A unicorn symbolizes purity, magic, and rarity in folklore and popular culture, often depicted as a horse with a single, spiraled horn. This mythical creature has inspired countless stories, artwork, and brand identities, representing uniqueness and untapped potential. Discover more about the fascinating history and symbolism of unicorns in the rest of the article.

Table of Comparison

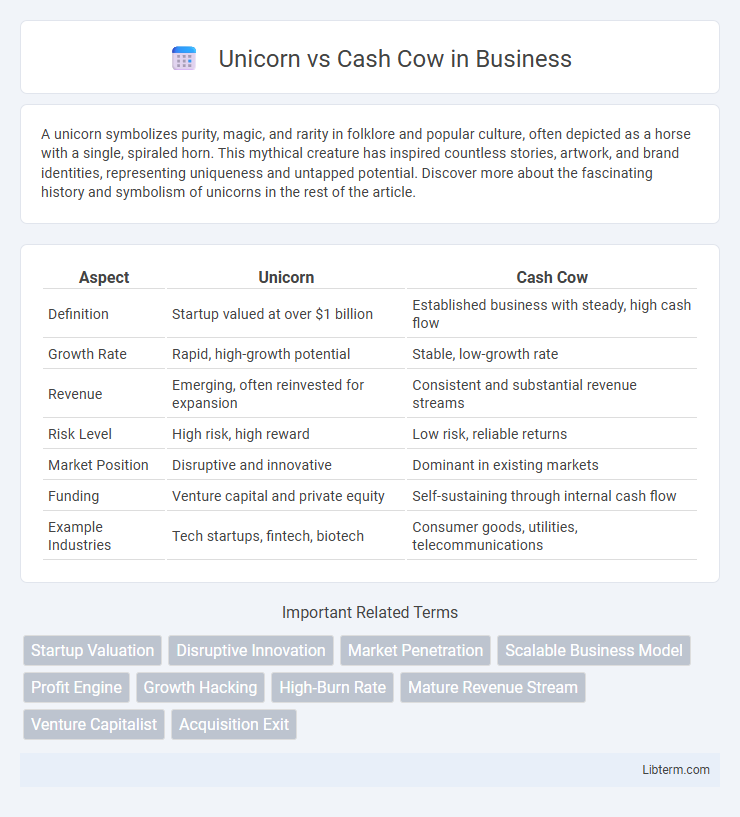

| Aspect | Unicorn | Cash Cow |

|---|---|---|

| Definition | Startup valued at over $1 billion | Established business with steady, high cash flow |

| Growth Rate | Rapid, high-growth potential | Stable, low-growth rate |

| Revenue | Emerging, often reinvested for expansion | Consistent and substantial revenue streams |

| Risk Level | High risk, high reward | Low risk, reliable returns |

| Market Position | Disruptive and innovative | Dominant in existing markets |

| Funding | Venture capital and private equity | Self-sustaining through internal cash flow |

| Example Industries | Tech startups, fintech, biotech | Consumer goods, utilities, telecommunications |

Understanding the Concept: Unicorn vs Cash Cow

Unicorns are startups valued at over $1 billion, symbolizing rapid growth and high potential in emerging markets, often driven by innovation and disruptive technology. Cash Cows, on the other hand, represent mature businesses with stable revenue streams and strong market positions, generating consistent cash flow with minimal investment. Understanding the distinction between Unicorns and Cash Cows helps investors balance risk and return by combining high-growth opportunities with reliable income sources.

Key Characteristics of a Unicorn

Unicorns are privately-held startups valued at over $1 billion, known for rapid growth, innovative business models, and significant market disruption potential. They typically operate in technology-driven sectors such as fintech, health tech, or artificial intelligence, attracting substantial venture capital investment. Their scalability and high-risk, high-reward nature contrast with the stable, established revenue streams and lower growth rates of cash cows.

Defining a Cash Cow in Business

A cash cow in business refers to a product, service, or business unit that consistently generates stable and substantial cash flow with minimal investment. These entities typically possess a large market share in mature industries, allowing companies to fund other ventures or innovations. Effective cash cows sustain profitability over time, providing financial stability and resources for growth.

Growth Potential: Unicorns vs Cash Cows

Unicorns exhibit high growth potential driven by disruptive innovation and scalable business models in emerging markets, often attracting significant venture capital investment. Cash cows generate steady, predictable revenue through established products with limited expansion, focusing on profitability rather than aggressive growth. The contrast lies in unicorns' exponential growth opportunities versus cash cows' stable, mature market dominance.

Investment Strategies for Unicorns and Cash Cows

Investment strategies for unicorns prioritize aggressive growth, market expansion, and innovation to maximize valuation and capture emerging opportunities in high-potential industries like technology and biotech. Cash cows, characterized by established revenue streams and market dominance, attract investment strategies focused on maximizing cash flow, optimizing operational efficiencies, and funding incremental improvements to sustain profitability. Investors balance portfolios by allocating capital to unicorns for high-risk, high-return outcomes while leveraging the stability of cash cows to support long-term financial health and dividend yields.

Revenue Models Compared: Unicorn vs Cash Cow

Unicorn companies typically pursue high-growth revenue models driven by rapid market expansion, often prioritizing user acquisition and recurring subscription services or platform-based ecosystems that scale quickly. Cash Cow businesses rely on established, stable revenue streams generated from mature markets with consistent product demand, leveraging efficiency and profitability through optimized sales and cost management. While Unicorns emphasize reinvestment and scalability, Cash Cows focus on maximizing cash flow and sustaining long-term profitability.

Risks and Challenges of Unicorns

Unicorns face significant risks including overvaluation, high burn rates, and intense pressure to scale rapidly, which often lead to unstable financial foundations and potential market corrections. Challenges also involve navigating regulatory scrutiny and sustaining competitive advantages amid fluctuating investor confidence. Unlike cash cows, which generate steady profits and possess mature business models, unicorns must constantly innovate to justify their valuations while managing growth risks and operational complexities.

Stability and Longevity of Cash Cows

Cash Cows provide stability and consistent revenue streams, making them vital for long-term business sustainability. Their established market position and strong cash flow enable companies to fund innovation and growth initiatives. Unlike Unicorns, which often experience rapid growth and high volatility, Cash Cows ensure predictable profitability and financial resilience over time.

Case Studies: Famous Unicorns and Cash Cows

Airbnb exemplifies a famous unicorn with its rapid valuation growth fueled by innovative disruptiveness in the hospitality sector, showcasing how tech-driven scalability propels startups into billion-dollar valuations. In contrast, Coca-Cola represents a classic cash cow with consistent revenue streams and market dominance derived from a well-established brand and loyal consumer base, emphasizing sustainable profitability. These case studies highlight the divergent growth trajectories and financial models differentiating unicorns' expansion potential from cash cows' steady income generation.

Choosing the Right Business Model: Which Suits Your Goals?

Selecting between a Unicorn and a Cash Cow business model depends on your growth objectives and risk tolerance. Unicorns emphasize rapid scaling and high valuation through innovation and market disruption, ideal for aggressive expansion and investor appeal. Cash Cows focus on generating steady, reliable profits with established products or services, suitable for sustainable income and long-term stability.

Unicorn Infographic

libterm.com

libterm.com