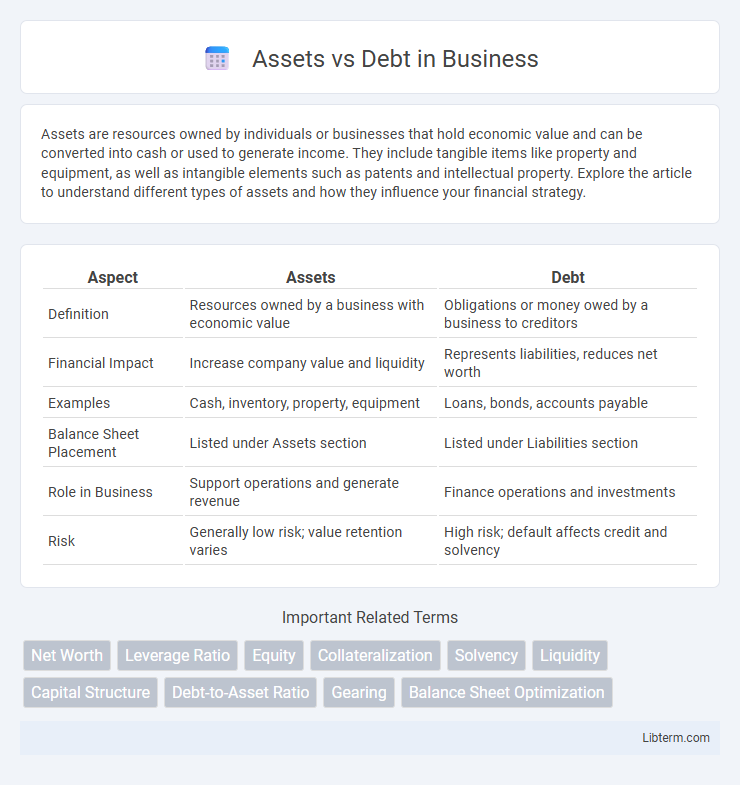

Assets are resources owned by individuals or businesses that hold economic value and can be converted into cash or used to generate income. They include tangible items like property and equipment, as well as intangible elements such as patents and intellectual property. Explore the article to understand different types of assets and how they influence your financial strategy.

Table of Comparison

| Aspect | Assets | Debt |

|---|---|---|

| Definition | Resources owned by a business with economic value | Obligations or money owed by a business to creditors |

| Financial Impact | Increase company value and liquidity | Represents liabilities, reduces net worth |

| Examples | Cash, inventory, property, equipment | Loans, bonds, accounts payable |

| Balance Sheet Placement | Listed under Assets section | Listed under Liabilities section |

| Role in Business | Support operations and generate revenue | Finance operations and investments |

| Risk | Generally low risk; value retention varies | High risk; default affects credit and solvency |

Understanding Assets and Debt

Assets represent resources owned by individuals or businesses that hold economic value, such as cash, property, investments, and equipment. Debt refers to financial obligations or liabilities that require repayment, including loans, mortgages, credit card balances, and bonds. Understanding the distinction between assets and debt is crucial for assessing net worth, cash flow, and overall financial health.

Types of Assets: Tangible vs Intangible

Tangible assets include physical items such as property, machinery, and inventory that hold measurable value and can be used as collateral for debt. Intangible assets consist of non-physical resources like patents, trademarks, and goodwill, which contribute to a company's market value but lack physical substance. Understanding the distinction between tangible and intangible assets is crucial for accurate financial assessment and effective debt management strategies.

Forms of Debt: Secured vs Unsecured

Secured debt involves borrowing backed by collateral, such as property or equipment, which reduces lender risk and often allows for lower interest rates. Unsecured debt lacks collateral, relying solely on the borrower's creditworthiness, resulting in higher interest rates and increased risk for lenders. Differentiating between secured and unsecured debt is crucial for asset management and financial planning, influencing credit terms and repayment obligations.

The Role of Assets in Wealth Building

Assets such as real estate, stocks, and businesses play a crucial role in wealth building by generating income and appreciating in value over time, thereby increasing net worth. Unlike liabilities or debt, assets provide financial stability and opportunities for reinvestment, fostering long-term growth. Effective asset management ensures cash flow generation and capital accumulation, which are fundamental to building sustainable wealth.

Debt: Tool or Trap?

Debt serves as a powerful financial tool when managed responsibly, enabling individuals and businesses to leverage capital for growth, investment, and cash flow management. However, excessive or poorly structured debt becomes a trap, leading to high-interest burdens, reduced financial flexibility, and increased risk of insolvency. Understanding interest rates, repayment terms, and debt-to-asset ratios is essential for maintaining a healthy balance between leveraging debt and protecting long-term financial stability.

Key Differences Between Assets and Debt

Assets represent valuable resources owned by an individual or business, including cash, property, investments, and equipment that generate future economic benefits. Debt refers to financial obligations or liabilities that require repayment, such as loans, bonds, and mortgages. The key difference lies in assets contributing positively to net worth, while debt represents claims against assets and reduces overall financial equity.

Impact of Assets and Debt on Net Worth

Assets increase net worth by representing valuable resources owned, such as real estate, investments, and cash, that contribute positively to overall financial health. Debt reduces net worth because it constitutes financial obligations or liabilities, like loans and credit card balances, that must be repaid, thereby diminishing the value of owned assets. The balance between assets and debt directly determines net worth, where higher assets relative to debt result in greater net worth and financial stability.

Strategies to Increase Assets

Growing your assets requires a strategic approach that includes diversifying investments across real estate, stocks, and bonds to maximize returns and minimize risk. Regularly contributing to retirement accounts such as 401(k)s and IRAs ensures steady asset accumulation through tax advantages and compound growth. Leveraging passive income streams like rental properties or dividend-paying stocks further accelerates wealth building while maintaining financial stability.

Managing and Reducing Debt

Effective managing and reducing debt involves prioritizing high-interest liabilities and establishing a consistent repayment plan to improve financial stability. Regularly reviewing assets can provide collateral opportunities and improve debt negotiation leverage. Leveraging budgeting tools and financial counseling enhances debt reduction strategies while preserving asset value.

Balancing Assets and Debt for Financial Health

Balancing assets and debt is essential for maintaining strong financial health, as assets represent the resources and investments that build wealth while debt signifies financial obligations that must be managed carefully. Optimizing the ratio of assets to debt improves creditworthiness and provides a cushion against economic downturns, ensuring liquidity and stability. Effective financial strategies prioritize increasing high-quality assets such as real estate, equities, and savings, while minimizing high-interest liabilities to achieve sustainable growth.

Assets Infographic

libterm.com

libterm.com