A management buyout (MBO) occurs when a company's existing management team acquires a significant portion or all of the business, often to increase control and drive growth. This strategic move can improve operational efficiency and align company goals with management's vision. Discover how an MBO could impact your business strategy by reading the rest of the article.

Table of Comparison

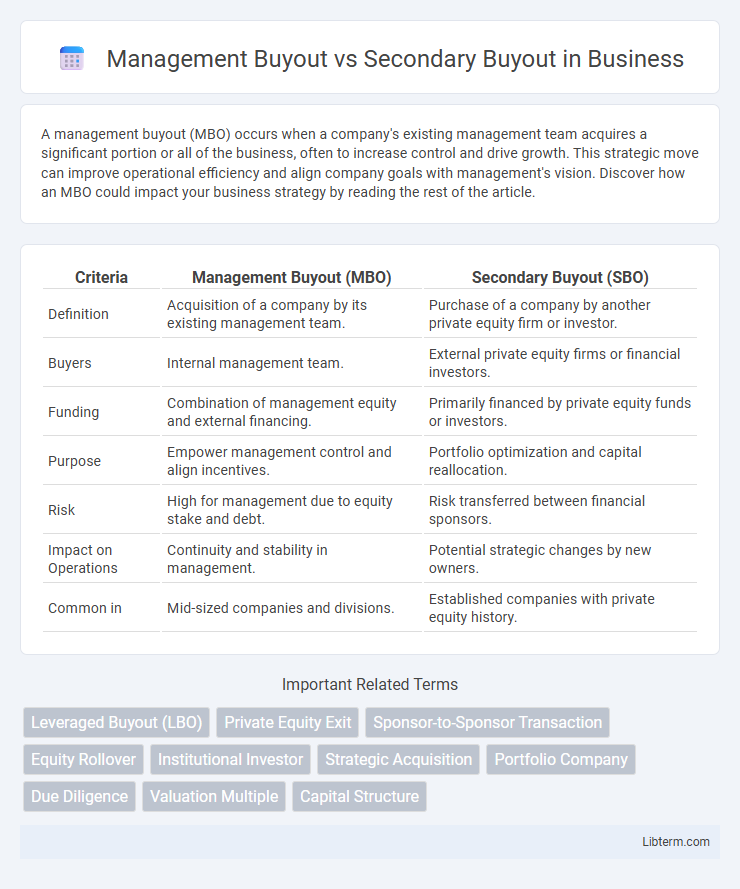

| Criteria | Management Buyout (MBO) | Secondary Buyout (SBO) |

|---|---|---|

| Definition | Acquisition of a company by its existing management team. | Purchase of a company by another private equity firm or investor. |

| Buyers | Internal management team. | External private equity firms or financial investors. |

| Funding | Combination of management equity and external financing. | Primarily financed by private equity funds or investors. |

| Purpose | Empower management control and align incentives. | Portfolio optimization and capital reallocation. |

| Risk | High for management due to equity stake and debt. | Risk transferred between financial sponsors. |

| Impact on Operations | Continuity and stability in management. | Potential strategic changes by new owners. |

| Common in | Mid-sized companies and divisions. | Established companies with private equity history. |

Introduction to Management Buyout (MBO) and Secondary Buyout (SBO)

Management Buyout (MBO) involves a company's existing management team acquiring a significant stake or full ownership, leveraging their intimate knowledge to drive growth and operational improvements. Secondary Buyout (SBO) occurs when one private equity firm sells its stake in a company to another private equity firm, often to realize gains or reposition the asset for future growth. Both MBO and SBO are critical mechanisms in private equity for ownership transition and value optimization.

Key Definitions: MBO vs Secondary Buyout

A Management Buyout (MBO) involves a company's existing management team acquiring a significant portion or all of the business, leveraging their insider knowledge and operational expertise. A Secondary Buyout (SBO) refers to the acquisition of a company by a new private equity firm or investor from an existing private equity owner, enabling liquidity and portfolio rebalancing. MBOs emphasize continuity of leadership, while SBOs focus on ownership transitions between financial investors.

Motivations Behind Management Buyouts

Management Buyouts (MBOs) are primarily driven by the internal management team's desire to gain full control and align operational decisions with long-term strategic goals. Motivations often include enhancing management autonomy, unlocking value through focused leadership, and preserving company culture during ownership transition. In contrast, Secondary Buyouts involve one private equity firm selling to another, motivated by portfolio rebalancing and realizing investment returns rather than internal management objectives.

Drivers of Secondary Buyouts

Secondary Buyouts are primarily driven by the desire for liquidity among existing private equity firms seeking to exit mature investments and reallocate capital to new opportunities. Improved operational performance and market conditions also incentivize buyers to acquire established portfolio companies with proven growth potential. These transactions facilitate value realization while enabling continued expansion under new ownership, distinguishing them from Management Buyouts where insiders focus on control transitions.

Deal Structure and Financing in MBOs and SBOs

Management Buyouts (MBOs) typically involve the existing management team acquiring the company using a mix of equity, seller financing, and leveraged debt, emphasizing alignment with long-term operational control and performance incentives. Secondary Buyouts (SBOs) occur when a private equity firm sells a portfolio company to another private equity firm, often relying heavily on leveraged financing and complex transaction structures to optimize exit valuations and return on investment. Financing in MBOs often includes managerial equity rollover and vendor loans, whereas SBOs prioritize institutional debt facilities and may incorporate refinancing mechanisms to balance risk between buyers and sellers.

Risk Factors: MBO vs Secondary Buyout

Management Buyouts (MBOs) typically carry higher operational risk as management teams take on significant debt to acquire the company, increasing financial leverage and pressure on cash flow. Secondary Buyouts (SBOs), involving sales between private equity firms, often face market risk related to valuation discrepancies and exit uncertainties but benefit from professional investor experience, potentially reducing operational risk. Both transaction types require careful due diligence on financial stability, growth prospects, and exit strategy to mitigate risks specific to ownership structure and market conditions.

Value Creation Strategies in MBOs and SBOs

Management Buyouts (MBOs) and Secondary Buyouts (SBOs) utilize distinct value creation strategies focused on operational improvements and market repositioning. MBOs leverage insider knowledge and managerial expertise to drive operational efficiencies, streamline decision-making, and foster long-term strategic growth. SBOs often concentrate on financial engineering, portfolio optimization, and scaling through bolt-on acquisitions to maximize exit valuations and enhance shareholder returns.

Benefits and Drawbacks of Each Approach

Management buyouts (MBOs) empower existing management teams to acquire ownership, aligning incentives and promoting operational continuity, but they may face financing challenges and potential conflicts of interest. Secondary buyouts occur when one private equity firm sells a portfolio company to another, enabling liquidity and strategic repositioning, yet they can lead to value dilution and increased debt levels. Each approach impacts company control, financial risk, and growth potential differently, requiring careful evaluation of capital structure and long-term objectives.

Market Trends and Recent Examples

Management Buyouts (MBOs) increasingly dominate the private equity landscape as executives seek greater control amid stable market conditions, with notable examples including Dell's $24.4 billion MBO in 2013. Secondary Buyouts (SBOs) show rising activity due to limited exit options for private equity firms, exemplified by the $5.4 billion acquisition of Refresco by another PE group in 2021. Market trends indicate MBOs drive operational continuity, while SBOs provide liquidity opportunities, reflecting evolving capital deployment strategies in 2023.

Choosing Between MBO and Secondary Buyout

Choosing between a Management Buyout (MBO) and a Secondary Buyout (SBO) depends on strategic goals, control preferences, and financial considerations. MBOs typically offer existing management teams greater operational control and alignment with company vision, while SBOs provide opportunities for external private equity firms to exit or reallocate investments, often bringing fresh capital and growth expertise. Evaluating the company's long-term growth potential, management capability, and investor objectives is crucial for selecting the optimal buyout structure.

Management Buyout Infographic

libterm.com

libterm.com