Acquisition is a strategic process where a company purchases another business to expand its market reach, acquire new technologies, or enhance competitive advantage. Understanding the key steps and potential challenges can help Your organization successfully navigate this complex transaction. Explore the rest of the article to learn how acquisitions can transform your business growth.

Table of Comparison

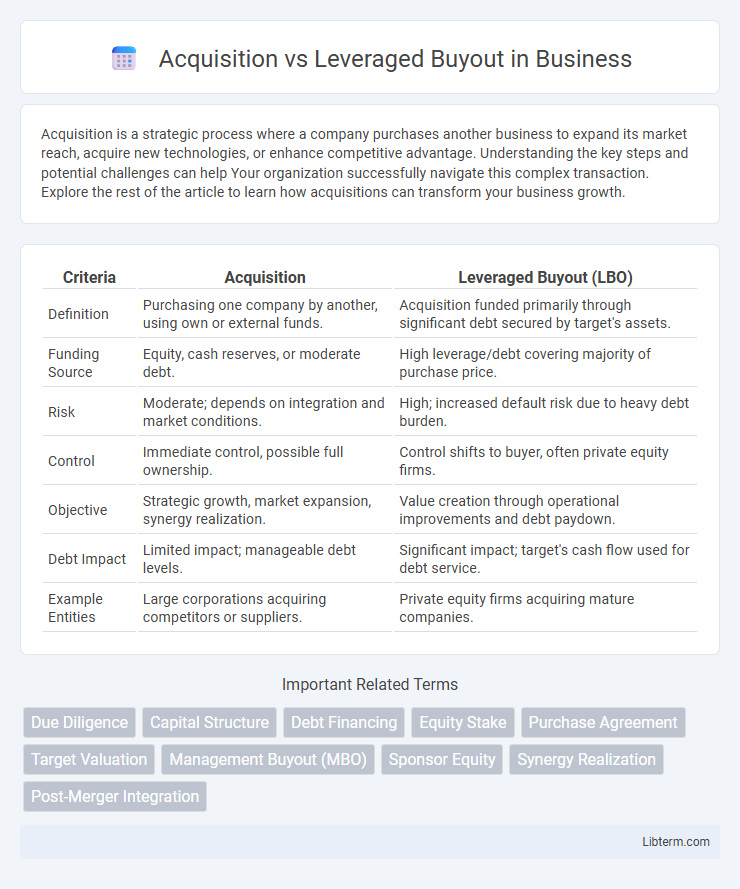

| Criteria | Acquisition | Leveraged Buyout (LBO) |

|---|---|---|

| Definition | Purchasing one company by another, using own or external funds. | Acquisition funded primarily through significant debt secured by target's assets. |

| Funding Source | Equity, cash reserves, or moderate debt. | High leverage/debt covering majority of purchase price. |

| Risk | Moderate; depends on integration and market conditions. | High; increased default risk due to heavy debt burden. |

| Control | Immediate control, possible full ownership. | Control shifts to buyer, often private equity firms. |

| Objective | Strategic growth, market expansion, synergy realization. | Value creation through operational improvements and debt paydown. |

| Debt Impact | Limited impact; manageable debt levels. | Significant impact; target's cash flow used for debt service. |

| Example Entities | Large corporations acquiring competitors or suppliers. | Private equity firms acquiring mature companies. |

Understanding Acquisition: Definition and Process

An acquisition involves one company purchasing most or all of another company's shares or assets to gain control, typically resulting in full ownership. The process includes identifying targets, conducting due diligence, negotiating terms, and integrating the acquired business. Acquisitions can be strategic or financial, and they often aim to expand market share, enter new markets, or achieve synergies.

What is a Leveraged Buyout (LBO)?

A Leveraged Buyout (LBO) is a financial transaction where a company is acquired using a significant amount of borrowed money, often secured by the assets of the company being acquired. The primary goal of an LBO is to enable investors to make large acquisitions without committing substantial capital upfront. This approach contrasts with traditional acquisitions by relying heavily on debt financing to increase potential returns on equity.

Key Differences Between Acquisition and Leveraged Buyout

Acquisition involves one company purchasing another, typically using cash, stock, or a combination, while a Leveraged Buyout (LBO) relies heavily on borrowed funds secured by the target company's assets. In an Acquisition, the buyer assumes ownership and control immediately, whereas an LBO often leads to significant debt restructuring and management-led buyouts. The primary distinction lies in financing structure: acquisitions can be equity- or cash-financed, whereas LBOs depend predominantly on high leverage to maximize returns.

Motivations Behind Acquisitions vs LBOs

Acquisitions are primarily motivated by strategic goals such as market expansion, diversification, and synergies to enhance competitive advantage and long-term growth. Leveraged Buyouts (LBOs) focus on financial engineering, where private equity firms aim to acquire undervalued companies using significant debt to maximize returns through operational improvements and asset restructuring. The fundamental drive behind acquisitions emphasizes growth and market positioning, while LBOs concentrate on optimizing capital structure and extracting value from acquired businesses.

Financing Structures: Acquisition vs Leveraged Buyout

Acquisition financing typically involves a mix of equity and debt, where companies use cash reserves, stock issuance, or bank loans to purchase a target firm outright. Leveraged buyouts (LBOs) rely heavily on debt financing, often using 60-90% borrowed capital secured against the acquired company's assets to maximize returns on equity. The high leverage in LBOs increases financial risk but allows private equity firms to amplify potential investment gains through operational improvements and strategic asset management.

Risk Factors in Acquisitions and Leveraged Buyouts

Risk factors in acquisitions primarily involve integration challenges, cultural clashes, and inaccurate valuation leading to overpayment, impacting the anticipated synergies and financial performance. Leveraged buyouts carry heightened financial risk due to substantial debt loads, which increase vulnerability to interest rate fluctuations and cash flow constraints, potentially resulting in default or restructuring. Both transaction types require thorough due diligence to assess market conditions, target company stability, and financing structures to mitigate risks effectively.

Legal and Regulatory Considerations

Acquisitions and leveraged buyouts (LBOs) both require extensive legal due diligence to ensure compliance with antitrust laws, securities regulations, and contractual obligations. In LBOs, heightened scrutiny is placed on debt financing structures and creditor rights to mitigate financial risk and regulatory violations. Regulatory bodies often assess the impact on market competition and financial market stability, enforcing disclosure requirements and approval processes specific to the transaction type.

Impact on Company Operations and Management

Acquisitions often lead to significant changes in company operations and management as the acquiring firm integrates resources, streamlines processes, and may restructure leadership to align with strategic goals. Leveraged buyouts (LBOs) typically impose intense financial discipline due to high debt levels, resulting in cost-cutting measures, management incentives tied to performance, and a sharper focus on cash flow optimization. Both strategies affect operational priorities but LBOs uniquely emphasize stringent financial controls and management accountability to ensure debt servicing and drive value creation.

Real-World Examples: Acquisition vs Leveraged Buyout

The acquisition of Instagram by Facebook in 2012 exemplifies a strategic acquisition aimed at expanding market reach and technology capabilities, while the leveraged buyout of Dell in 2013 by Silver Lake Partners and Michael Dell showcased a financially engineered deal using significant debt to privatize the company and restructure operations. In acquisitions, companies typically pay with cash or stock to gain control, as seen in Amazon's purchase of Whole Foods in 2017 for $13.7 billion, whereas leveraged buyouts involve acquiring companies primarily through borrowed funds, like the 2007 buyout of TXU Energy by KKR and TPG Capital valued at approximately $45 billion. These examples highlight key differences in use cases, financial structuring, and strategic objectives between acquisitions and leveraged buyouts in real-world corporate transactions.

Choosing the Right Strategy: Acquisition or LBO?

Choosing the right strategy between acquisition and leveraged buyout (LBO) depends on factors such as financing structure, risk tolerance, and control objectives. Acquisitions often require substantial equity and offer immediate control, while LBOs primarily rely on debt financing to maximize returns but increase financial risk. Assessing the target company's cash flow stability and growth potential is crucial to determine whether an acquisition's straightforward ownership or an LBO's leverage-driven approach aligns best with strategic goals.

Acquisition Infographic

libterm.com

libterm.com