Turnaround refers to the period required to complete a specific process, project, or task, especially in business or manufacturing contexts, where efficiency and speed are critical. Optimizing turnaround time can significantly improve productivity, customer satisfaction, and overall operational performance. Explore the rest of the article to discover strategies that can enhance your turnaround processes effectively.

Table of Comparison

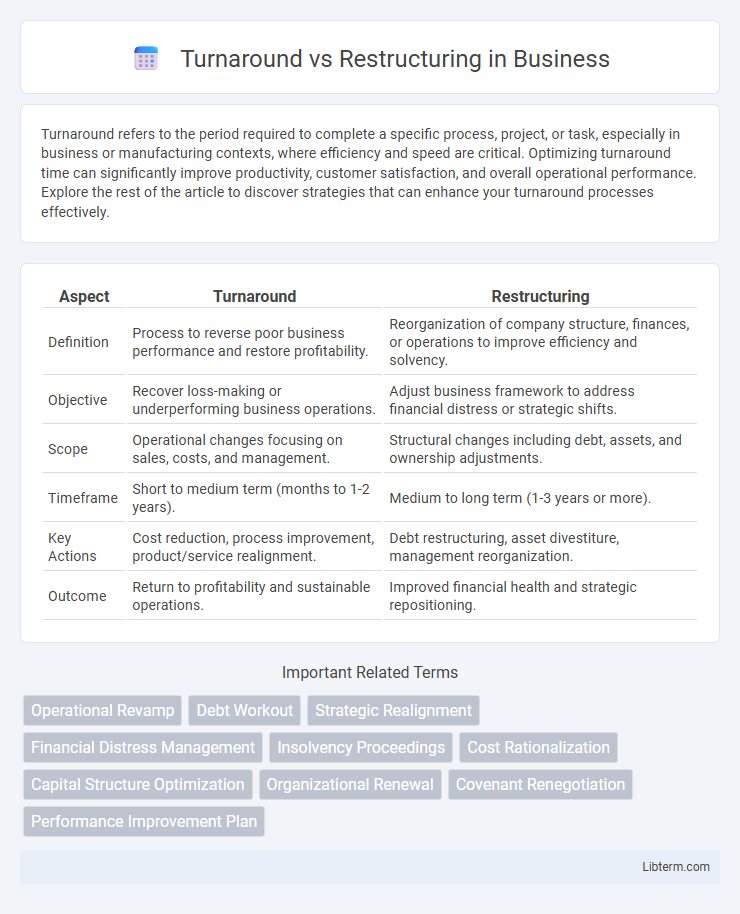

| Aspect | Turnaround | Restructuring |

|---|---|---|

| Definition | Process to reverse poor business performance and restore profitability. | Reorganization of company structure, finances, or operations to improve efficiency and solvency. |

| Objective | Recover loss-making or underperforming business operations. | Adjust business framework to address financial distress or strategic shifts. |

| Scope | Operational changes focusing on sales, costs, and management. | Structural changes including debt, assets, and ownership adjustments. |

| Timeframe | Short to medium term (months to 1-2 years). | Medium to long term (1-3 years or more). |

| Key Actions | Cost reduction, process improvement, product/service realignment. | Debt restructuring, asset divestiture, management reorganization. |

| Outcome | Return to profitability and sustainable operations. | Improved financial health and strategic repositioning. |

Understanding Turnaround and Restructuring: Key Definitions

Turnaround refers to strategic efforts aimed at reversing a company's decline by improving operational efficiency, profitability, and market position. Restructuring involves reorganizing a company's financial and organizational structures, often including debt renegotiation, asset sales, and changes in management to stabilize and enhance business performance. Both processes are essential for business recovery but differ in scope, with turnaround focusing on performance improvement and restructuring emphasizing structural changes.

Core Objectives: Turnaround vs. Restructuring

Turnaround focuses on stabilizing a struggling company's operations by improving cash flow, enhancing efficiency, and restoring profitability. Restructuring aims to fundamentally alter the company's capital structure, debt obligations, or organizational framework to ensure long-term financial health and competitiveness. Both strategies target recovery but differ in scope, with turnaround addressing operational fixes and restructuring addressing financial and structural redesign.

Triggers for Turnaround and Restructuring Initiatives

Turnaround initiatives are typically triggered by declining financial performance, operational inefficiencies, or loss of market share, signaling a need for immediate strategic and managerial changes to restore profitability. Restructuring efforts often arise from deeper challenges such as insolvency risks, excessive debt burdens, or significant shifts in business models requiring legal, organizational, or financial reorganization. Both processes aim to stabilize and reposition the company, but turnaround focuses on quick recovery while restructuring addresses fundamental issues threatening the firm's viability.

Strategic Differences Between Turnaround and Restructuring

Turnaround focuses on reversing declining performance through strategic realignment, operational improvements, and enhancing cash flow, aiming for long-term sustainability and growth. Restructuring primarily involves financial reorganization, debt renegotiation, and asset divestiture to stabilize balance sheets and address insolvency risks. While turnaround emphasizes proactive strategy shifts and market repositioning, restructuring concentrates on addressing immediate financial distress and improving capital structure.

Financial Implications in Turnaround vs. Restructuring

Turnaround and restructuring both address financial distress but differ in scope and impact. Turnaround focuses on improving operational efficiency and cash flow to restore profitability without significant changes to the capital structure. Restructuring involves altering the company's financial architecture, such as debt refinancing, asset sales, or equity infusion, to manage liabilities and improve long-term solvency.

Stakeholder Roles and Impacts

Turnaround initiatives require active involvement from leadership, employees, creditors, and shareholders to stabilize operations and restore profitability, with a focus on quick decision-making and resource reallocation. Restructuring involves more complex stakeholder negotiations, often including legal and financial advisors, as it addresses long-term viability through debt reorganization, asset sales, or changes in ownership structure. Stakeholders in restructuring face significant impacts such as altered equity stakes, modified debt terms, or shifts in strategic control, whereas turnaround efforts primarily influence operational roles and immediate financial performance.

Processes and Methodologies: Turnaround vs. Restructuring

Turnaround processes prioritize rapid financial stabilization and operational improvements through immediate cash flow management, cost reduction, and stakeholder communication to restore business viability. Restructuring methodologies involve comprehensive strategic redesign, including asset reallocation, debt renegotiation, and organizational realignment to achieve long-term sustainability. Both approaches utilize diagnostic assessment tools and data-driven decision-making but differ in scope, with turnaround focusing on short-term recovery and restructuring targeting systemic transformation.

Common Challenges and Risks

Turnaround and restructuring processes often face common challenges such as cash flow constraints, resistance to change from employees, and maintaining customer confidence during uncertain times. Risks include potential asset write-downs, loss of key personnel, and strained supplier relationships that can disrupt operations. Effective communication and strategic planning are crucial to mitigate these risks and achieve organizational stability.

Success Metrics and Outcomes

Turnaround strategies focus on stabilizing a company's financial performance by improving cash flow, reducing costs, and restoring profitability within a short timeframe. Success metrics for turnaround include achieving positive EBITDA, meeting liquidity targets, and securing stakeholder confidence. Restructuring emphasizes long-term organizational change through asset reallocation, debt renegotiation, and operational redesign, with outcomes measured by sustainable revenue growth, improved credit ratings, and enhanced market competitiveness.

Choosing the Right Approach: Turnaround or Restructuring?

Choosing between turnaround and restructuring depends on a company's financial health and operational challenges. Turnaround strategies focus on reviving profitability through efficiency improvements and market repositioning, ideal for firms with viable core business models. Restructuring involves comprehensive changes such as debt renegotiation, asset liquidation, or organizational redesign, suited for companies facing severe financial distress or insolvency risks.

Turnaround Infographic

libterm.com

libterm.com