Internal Rate of Return (IRR) measures the profitability of potential investments by calculating the discount rate that makes the net present value (NPV) of all cash flows equal to zero. Understanding IRR helps your business evaluate and compare different projects' financial viability effectively. Dive into the rest of the article to uncover how IRR can optimize your investment decisions.

Table of Comparison

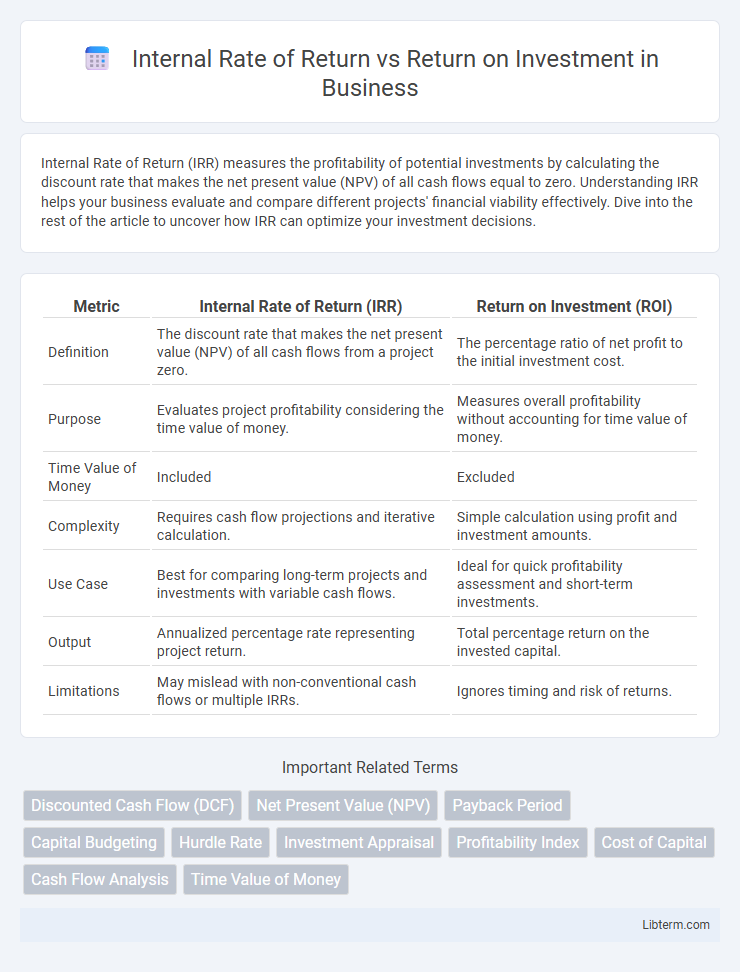

| Metric | Internal Rate of Return (IRR) | Return on Investment (ROI) |

|---|---|---|

| Definition | The discount rate that makes the net present value (NPV) of all cash flows from a project zero. | The percentage ratio of net profit to the initial investment cost. |

| Purpose | Evaluates project profitability considering the time value of money. | Measures overall profitability without accounting for time value of money. |

| Time Value of Money | Included | Excluded |

| Complexity | Requires cash flow projections and iterative calculation. | Simple calculation using profit and investment amounts. |

| Use Case | Best for comparing long-term projects and investments with variable cash flows. | Ideal for quick profitability assessment and short-term investments. |

| Output | Annualized percentage rate representing project return. | Total percentage return on the invested capital. |

| Limitations | May mislead with non-conventional cash flows or multiple IRRs. | Ignores timing and risk of returns. |

Understanding Internal Rate of Return (IRR)

Internal Rate of Return (IRR) measures the discount rate that makes the net present value (NPV) of all cash flows from a project equal to zero, reflecting the project's profitability over time. IRR provides a dynamic metric by accounting for the timing and magnitude of cash inflows and outflows, unlike Return on Investment (ROI), which calculates a simple percentage return based on initial investment cost. Understanding IRR enables investors to compare projects with varying durations and cash flow patterns to determine which investment yields the highest potential growth rate.

Defining Return on Investment (ROI)

Return on Investment (ROI) measures the profitability of an investment by calculating the percentage gain or loss relative to its initial cost. ROI is a straightforward financial metric used to evaluate the efficiency of an investment or compare the profitability of multiple investments. Unlike Internal Rate of Return (IRR), which considers the time value of money, ROI provides a simple snapshot of overall return without accounting for the timing of cash flows.

Key Differences Between IRR and ROI

Internal Rate of Return (IRR) measures the annualized rate of growth a project generates, reflecting the time value of money, while Return on Investment (ROI) calculates the simple percentage gain or loss relative to the initial investment without considering time. IRR is useful for comparing projects with different durations and cash flow patterns, as it incorporates the timing and magnitude of cash inflows and outflows. ROI provides a straightforward snapshot of profitability but lacks the ability to account for the investment's timing and risks, which IRR can address through its discount rate calculation.

Calculation Methods for IRR and ROI

Internal Rate of Return (IRR) is calculated by finding the discount rate that makes the net present value (NPV) of all cash flows from an investment equal to zero, often requiring iterative methods or financial software for precise results. Return on Investment (ROI) is determined by dividing the net profit of an investment by the initial cost, expressed as a percentage, using a straightforward formula: (Net Profit / Cost of Investment) x 100. While IRR accounts for the time value of money and cash flow timing, ROI provides a simple ratio of gain to cost without considering when returns occur.

When to Use IRR vs. ROI in Decision-Making

Internal Rate of Return (IRR) is best used for evaluating the profitability of potential investments by considering the time value of money and expected cash flows, making it ideal for comparing projects with different durations. Return on Investment (ROI) provides a straightforward percentage measure of efficiency by comparing net profit to the initial cost, useful for quick assessments and benchmarking against other investments. Use IRR when the timing and scale of cash flows vary significantly; opt for ROI when simplicity and initial cost-return comparison are priorities.

Advantages and Limitations of IRR

Internal Rate of Return (IRR) provides a percentage measure of an investment's profitability by calculating the discount rate that makes the net present value (NPV) of cash flows zero, which helps compare projects with varying time horizons and scales. The primary advantage of IRR lies in its ability to account for the time value of money, offering intuitive insight into an investment's efficiency, but it often struggles with projects that have non-conventional cash flows, potentially yielding multiple IRRs or no solution. Limitations also include the assumption that interim cash flows are reinvested at the IRR itself, which can overstate returns compared to more conservative reinvestment rates used in metrics like NPV or ROI.

Pros and Cons of ROI

Return on Investment (ROI) calculates the percentage gain or loss relative to the initial investment, offering a straightforward measure of profitability that is easy to understand and widely used across industries. However, ROI does not account for the time value of money or project duration, potentially leading to misleading comparisons between investments with different time horizons. Despite its simplicity, ROI's lack of consideration for cash flow timing and risk factors limits its effectiveness in evaluating long-term projects compared to Internal Rate of Return (IRR).

Real-World Examples: IRR vs. ROI

Internal Rate of Return (IRR) measures the annualized percentage yield of an investment considering the time value of money, making it ideal for projects with multiple cash flows over time. Return on Investment (ROI) calculates the total percentage gain or loss relative to the initial investment, providing a straightforward snapshot without factoring in timing. For instance, a real estate project with upfront costs and staggered rental income is better assessed using IRR, while a stock investment held for a fixed period often relies on ROI to evaluate profitability.

Common Mistakes in Comparing IRR and ROI

Confusing Internal Rate of Return (IRR) with Return on Investment (ROI) stems from their distinct calculations and implications; IRR accounts for the timing and scale of cash flows, while ROI simply measures the overall profit relative to initial investment. A prevalent error is comparing IRR percentages directly with ROI percentages without considering IRR's time value of money component, leading to misleading conclusions. Ignoring the reinvestment assumption inherent in IRR or overlooking ROI's inability to account for project duration often results in flawed investment decisions.

Choosing the Right Metric for Your Investments

Choosing the right metric for your investments depends on the specific financial goals and project timelines; Internal Rate of Return (IRR) measures the annualized profitability considering the time value of money, making it ideal for comparing projects with different durations. Return on Investment (ROI) provides a straightforward percentage gain relative to the initial cost, best suited for quick assessments without accounting for time. Evaluating IRR helps investors understand long-term efficiency, while ROI excels in measuring overall gains, enabling more informed decision-making tailored to investment strategies.

Internal Rate of Return Infographic

libterm.com

libterm.com