Crafting a clear and concise statement enhances communication by eliminating ambiguity and ensuring your message resonates with the intended audience. A well-structured statement emphasizes key points that support your goals while maintaining reader engagement. Explore the rest of the article to discover strategies for creating powerful statements that capture attention effectively.

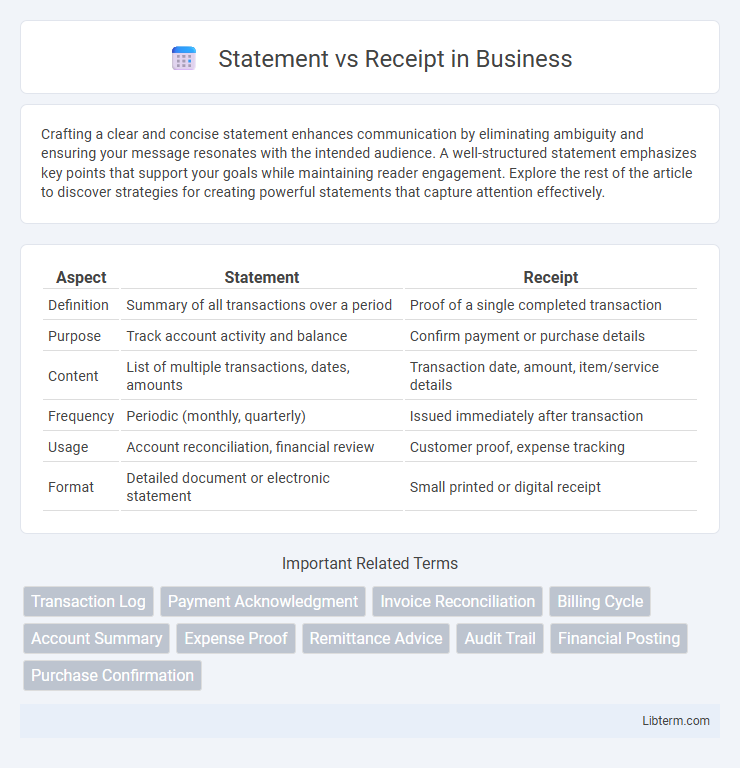

Table of Comparison

| Aspect | Statement | Receipt |

|---|---|---|

| Definition | Summary of all transactions over a period | Proof of a single completed transaction |

| Purpose | Track account activity and balance | Confirm payment or purchase details |

| Content | List of multiple transactions, dates, amounts | Transaction date, amount, item/service details |

| Frequency | Periodic (monthly, quarterly) | Issued immediately after transaction |

| Usage | Account reconciliation, financial review | Customer proof, expense tracking |

| Format | Detailed document or electronic statement | Small printed or digital receipt |

Understanding Statements and Receipts

Statements provide a comprehensive summary of all transactions within a specific period, offering detailed insights into account activities, balances, and interest calculations. Receipts serve as proof of individual transactions, documenting specific payments or purchases with essential details like date, amount, and vendor information. Understanding the distinct purposes of statements and receipts helps individuals manage finances more effectively by tracking overall account history versus verifying specific expenditures.

Key Differences: Statement vs. Receipt

A statement provides a summary of multiple financial transactions over a specific period, while a receipt is a proof of a single transaction. Statements include detailed information such as dates, amounts, and balances, useful for tracking overall account activity, whereas receipts serve as immediate evidence of payment or purchase. The primary difference lies in the scope: statements offer a comprehensive overview, and receipts confirm individual exchanges.

Purpose of a Financial Statement

A financial statement consolidates and summarizes an organization's financial activities over a specific period, providing a comprehensive overview of its financial health, including assets, liabilities, revenues, and expenses. It serves as a critical tool for stakeholders such as investors, creditors, and management to evaluate performance, make informed decisions, and ensure regulatory compliance. Unlike a receipt, which confirms an individual transaction, a financial statement presents aggregated data to offer insights into overall financial stability and profitability.

What Is a Receipt?

A receipt is a document issued by a seller to confirm that payment has been received for goods or services, detailing the transaction date, items purchased, prices, and payment method. It serves as proof of purchase and is essential for returns, warranties, and accounting purposes. Unlike a statement, which summarizes multiple transactions over a period, a receipt records a single completed transaction.

Essential Components of a Statement

A statement typically includes essential components such as the account holder's name, statement period, transaction details, opening and closing balances, and any fees or interest charges applicable during the period. It provides a comprehensive summary of all financial activities within the specified timeframe, helping users track and reconcile their accounts. Unlike receipts, statements are periodic records designed for ongoing monitoring rather than proof of individual transactions.

Core Elements Found in Receipts

Receipts typically include core elements such as the vendor's name, transaction date, itemized list of purchased goods or services, payment method, and total amount paid. They serve as proof of payment and are issued immediately after a transaction, unlike statements which summarize multiple transactions over a period. Essential details found in receipts ensure accurate record-keeping for both customers and businesses.

When to Use a Statement

Use a statement when providing a comprehensive overview of a customer's account over a specific period, typically monthly, including all transactions, payments, and outstanding balances. Statements are beneficial for customers needing to reconcile their accounts or track spending habits over time. Businesses send statements to encourage timely payments by clearly communicating what is owed after accounting for all activity.

Importance of Receipts in Record-Keeping

Receipts serve as crucial proof of transactions, ensuring accurate record-keeping for both individuals and businesses by documenting dates, amounts, and items purchased. Unlike bank statements that summarize account activity, receipts provide detailed evidence required for expense tracking, tax deductions, and resolving disputes. Maintaining organized receipts supports financial transparency and aids in auditing processes.

Statement vs. Receipt: Common Misconceptions

A statement summarizes all transactions within a specific period, providing an overview of account activity rather than proof of individual payments. In contrast, a receipt serves as a direct proof of a single transaction or payment made. Misconceptions often arise when statements are mistakenly used as receipts, leading to confusion in verifying payment authenticity.

Choosing the Right Document for Your Needs

Choosing between a statement and a receipt depends on the purpose of your record-keeping: a receipt provides proof of a specific transaction with detailed information like date, amount paid, and items purchased, ideal for returns or warranty claims. Statements offer a comprehensive summary of all transactions within a billing cycle, helping you track spending and reconcile accounts efficiently. For accurate financial management, receipts serve well for individual purchases, while statements are essential for monitoring overall account activity.

Statement Infographic

libterm.com

libterm.com