-member, one-vote principles, ensuring equal participation regardless of capital contribution. Sole proprietorship centralizes management and decision-making authority in a single individual, allowing for swift decisions but placing full responsibility and risk on the owner. The cooperative model fosters shared accountability and consensus-driven policies, while sole proprietorship benefits from agility and unilateral control.

Profit Distribution

Profit distribution in a cooperative typically follows a member-based allocation system where earnings are distributed according to each member's contribution or participation, fostering equitable sharing. Sole proprietorship profits are entirely owned and retained by a single individual, allowing full control but bearing all risks and rewards personally. The cooperative model prioritizes collective benefit, whereas sole proprietorship emphasizes individual gain.

Capital and Funding Sources

Cooperatives primarily raise capital through member contributions, collective investments, and retained earnings, ensuring democratic control and shared financial responsibility among members. Sole proprietorships rely heavily on personal funds, loans, and limited external financing, with the owner bearing full financial risk and control. Access to diverse funding sources in cooperatives often provides greater capital stability compared to the sole proprietorship's reliance on individual creditworthiness.

Legal and Regulatory Requirements

Cooperatives require a formal legal structure defined by cooperative laws, including registration, governance by a board of directors, and adherence to specific member rights and profit distribution rules, ensuring democratic control and accountability. Sole proprietorships involve minimal legal formalities, typically requiring only business licenses and permits, with the owner personally liable for all debts and legal obligations, creating simpler but riskier regulatory compliance. Regulatory oversight for cooperatives tends to be more rigorous due to their collective ownership and profit-sharing model, whereas sole proprietorships face fewer ongoing reporting requirements but no protection from personal liability.

Advantages of Cooperatives

Cooperatives offer distinct advantages including shared ownership which leads to democratic decision-making and equitable profit distribution among members. They benefit from collective bargaining power, reducing costs for goods and services while enhancing market competitiveness. Tax benefits and access to government grants also make cooperatives financially advantageous compared to sole proprietorships.

Benefits of Sole Proprietorship

Sole proprietorship offers complete control and decision-making power to the owner, enabling swift and flexible business operations without the need for consensus. This structure provides direct access to all profits and simpler tax filing, as income is reported on the owner's personal tax return, reducing administrative burdens. Low startup costs and minimal regulatory requirements make sole proprietorship an accessible and cost-effective choice for small business owners.

Which Business Model Is Right for You?

Choosing between a cooperative and a sole proprietorship depends on your business goals and values. A cooperative emphasizes shared ownership and democratic decision-making, ideal for those seeking collective benefits and community focus. In contrast, a sole proprietorship offers full control and simpler tax structures, suited for entrepreneurs wanting sole authority and ease of management.

Cooperative Infographic

libterm.com

libterm.com