Accrued expenses represent costs that have been incurred but not yet paid, impacting your company's financial statements by increasing liabilities and reducing net income until settled. Properly accounting for accrued expenses ensures accurate financial reporting and helps maintain compliance with accounting standards. Discover more about how accrued expenses affect your business and how to manage them effectively in the rest of this article.

Table of Comparison

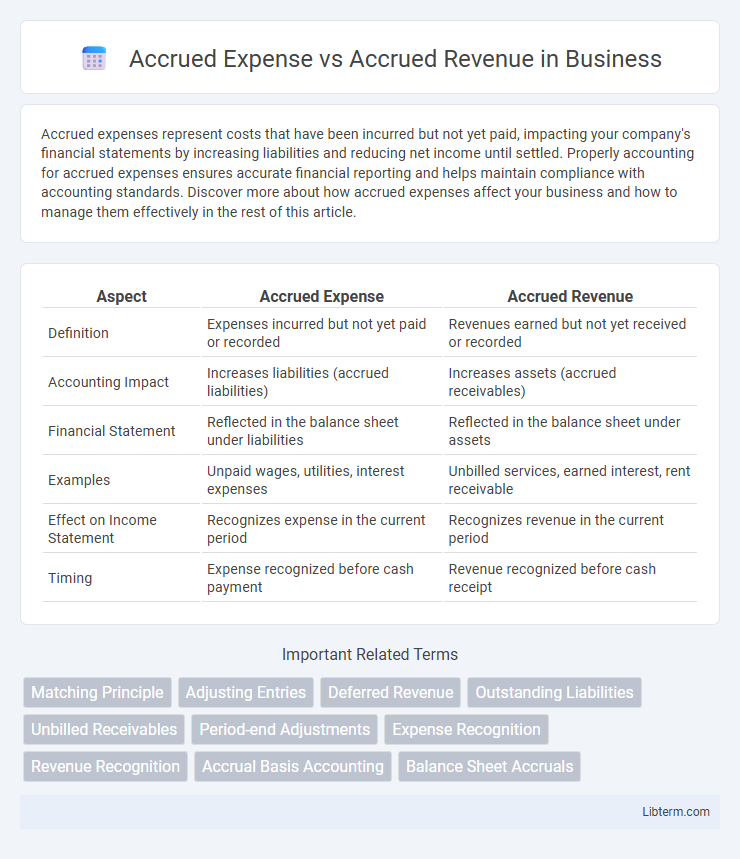

| Aspect | Accrued Expense | Accrued Revenue |

|---|---|---|

| Definition | Expenses incurred but not yet paid or recorded | Revenues earned but not yet received or recorded |

| Accounting Impact | Increases liabilities (accrued liabilities) | Increases assets (accrued receivables) |

| Financial Statement | Reflected in the balance sheet under liabilities | Reflected in the balance sheet under assets |

| Examples | Unpaid wages, utilities, interest expenses | Unbilled services, earned interest, rent receivable |

| Effect on Income Statement | Recognizes expense in the current period | Recognizes revenue in the current period |

| Timing | Expense recognized before cash payment | Revenue recognized before cash receipt |

Introduction to Accrued Expense and Accrued Revenue

Accrued expenses represent liabilities for costs incurred but not yet paid, such as wages, utilities, or interest, recognized in the accounting period they occur to match expenses with revenues. Accrued revenue, conversely, refers to earnings recognized when services are performed or goods delivered, though payment is not yet received, reflecting assets in the form of receivables. Both concepts ensure accurate financial reporting by adhering to the accrual basis of accounting, capturing economic activities as they happen.

Definition of Accrued Expense

Accrued expense refers to costs that a company has incurred but has not yet paid by the end of the accounting period, representing liabilities on the balance sheet. These expenses are recorded to comply with the matching principle, ensuring that expenses are matched with the revenues they help generate within the same period. Examples of accrued expenses include wages payable, interest payable, and utilities expenses that have been incurred but not settled.

Definition of Accrued Revenue

Accrued revenue refers to income earned by a business for goods or services delivered but not yet invoiced or received in cash, representing assets on the balance sheet. It contrasts with accrued expenses, which are costs incurred but not yet paid or recorded. Recognizing accrued revenue ensures accurate financial reporting by matching revenues to the period they are earned, per accrual accounting principles.

Key Differences Between Accrued Expense and Accrued Revenue

Accrued expenses represent obligations for goods or services received but not yet paid, reflecting liabilities on the balance sheet, whereas accrued revenue refers to earnings recognized for delivered goods or services not yet billed or received as cash, marking assets. The key difference lies in their accounting treatment: accrued expenses increase liabilities, while accrued revenues increase assets. Timing also distinguishes them; accrued expenses anticipate future cash outflows, whereas accrued revenues anticipate future cash inflows.

Examples of Accrued Expense

Accrued expenses represent liabilities for goods or services received but not yet paid, such as accrued salaries for employee work completed during the accounting period but paid in the next period. Common examples include accrued interest on loans, utility bills incurred but not yet billed, and accrued rent expenses when rent is owed but unpaid at the end of the period. Recognizing these expenses ensures adherence to the matching principle by recording costs in the period they are incurred, even if payment occurs later.

Examples of Accrued Revenue

Accrued revenue represents income earned by a company for goods or services provided but not yet invoiced or received, such as interest earned on investments or consulting services performed without billing the client. For example, a software firm delivering monthly subscription services may recognize accrued revenue if the billing occurs after the service period ends. This contrasts with accrued expenses, which are costs incurred but not yet paid, like utility bills received after the usage period.

Accounting Treatment for Accrued Expense

Accrued expenses are recorded as liabilities on the balance sheet to reflect expenses incurred but not yet paid, ensuring accurate matching of costs with related revenues in the accounting period. The accounting treatment involves debiting the relevant expense account and crediting accrued liabilities, often termed accrued expenses payable, until the actual payment is made. This approach aligns with the accrual basis of accounting and improves financial statement accuracy by recognizing obligations promptly.

Accounting Treatment for Accrued Revenue

Accrued revenue represents revenue earned but not yet received or recorded, requiring recognition under the accrual basis of accounting to match income with the period earned. The accounting treatment involves recording a debit to accounts receivable and a credit to revenue, reflecting the amount due without cash receipt. This ensures financial statements accurately depict earned income and improve the matching of revenues with corresponding expenses in the same accounting period.

Importance of Accrual Accounting in Financial Statements

Accrued expenses and accrued revenues are critical components of accrual accounting, ensuring that financial statements accurately reflect a company's financial position by recognizing expenses and revenues when they are incurred or earned, not when cash is exchanged. This matching principle enhances the reliability and relevance of financial reports, providing stakeholders with a true picture of operational performance and financial health. Accurate accrual accounting supports regulatory compliance and informed decision-making by presenting earned revenues and incurred liabilities in the appropriate accounting periods.

Conclusion: Accrued Expense vs Accrued Revenue

Accrued expenses represent liabilities for goods or services received but not yet paid, impacting the balance sheet and expense accounts. Accrued revenue reflects earned income not yet received in cash, increasing assets and revenue accounts. Understanding the distinction is crucial for accurate financial reporting and cash flow management.

Accrued Expense Infographic

libterm.com

libterm.com