A merger agreement outlines the terms and conditions under which two companies combine to form a single entity, detailing the responsibilities, financial arrangements, and legal obligations of each party involved. Ensuring clarity in this contract is crucial to avoid disputes and streamline the integration process, protecting both companies' interests and stakeholder value. Explore the rest of the article to understand key provisions and how a well-crafted merger agreement benefits your business transition.

Table of Comparison

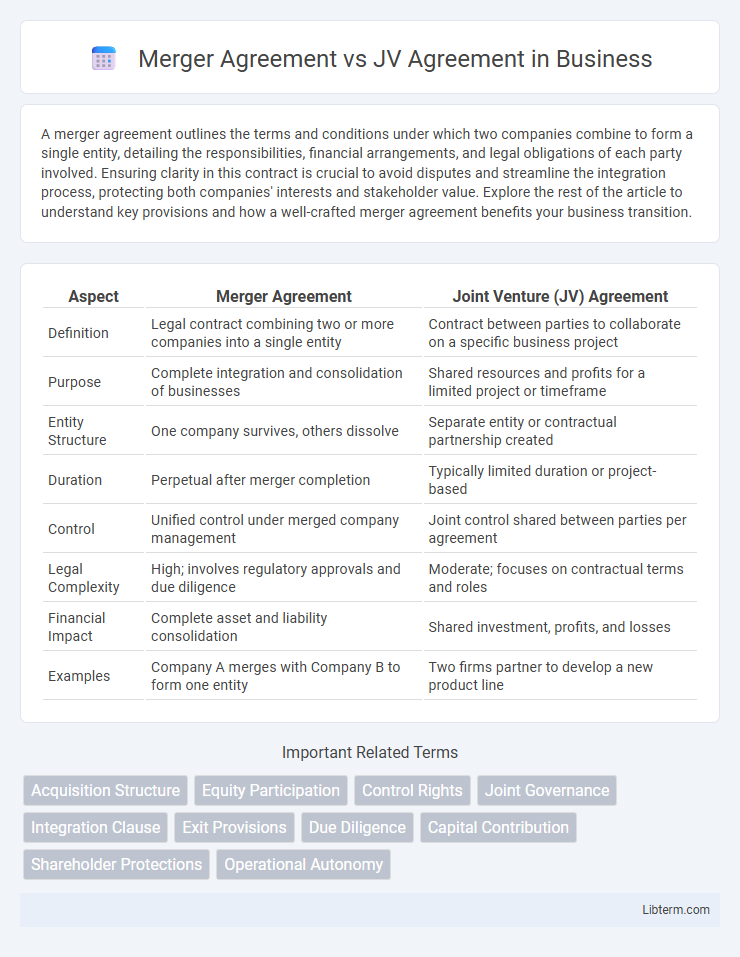

| Aspect | Merger Agreement | Joint Venture (JV) Agreement |

|---|---|---|

| Definition | Legal contract combining two or more companies into a single entity | Contract between parties to collaborate on a specific business project |

| Purpose | Complete integration and consolidation of businesses | Shared resources and profits for a limited project or timeframe |

| Entity Structure | One company survives, others dissolve | Separate entity or contractual partnership created |

| Duration | Perpetual after merger completion | Typically limited duration or project-based |

| Control | Unified control under merged company management | Joint control shared between parties per agreement |

| Legal Complexity | High; involves regulatory approvals and due diligence | Moderate; focuses on contractual terms and roles |

| Financial Impact | Complete asset and liability consolidation | Shared investment, profits, and losses |

| Examples | Company A merges with Company B to form one entity | Two firms partner to develop a new product line |

Introduction to Merger Agreements and JV Agreements

Merger agreements legally unify two or more companies into a single entity, transferring assets and liabilities to streamline operations and increase market share. Joint venture agreements establish a collaborative partnership between separate entities to share resources, risks, and profits for a specific project or business objective without full corporate integration. Understanding the distinct contractual terms and objectives in merger and joint venture agreements is crucial for aligning strategic business goals and regulatory compliance.

Definition and Key Features of Merger Agreements

A Merger Agreement is a legal contract that outlines the terms and conditions under which two or more companies combine into a single entity, focusing on the transfer of assets, liabilities, and equity ownership. Key features include the identification of the surviving entity, valuation and exchange ratio of shares, representations and warranties, conditions precedent to closing, and provisions for regulatory approvals and employee rights. Unlike JV Agreements, which create a separate business entity for collaboration while maintaining the independence of the original companies, Merger Agreements result in the consolidation and dissolution of the merging companies.

Definition and Key Features of JV Agreements

A Joint Venture (JV) Agreement is a contractual partnership where two or more parties collaborate to achieve a specific business objective, sharing resources, risks, and profits without forming a new legal entity. Unlike a Merger Agreement, which combines companies into a single entity, a JV Agreement defines the roles, contributions, governance, and profit-sharing mechanisms of each participant while maintaining their separate identities. Key features of JV Agreements include clear scope of the project, capital and resource commitments, management structure, duration, and dispute resolution provisions.

Legal Structure: Merger vs Joint Venture

A Merger Agreement legally consolidates two or more companies into a single entity, resulting in the absorption of one company by another and the termination of the absorbed company's separate legal existence. In contrast, a Joint Venture Agreement establishes a new, jointly owned entity where participating companies retain their original legal identities while sharing control, risks, and profits according to the agreement terms. The legal structure of a merger eliminates separate legal personalities, whereas a joint venture creates a collaborative partnership without dissolving existing companies.

Objectives and Strategic Goals: Comparing Both Agreements

A Merger Agreement focuses on the complete integration of two companies to achieve expanded market share, operational synergies, and increased shareholder value through consolidation. A JV Agreement establishes a collaborative partnership between entities to pursue specific projects or business activities while maintaining their independent operations and leveraging combined resources. Both agreements aim to enhance competitive advantage but differ in structure, with mergers targeting full unification and joint ventures emphasizing shared objectives without full amalgamation.

Ownership and Control Dynamics

Merger agreements result in the full consolidation of two companies, transferring ownership and control to a single, unified entity, often giving majority shareholders dominant decision-making power. Joint venture (JV) agreements establish a separate business entity where ownership and control are shared proportionally among the partners, each retaining specific rights and decision-making authority as outlined in the agreement. Control dynamics in mergers typically centralize under the acquiring or combined entity's management, while JV control remains distributed, requiring consensus or predefined governance mechanisms.

Risk Allocation and Liability Issues

A Merger Agreement typically consolidates two entities into one, centralizing risk allocation and liability, where the surviving company assumes all obligations, including debts and legal responsibilities. In contrast, a Joint Venture (JV) Agreement allows parties to share risks and liabilities proportionally based on their ownership interests without full consolidation, often with limited liability clauses protecting individual participants. These differences in risk allocation impact decision-making, financial exposure, and long-term accountability within corporate structures.

Tax Implications and Financial Considerations

Merger agreements often trigger immediate tax liabilities due to asset transfers and potential recognition of capital gains, whereas joint venture (JV) agreements typically structure collaborations without altering ownership, allowing profits and losses to be shared pass-through for tax purposes. Financially, mergers consolidate balance sheets and income statements, impacting debt ratios and shareholder equity, while JVs maintain separate financial records, with shared capital contributions and proportional profit distributions. Understanding these distinctions is critical for optimizing tax efficiency and financial structuring in corporate transactions.

Regulatory and Compliance Requirements

Merger agreements typically demand comprehensive regulatory approvals from antitrust authorities to ensure compliance with competition laws and prevent market monopolization. Joint venture agreements require adherence to sector-specific regulations and may involve obtaining licenses or permits for collaborative operations while maintaining distinct legal entities. Both agreement types mandate rigorous compliance frameworks to address reporting obligations, tax implications, and international trade regulations.

Choosing the Right Agreement: Factors to Consider

Choosing between a Merger Agreement and a Joint Venture Agreement depends on the strategic goals, level of integration, and desired control structure. A Merger Agreement typically suits companies seeking complete amalgamation and unified management, while a Joint Venture Agreement benefits parties aiming for collaborative projects without full corporate integration. Key factors include ownership distribution, risk sharing, regulatory implications, and long-term objectives to ensure that the selected agreement aligns with business growth and compliance requirements.

Merger Agreement Infographic

libterm.com

libterm.com