Restricted shares are company stock granted to employees with limitations on transferability and sale until certain conditions, like vesting periods, are met. These shares align the interests of employees with shareholders while providing potential tax advantages. Discover how restricted shares can impact your compensation and investment strategy by reading the full article.

Table of Comparison

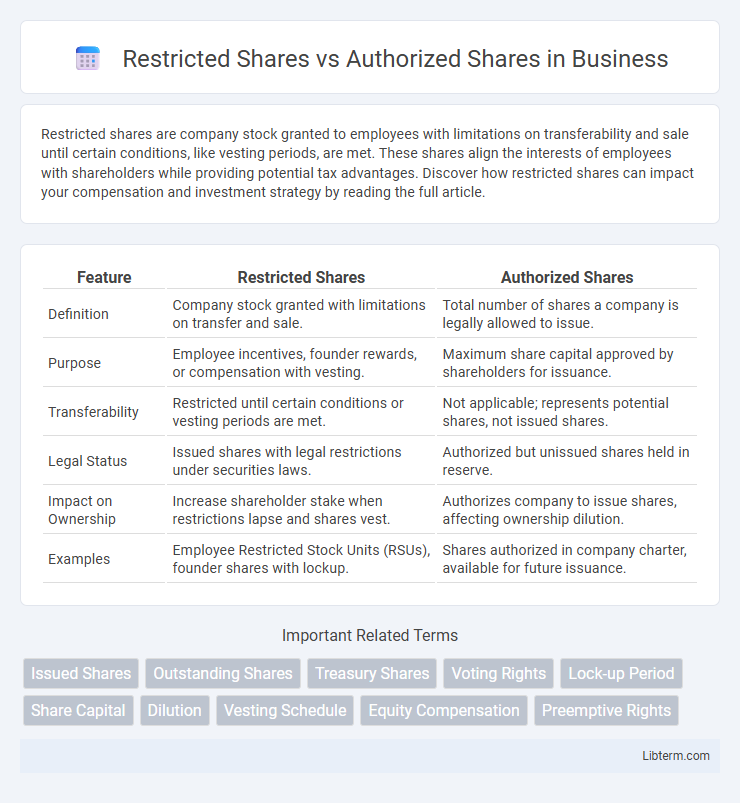

| Feature | Restricted Shares | Authorized Shares |

|---|---|---|

| Definition | Company stock granted with limitations on transfer and sale. | Total number of shares a company is legally allowed to issue. |

| Purpose | Employee incentives, founder rewards, or compensation with vesting. | Maximum share capital approved by shareholders for issuance. |

| Transferability | Restricted until certain conditions or vesting periods are met. | Not applicable; represents potential shares, not issued shares. |

| Legal Status | Issued shares with legal restrictions under securities laws. | Authorized but unissued shares held in reserve. |

| Impact on Ownership | Increase shareholder stake when restrictions lapse and shares vest. | Authorizes company to issue shares, affecting ownership dilution. |

| Examples | Employee Restricted Stock Units (RSUs), founder shares with lockup. | Shares authorized in company charter, available for future issuance. |

Introduction to Restricted Shares and Authorized Shares

Restricted shares are company stock granted to employees or insiders subject to specific transfer limitations, vesting schedules, or resale restrictions, often used as compensation incentives. Authorized shares represent the maximum number of shares a corporation is legally permitted to issue according to its corporate charter, establishing the upper limit for stock issuance. Understanding the distinction between authorized shares and restricted shares is essential for grasping company capital structure and stock ownership dynamics.

Defining Restricted Shares: Key Features

Restricted shares are company stock granted to employees or insiders with limitations on transferability and sale, often subject to vesting schedules and regulatory compliance. These shares come with specific restrictions that prevent immediate liquidation, fostering long-term commitment and alignment with shareholder interests. Unlike authorized shares, which represent the maximum number of shares a company can issue, restricted shares are a subset of issued stock with binding conditions.

What Are Authorized Shares?

Authorized shares represent the maximum number of shares a corporation is legally permitted to issue as specified in its articles of incorporation. These shares provide a ceiling for issuing stock and do not necessarily indicate how many shares are outstanding or held by investors. Companies can issue authorized shares as common stock, preferred stock, or other classes according to corporate bylaws and shareholder agreements.

Differences Between Restricted and Authorized Shares

Restricted shares are a type of stock granted to employees with limitations on transferability and sale until certain conditions or vesting periods are met, whereas authorized shares represent the maximum number of shares a corporation is legally permitted to issue as specified in its corporate charter. Unlike authorized shares, restricted shares impact employee compensation and corporate governance due to their non-transferable status during the restriction period. Authorized shares define the potential equity capacity of a company, while restricted shares directly influence ownership distribution and liquidity among stakeholders.

Legal Implications of Restricted Shares

Restricted shares carry specific legal implications, including compliance with Securities Act regulations and restrictions on transferability until certain conditions, such as vesting periods or performance milestones, are met. Companies must adhere to federal and state securities laws, necessitating proper disclosures and potentially filing exemption notices with regulatory bodies like the SEC. Failure to comply with these legal requirements can result in penalties, forfeiture of shares, or invalidation of the share issuance.

Issuance Process: Restricted vs Authorized Shares

Restricted shares involve a formal issuance process where shares are granted to employees or insiders with specific vesting schedules and legal restrictions on transferability to align incentives and retain talent. Authorized shares represent the maximum number of shares a company can legally issue, but only a subset is actually issued or outstanding, requiring board approval before any issuance. The issuance of restricted shares requires compliance with securities regulations and often includes shareholder agreements, whereas authorized shares serve as a ceiling without immediate issuance or restrictions.

How Restricted Shares Affect Shareholder Rights

Restricted shares limit shareholder rights by imposing transferability and voting restrictions until certain conditions, such as vesting or performance milestones, are met. These limitations delay shareholders' ability to freely sell or transfer the shares, impacting liquidity and control over the shares. Unlike authorized shares, which represent the maximum number of shares a company can issue, restricted shares grant ownership but with conditional rights that influence voting power and dividend entitlement.

Impact on Company Valuation and Capital Structure

Restricted shares represent stock granted with conditions that limit transferability, often issued as employee compensation, directly impacting company valuation by aligning shareholder incentives and potentially diluting ownership only upon vesting. Authorized shares define the maximum number of shares a company can issue, shaping the capital structure by setting a ceiling on equity issuance and influencing potential dilution. The interplay between restricted and authorized shares affects company valuation by balancing control, shareholder rights, and the flexibility to raise capital without exceeding authorized limits.

Regulatory Compliance and Reporting Requirements

Restricted shares require stringent regulatory compliance, including adherence to securities laws such as Rule 144 under the Securities Act of 1933, mandating holding periods and resale restrictions to prevent market manipulation. Authorized shares define the maximum number of shares a company may issue, subject to corporate governance rules and disclosure obligations under SEC regulations like Form S-1 or 10-K filings, ensuring transparency to investors. Proper reporting of both restricted and authorized shares is critical for maintaining compliance with the Sarbanes-Oxley Act and avoiding penalties for misrepresentation or non-disclosure.

Choosing the Right Share Structure for Your Business

Choosing the right share structure for your business involves understanding the differences between restricted shares and authorized shares. Restricted shares are issued to employees or insiders with limitations on transferability and are often used as incentives or retention tools. Authorized shares represent the maximum number of shares a company can issue, providing flexibility for future financing and ownership distribution.

Restricted Shares Infographic

libterm.com

libterm.com