Golden parachutes provide senior executives with substantial financial benefits in the event of job termination, often including severance pay, bonuses, and stock options. These agreements aim to protect executives from sudden job loss following mergers or acquisitions, ensuring financial stability during transitions. Explore the rest of the article to understand how golden parachutes impact corporate governance and shareholder interests.

Table of Comparison

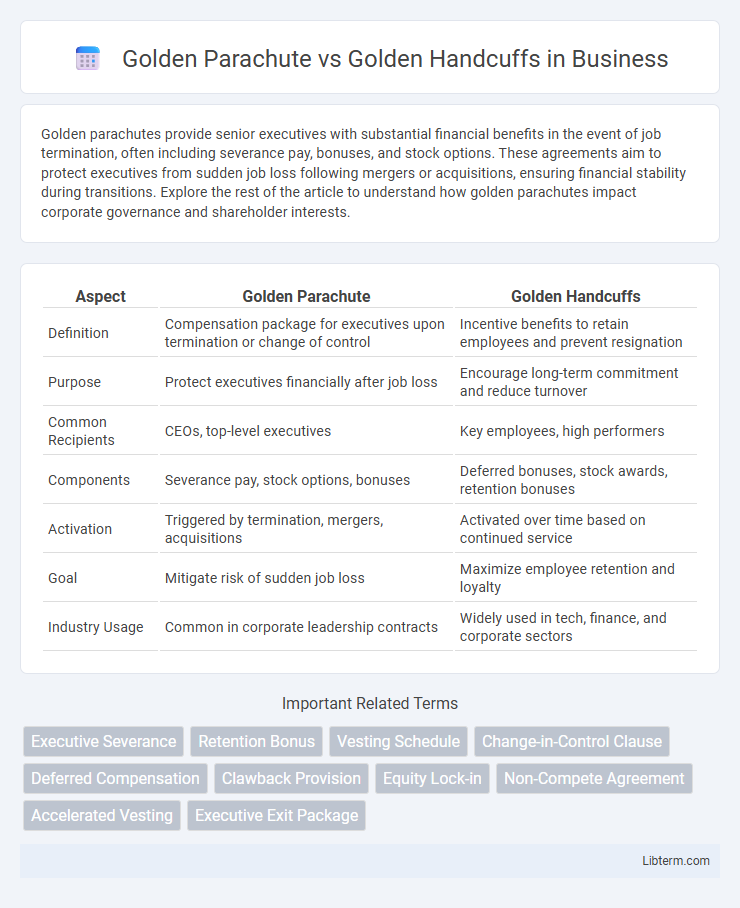

| Aspect | Golden Parachute | Golden Handcuffs |

|---|---|---|

| Definition | Compensation package for executives upon termination or change of control | Incentive benefits to retain employees and prevent resignation |

| Purpose | Protect executives financially after job loss | Encourage long-term commitment and reduce turnover |

| Common Recipients | CEOs, top-level executives | Key employees, high performers |

| Components | Severance pay, stock options, bonuses | Deferred bonuses, stock awards, retention bonuses |

| Activation | Triggered by termination, mergers, acquisitions | Activated over time based on continued service |

| Goal | Mitigate risk of sudden job loss | Maximize employee retention and loyalty |

| Industry Usage | Common in corporate leadership contracts | Widely used in tech, finance, and corporate sectors |

Introduction to Golden Parachutes and Golden Handcuffs

Golden Parachutes are contractual agreements that provide executives with substantial financial benefits if they are terminated following a merger or acquisition, ensuring a secure financial exit. Golden Handcuffs refer to incentives like stock options or bonuses designed to retain key employees by making it financially disadvantageous for them to leave the company. Both mechanisms play crucial roles in executive compensation strategies, balancing risk protection and employee retention.

Defining Golden Parachute: Meaning and Purpose

A golden parachute is a contractual agreement that provides executives with significant financial benefits, such as severance pay, stock options, or bonuses, upon termination due to mergers or acquisitions. Its purpose is to offer a safety net, ensuring financial security and incentivizing leadership stability during company transitions. This arrangement helps protect top executives from the uncertainties and risks associated with corporate restructuring or takeovers.

What Are Golden Handcuffs? Key Features Explained

Golden handcuffs refer to financial incentives offered to employees to encourage long-term retention, typically through stock options, bonuses, or deferred benefits. Key features include vesting schedules that require employees to remain with the company for a certain period to fully capitalize on these rewards, fostering loyalty and reducing turnover. Unlike golden parachutes, which provide severance benefits upon termination, golden handcuffs are designed to retain talent actively by aligning employees' financial interests with the company's success.

Core Differences Between Golden Parachute and Golden Handcuffs

Golden Parachute provides executives with significant financial benefits and severance packages upon termination or change in company control, ensuring security during job loss. Golden Handcuffs are designed to retain key employees by offering financial incentives, such as stock options or bonuses, contingent on staying with the company for a specified period. The core difference lies in Golden Parachute focusing on protection after exit, while Golden Handcuffs emphasize retention and preventing departure.

Benefits of Golden Parachutes for Executives and Employers

Golden Parachutes provide executives with substantial financial security by guaranteeing significant compensation packages upon termination or company acquisition, which incentivizes leadership retention during mergers or restructuring. Employers benefit by attracting top talent, reducing litigation risks, and ensuring smooth transitions in leadership, fostering organizational stability. These agreements align executive interests with shareholders by facilitating decisive actions without fear of personal financial loss.

Advantages of Golden Handcuffs in Employee Retention

Golden Handcuffs offer a strategic advantage in employee retention by providing long-term financial incentives that encourage employees to remain with a company, reducing turnover rates. These incentives typically include stock options, deferred bonuses, or restricted shares that vest over several years, aligning employee interests with organizational goals. By creating a strong loyalty bond, Golden Handcuffs help companies maintain talent stability and protect valuable institutional knowledge.

Legal and Ethical Considerations for Both Incentives

Golden parachutes, legally binding agreements that guarantee substantial compensation upon executive termination, require careful adherence to regulatory disclosure requirements under laws such as SEC Rule 402, ensuring transparency to shareholders. Golden handcuffs, designed to retain key employees through deferred compensation or stock options, must comply with employment law standards to avoid allegations of coercion or unfair labor practices. Ethically, both incentives demand balance between rewarding contribution and preventing excessive executive risk-taking or entrapment, fostering corporate governance that aligns with shareholder and stakeholder interests.

Potential Drawbacks and Criticisms

Golden parachutes may face criticism for encouraging executives to take excessive risks, as large compensation packages cushion potential job losses regardless of company performance. Golden handcuffs can create employee dissatisfaction and limit mobility, potentially reducing innovation and adaptability within an organization. Both mechanisms risk fostering a perception of inequality, which may harm overall employee morale and corporate culture.

Industry Examples: When Are They Used?

Golden parachutes are commonly used in industries like technology and finance to protect top executives during mergers and acquisitions, ensuring substantial severance packages if they are terminated. Golden handcuffs are prevalent in sectors such as pharmaceuticals and entertainment, designed to retain key talents by offering long-term incentives like stock options or bonuses contingent on continued employment. Both strategies serve distinct purposes: parachutes provide exit security, while handcuffs encourage loyalty and reduce turnover.

Choosing the Right Incentive: Factors to Consider

Choosing the right incentive between Golden Parachutes and Golden Handcuffs depends on factors such as company stability, executive retention goals, and risk tolerance. Golden Parachutes offer substantial severance packages to ease transitions during mergers or layoffs, securing loyalty in uncertain times. Golden Handcuffs provide long-term financial rewards tied to continued employment, promoting sustained commitment and performance within stable corporate environments.

Golden Parachute Infographic

libterm.com

libterm.com