Bonds are fixed-income securities that provide investors with regular interest payments and return of principal at maturity, making them a stable option for portfolio diversification. They come in various types, such as government, municipal, and corporate bonds, each carrying different risk and return profiles. Explore this article to understand how bonds can strengthen your investment strategy and protect your financial future.

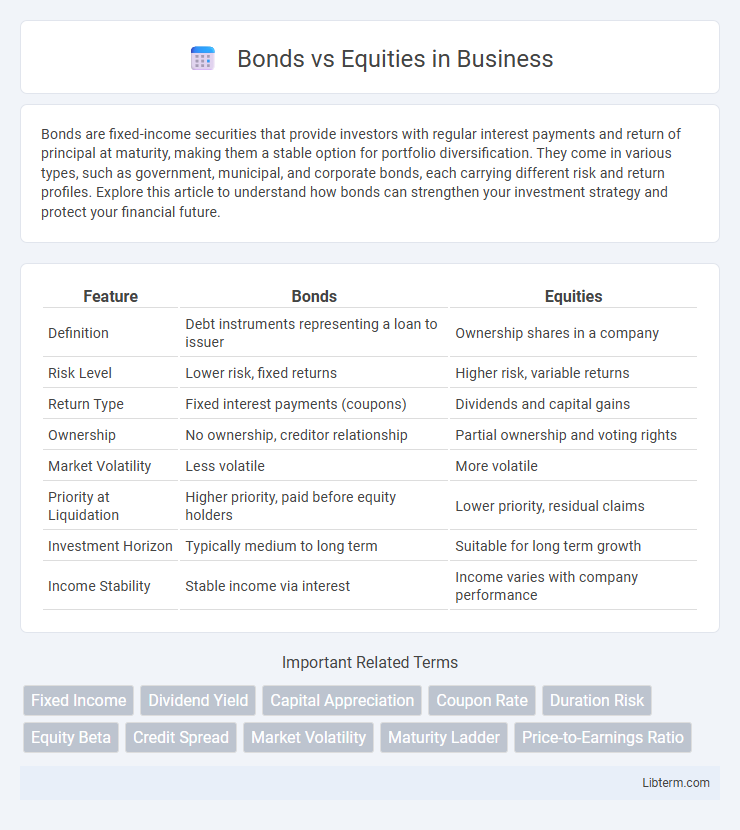

Table of Comparison

| Feature | Bonds | Equities |

|---|---|---|

| Definition | Debt instruments representing a loan to issuer | Ownership shares in a company |

| Risk Level | Lower risk, fixed returns | Higher risk, variable returns |

| Return Type | Fixed interest payments (coupons) | Dividends and capital gains |

| Ownership | No ownership, creditor relationship | Partial ownership and voting rights |

| Market Volatility | Less volatile | More volatile |

| Priority at Liquidation | Higher priority, paid before equity holders | Lower priority, residual claims |

| Investment Horizon | Typically medium to long term | Suitable for long term growth |

| Income Stability | Stable income via interest | Income varies with company performance |

Introduction to Bonds and Equities

Bonds represent debt securities where investors lend money to an issuer, receiving fixed interest payments over a specified period before the principal is repaid, making them a lower-risk investment compared to equities. Equities, or stocks, signify ownership in a company, granting shareholders potential dividends and capital appreciation but with higher volatility and risk. Understanding the fundamental differences in risk, return, and ownership between bonds and equities is crucial for effective portfolio diversification and long-term financial planning.

Fundamental Differences Between Bonds and Equities

Bonds represent debt instruments where investors lend money to issuers in exchange for fixed interest payments and principal repayment, offering lower risk and predictable income streams. Equities signify ownership shares in a company, providing potential for capital appreciation and dividends but carrying higher volatility and risk. The fundamental difference lies in bonds being creditors with priority claims in bankruptcy, whereas equity holders are residual claimants, benefiting from company growth but exposed to greater financial uncertainty.

Risk and Return Profiles

Bonds typically offer lower risk and more stable returns compared to equities due to fixed interest payments and principal repayment at maturity. Equities carry higher risk because their returns depend on company performance and market fluctuations, but they provide greater potential for capital appreciation and dividends. Investors often balance portfolios by combining bonds' predictable income with equities' growth opportunities to optimize risk and return profiles.

Income Generation: Interest vs Dividends

Bonds generate income primarily through fixed interest payments, providing predictable cash flow to investors, while equities offer income via dividends, which fluctuate based on company profits and board decisions. Interest from bonds is generally prioritized over dividends during financial distributions, making bonds a more stable income source. Dividend income can grow over time with company earnings, offering potential for increasing returns compared to the fixed nature of bond interest.

Capital Appreciation Potential

Equities generally offer higher capital appreciation potential compared to bonds due to their ownership stake in companies and participation in earnings growth. Bonds provide fixed interest payments and return of principal, resulting in more stable but limited capital gains. Investors seeking significant growth typically favor equities, while those prioritizing capital preservation often choose bonds.

Liquidity and Market Accessibility

Bonds typically offer lower liquidity compared to equities due to less frequent trading and longer maturity periods, making them less accessible for quick transactions. Equities provide higher market accessibility through major stock exchanges and continuous trading hours, allowing investors to buy and sell shares with greater ease. Investment decisions hinge on the preference for liquidity and market entry speed, with equities favoring active traders and bonds suited for long-term, stable investment strategies.

Tax Implications of Bonds and Equities

Interest income from bonds is generally taxed as ordinary income at the federal and state levels, though municipal bond interest is often exempt from federal and sometimes state taxes. Equities generate dividends and capital gains, with qualified dividends and long-term capital gains typically benefiting from lower tax rates compared to ordinary income. Understanding these tax implications is critical for optimizing after-tax returns in a diversified investment portfolio.

Portfolio Diversification Strategies

Bonds provide stable income and lower volatility, making them essential for risk management in portfolio diversification strategies. Equities offer higher growth potential and capital appreciation, balancing bonds' conservative nature to achieve optimal returns. Integrating both asset classes reduces overall portfolio risk and enhances long-term financial stability.

Suitability for Different Investor Types

Bonds suit risk-averse investors prioritizing capital preservation and steady income through fixed interest payments, making them ideal for retirees or conservative portfolios. Equities attract growth-oriented investors willing to accept market volatility for potential high returns and capital appreciation, fitting younger investors or those with longer investment horizons. Diversifying with both asset types aligns with balanced risk tolerance and investment goals across different investor profiles.

Key Factors to Consider When Choosing Between Bonds and Equities

Risk tolerance plays a crucial role when choosing between bonds and equities, as bonds generally offer lower risk and stable returns, while equities present higher volatility with potential for greater gains. The investment horizon significantly influences the decision, with bonds being suitable for short- to medium-term goals due to predictable income, whereas equities are preferred for long-term growth opportunities. Interest rate sensitivity and market conditions also impact these choices, since rising rates can negatively affect bond prices, and equities may benefit from economic expansion and corporate earnings growth.

Bonds Infographic

libterm.com

libterm.com