Scaling in cloud computing involves reducing the number of active resources in response to decreased demand, optimizing cost efficiency while maintaining application performance. This process ensures your infrastructure adapts dynamically, preventing unnecessary expenses without compromising service availability. Explore the rest of the article to understand how scaling in strategies can enhance your system's flexibility and savings.

Table of Comparison

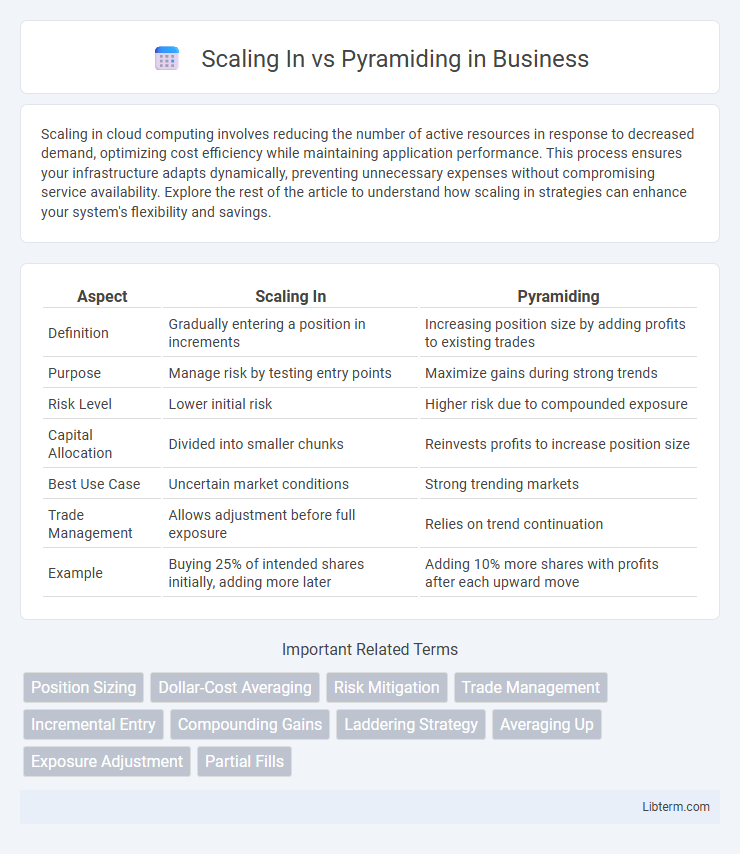

| Aspect | Scaling In | Pyramiding |

|---|---|---|

| Definition | Gradually entering a position in increments | Increasing position size by adding profits to existing trades |

| Purpose | Manage risk by testing entry points | Maximize gains during strong trends |

| Risk Level | Lower initial risk | Higher risk due to compounded exposure |

| Capital Allocation | Divided into smaller chunks | Reinvests profits to increase position size |

| Best Use Case | Uncertain market conditions | Strong trending markets |

| Trade Management | Allows adjustment before full exposure | Relies on trend continuation |

| Example | Buying 25% of intended shares initially, adding more later | Adding 10% more shares with profits after each upward move |

Introduction to Scaling In and Pyramiding

Scaling In involves gradually increasing a position size by entering multiple smaller trades as price moves favorably, helping manage risk and optimize capital deployment. Pyramiding consists of adding to an already profitable position by using unrealized gains to fund new entries, amplifying exposure as the trend continues. Both techniques enhance trade management but differ in timing and risk tolerance, with Scaling In emphasizing cautious accumulation and Pyramiding focusing on momentum-driven growth.

Key Differences Between Scaling In and Pyramiding

Scaling in involves gradually entering a position by buying smaller increments over time to manage risk and adjust to market conditions, whereas pyramiding entails adding to an existing profitable position using unrealized gains to maximize returns. Scaling in emphasizes risk control and cautious exposure buildup, while pyramiding focuses on leveraging accumulated profits to amplify gains. The key difference lies in the risk approach: scaling in reduces initial risk exposure, whereas pyramiding increases position size based on positive performance momentum.

Benefits of Scaling In Strategies

Scaling in strategies enable traders to enter positions gradually, reducing the risk of market volatility and allowing for better price averaging. This approach enhances capital efficiency by limiting exposure during uncertain market conditions while still participating in potential price movements. The method also facilitates more disciplined risk management, preventing overcommitment and enabling adjustments based on evolving market trends.

Advantages of Pyramiding Techniques

Pyramiding techniques maximize profits by gradually increasing position size as the trade moves favorably, effectively leveraging winning momentum to compound gains. This strategy improves capital efficiency and risk management by allocating more resources only when the initial position shows positive performance, reducing exposure in unprofitable trades. Traders benefit from improved average entry prices and enhanced overall returns by layering entries strategically during confirmed trend continuation.

When to Use Scaling In vs Pyramiding

Scaling in is best used when entering a position gradually to manage risk in volatile or uncertain markets, allowing traders to build exposure as confidence in the trade setup increases. Pyramiding suits trending markets, adding to winning positions to maximize profits while the trend persists, relying on strong momentum and clear directional bias. Traders should choose scaling in during unpredictable conditions and opt for pyramiding when trends demonstrate sustained strength and confirmatory signals.

Risks Involved in Scaling In

Scaling in involves gradually increasing a position size in a security as its price moves favorably, which helps manage risk by avoiding large entry points at once, but it exposes traders to the risk of missing out if the price reverses before full position establishment. This technique can lead to higher transaction costs due to multiple entries and complicates risk management because the average entry price can become less favorable if the market moves against subsequent entries. Effective scaling in demands strict discipline and trend confirmation to mitigate the risk of accumulating losses and overexposure in volatile markets.

Pyramiding: Common Pitfalls and How to Avoid Them

Pyramiding involves increasing position sizes by adding to winning trades, but common pitfalls include overexposure, increased risk of margin calls, and poor timing that can amplify losses. Traders often underestimate market volatility or rely on emotional decision-making, leading to unsustainable positions and diminished returns. Effective risk management, setting clear entry and exit points, and maintaining disciplined adherence to trading plans are essential to avoid these pitfalls and maximize pyramiding benefits.

Tools and Indicators for Effective Position Sizing

Effective position sizing through scaling in involves gradually adding to a position using technical tools like moving averages, RSI, and volume analysis to confirm trend strength and entry points, minimizing risk. Pyramiding utilizes indicators such as MACD, Bollinger Bands, and Fibonacci retracements to strategically increase position size as the trend progresses, capitalizing on confirmed momentum. Both methods benefit from real-time price action monitoring and volatility indicators like ATR for dynamic adjustment of position sizes and stop-loss levels.

Real-World Examples of Scaling In and Pyramiding

Scaling in involves gradually entering a position by buying shares in increments to manage risk, exemplified by Warren Buffett's approach to accumulating stakes in companies like Apple over time. Pyramiding, on the other hand, entails increasing position size by using unrealized profits as margin, famously used by traders like Paul Tudor Jones during strong trending markets such as the 1987 stock rally. Real-world examples highlight how scaling in helps limit downside exposure in volatile conditions, while pyramiding maximizes gains in confirmed uptrends.

Best Practices for Safely Growing Trading Positions

Scaling in involves gradually increasing a position size at different price levels to manage risk and capitalize on trend confirmation, while pyramiding adds to winning positions using profits from previous trades to maximize gains. Best practices for safely growing trading positions include setting predefined entry points, employing strict stop-loss orders to protect capital, and avoiding overexposure by limiting total position size relative to portfolio value. Consistent risk management and disciplined execution ensure sustainable growth without compromising overall account health.

Scaling In Infographic

libterm.com

libterm.com