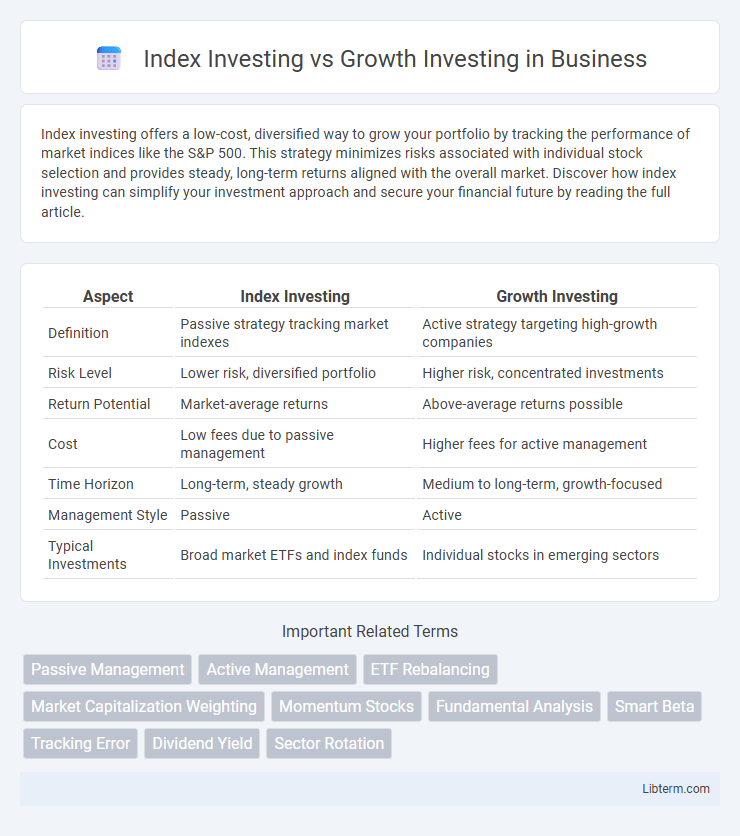

Index investing offers a low-cost, diversified way to grow your portfolio by tracking the performance of market indices like the S&P 500. This strategy minimizes risks associated with individual stock selection and provides steady, long-term returns aligned with the overall market. Discover how index investing can simplify your investment approach and secure your financial future by reading the full article.

Table of Comparison

| Aspect | Index Investing | Growth Investing |

|---|---|---|

| Definition | Passive strategy tracking market indexes | Active strategy targeting high-growth companies |

| Risk Level | Lower risk, diversified portfolio | Higher risk, concentrated investments |

| Return Potential | Market-average returns | Above-average returns possible |

| Cost | Low fees due to passive management | Higher fees for active management |

| Time Horizon | Long-term, steady growth | Medium to long-term, growth-focused |

| Management Style | Passive | Active |

| Typical Investments | Broad market ETFs and index funds | Individual stocks in emerging sectors |

Introduction to Index Investing and Growth Investing

Index investing involves purchasing a diversified portfolio that mirrors a market index, such as the S&P 500, minimizing risks through broad market exposure and low fees. Growth investing targets companies with above-average earnings growth potential, often in emerging industries like technology or healthcare, aiming for substantial capital appreciation. Both strategies offer different risk-return profiles, with index investing emphasizing stability and growth investing focusing on higher returns through market outperformance.

Key Differences Between Index and Growth Investing

Index investing involves purchasing a broad market index fund that replicates the performance of a specific market segment, offering diversification and lower fees. Growth investing targets individual stocks or sectors with high potential for capital appreciation, typically in rapidly expanding industries like technology or biotech. The key differences lie in risk exposure, with index investing providing stability through diversification, while growth investing carries higher volatility but the potential for greater returns.

Understanding Index Funds: Definition and Benefits

Index investing involves purchasing a broad market index fund, which tracks the performance of a specific segment of the stock market, such as the S&P 500, providing diversified exposure with lower fees. Index funds minimize individual stock risk and offer consistent returns that mirror the overall market, making them ideal for long-term investors seeking steady growth. Benefits include tax efficiency, lower management costs compared to active funds, and reduced volatility due to wide diversification.

What is Growth Investing? Core Concepts and Strategies

Growth investing centers on selecting stocks expected to increase at an above-average rate compared to the overall market, emphasizing companies with strong revenue and earnings growth potential. Core strategies involve targeting innovative sectors such as technology and healthcare, where businesses reinvest profits to accelerate expansion rather than paying dividends. Investors prioritize metrics like earnings growth rate, price-to-earnings-to-growth (PEG) ratio, and future cash flow projections to identify high-potential growth opportunities.

Historical Performance Comparison: Index vs Growth Investing

Historical performance comparison reveals that index investing typically offers more stable, broad market returns aligned with major benchmarks like the S&P 500, while growth investing targets companies with high revenue and earnings growth potential, often resulting in higher volatility. Over long-term periods, index funds have demonstrated consistent average annual returns around 7-10%, whereas growth stocks can outperform during bullish markets but face significant drawdowns during downturns. Examining past decades, the S&P 500 Growth Index has exhibited higher peaks but with greater risk, making index investing a more conservative choice for steady wealth accumulation.

Risk Factors in Index and Growth Investing

Index investing spreads risk by tracking a broad market benchmark, reducing the impact of individual stock volatility through diversification. Growth investing carries higher risk due to concentrated portfolios focused on high-potential companies, which often experience price fluctuations linked to earnings uncertainty and market sentiment. Investors in growth stocks face increased exposure to market volatility, sector-specific downturns, and valuation bubbles compared to the relatively stable nature of index funds.

Costs and Fees: Analyzing Expense Ratios

Index investing typically features lower expense ratios, averaging around 0.03% to 0.10%, due to passive management strategies that track market indexes. Growth investing often involves higher fees, with expense ratios ranging from 0.50% to 1.50%, reflecting active management and research costs to identify high-potential stocks. Lower costs associated with index funds enhance net returns over time, making expense ratios a crucial factor in investment strategy decisions.

Suitability: Who Should Choose Index or Growth Investing?

Index investing suits investors seeking broad market exposure, lower fees, and long-term stability by tracking market indexes like the S&P 500 or MSCI World. Growth investing appeals to those willing to accept higher volatility and risk for potential above-average returns by targeting companies with strong earnings growth and innovation in sectors like technology or healthcare. Risk tolerance, investment horizon, and financial goals determine whether index investing's diversification or growth investing's focused strategy aligns better with an individual's portfolio needs.

Tax Implications and Efficiency

Index investing offers tax efficiency by minimizing capital gains through lower portfolio turnover compared to growth investing, which tends to trigger higher tax liabilities due to frequent buying and selling of high-growth stocks. The passive nature of index funds often results in deferred tax events and lower taxable distributions, enhancing after-tax returns. Growth investing's active management can lead to short-term gains taxed at higher ordinary income rates, reducing overall tax efficiency.

Which Strategy is Right For You?

Index investing offers broad market exposure with lower fees and reduced risk through diversification, making it ideal for investors seeking steady, long-term growth. Growth investing targets companies with high potential for above-average earnings, appealing to those comfortable with higher volatility and aiming for significant capital appreciation. Choosing between these strategies depends on your risk tolerance, investment horizon, and financial goals, where index investing suits conservative investors and growth investing fits those with a higher risk appetite.

Index Investing Infographic

libterm.com

libterm.com