The waiting period refers to the time between initiating a process and the moment when benefits or results begin to take effect. Understanding the specific waiting period for your insurance policy or service agreement is crucial to avoid unexpected delays or denials. Explore the rest of the article to learn how waiting periods impact your coverage and what steps you can take to manage them effectively.

Table of Comparison

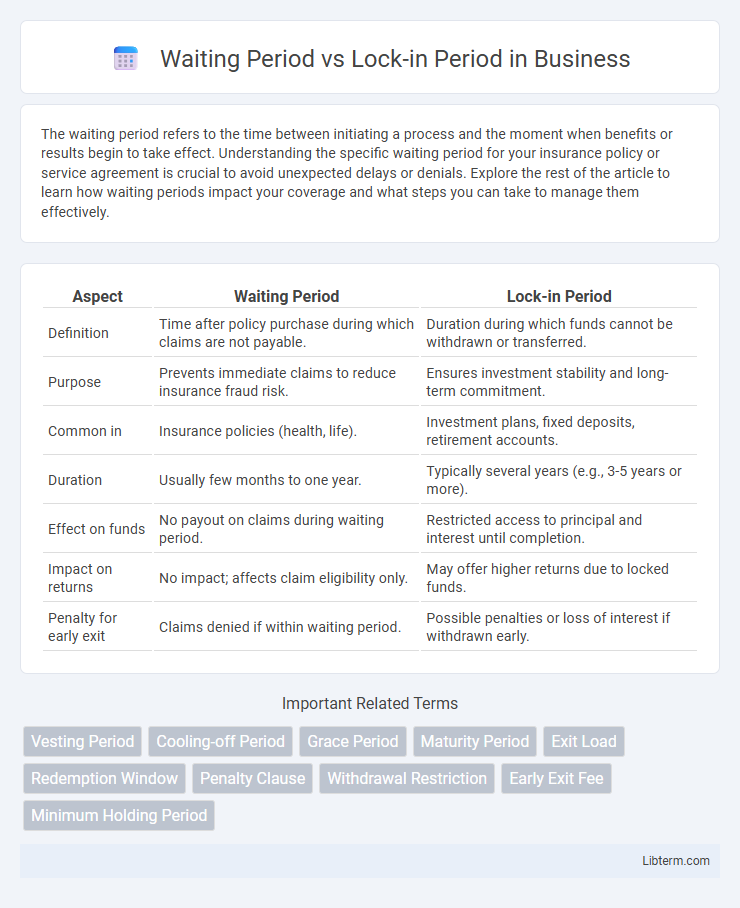

| Aspect | Waiting Period | Lock-in Period |

|---|---|---|

| Definition | Time after policy purchase during which claims are not payable. | Duration during which funds cannot be withdrawn or transferred. |

| Purpose | Prevents immediate claims to reduce insurance fraud risk. | Ensures investment stability and long-term commitment. |

| Common in | Insurance policies (health, life). | Investment plans, fixed deposits, retirement accounts. |

| Duration | Usually few months to one year. | Typically several years (e.g., 3-5 years or more). |

| Effect on funds | No payout on claims during waiting period. | Restricted access to principal and interest until completion. |

| Impact on returns | No impact; affects claim eligibility only. | May offer higher returns due to locked funds. |

| Penalty for early exit | Claims denied if within waiting period. | Possible penalties or loss of interest if withdrawn early. |

Understanding Waiting Periods vs Lock-in Periods

The waiting period refers to the time span during which a policyholder cannot claim specific benefits after purchasing an insurance policy, primarily designed to prevent misuse and fraud. The lock-in period signifies the minimum duration an investor must hold a financial product, like a fixed deposit or mutual fund, to avoid penalties and ensure commitment to the investment. Distinguishing waiting periods from lock-in periods is crucial for informed decisions in insurance and investment planning.

Key Differences Between Waiting Period and Lock-in Period

The waiting period refers to the time frame after purchasing an insurance policy during which certain claims are not payable, whereas the lock-in period denotes the minimum time an investor must hold an investment or insurance plan before partial or full withdrawal is permitted. The waiting period primarily protects the insurer from immediate claims due to pre-existing conditions, while the lock-in period safeguards the investment's tenure to encourage long-term savings or growth. Understanding these distinctions is crucial for policyholders to manage expectations regarding claim eligibility and fund liquidity.

Importance of Waiting Period in Financial Products

The waiting period in financial products is crucial as it determines the minimum time before policyholders can claim benefits, ensuring risk mitigation for insurers and financial stability for consumers. Unlike the lock-in period, which restricts withdrawals to encourage long-term investment, the waiting period primarily safeguards against immediate claims from pre-existing conditions or early policy lapses. Understanding the waiting period helps investors make informed decisions about coverage eligibility and timing, enhancing the value and effectiveness of insurance and investment plans.

What is a Lock-in Period?

A lock-in period is a fixed duration during which an investor cannot redeem or withdraw funds from an investment, ensuring capital remains invested for a specified time frame. Commonly applied in mutual funds, fixed deposits, and retirement plans, this period protects the fund's stability and promotes long-term growth. Understanding the lock-in period is crucial for aligning investment goals with liquidity needs.

Benefits of Waiting Periods in Insurance and Investments

Waiting periods in insurance and investments provide a crucial buffer that helps mitigate adverse selection by ensuring only genuine claims or withdrawals occur after a specified time frame. These periods enhance policyholder discipline, encouraging long-term commitment and reducing the risk of premature surrender or claim. Furthermore, waiting periods contribute to premium stability and investment growth by allowing funds to accumulate and policies to mature, ultimately strengthening overall financial security.

Drawbacks of Lock-in Periods in Financial Instruments

Lock-in periods in financial instruments restrict the investor's ability to redeem or withdraw funds before a specified time, leading to reduced liquidity and flexibility. This constraint can result in missed opportunities to capitalize on market fluctuations or urgent financial needs. Moreover, lock-in periods may limit portfolio diversification and increase investment risk if market conditions deteriorate during the locked phase.

How Waiting Period Impacts Your Policy Claims

The waiting period in an insurance policy defines the initial timeframe during which no claims can be made, affecting how soon policyholders receive benefits after enrolling. This period helps insurers manage risk by preventing claims for pre-existing conditions or early onset illnesses, ultimately influencing claim eligibility and payout schedules. Understanding the waiting period is crucial for policyholders to anticipate when their coverage becomes active for specific medical treatments or conditions.

Exit Options During Lock-in Period

Exit options during the lock-in period are typically restricted, preventing premature withdrawal of funds to ensure disciplined investment. In contrast, the waiting period primarily refers to the time before benefits or returns commence, with fewer constraints on fund access. Understanding these distinctions helps investors manage liquidity while maximizing returns within financial products like mutual funds and insurance policies.

Real-life Examples of Waiting and Lock-in Periods

Waiting periods in insurance policies, such as the 30-day health insurance waiting period before coverage begins, prevent immediate claims for pre-existing conditions, while lock-in periods, like a 3-year fixed deposit lock-in, restrict premature withdrawals to ensure investment stability. For example, term insurance policies often have a 90-day waiting period for accidental death claims, whereas Public Provident Fund (PPF) accounts impose a 15-year lock-in period to encourage long-term savings. Understanding these intervals helps policyholders manage expectations about benefits accessibility and financial planning.

Choosing the Right Product: Considering Waiting and Lock-in Periods

Waiting period and lock-in period are crucial factors when choosing insurance or investment products, as they influence liquidity and access to benefits. The waiting period determines the time before policy benefits activate, affecting immediate claim eligibility, whereas the lock-in period mandates the minimum duration for holding the product without withdrawal or penalty, impacting long-term financial planning. Analyzing these periods based on individual cash flow needs and risk tolerance ensures optimal product selection aligned with financial goals.

Waiting Period Infographic

libterm.com

libterm.com