A purchase order is a formal document issued by a buyer to a supplier, detailing the products or services required, quantities, and agreed prices. It serves as a legally binding contract that ensures clarity and accountability between both parties during a transaction. Explore the rest of the article to understand how purchase orders streamline your procurement processes and protect your business interests.

Table of Comparison

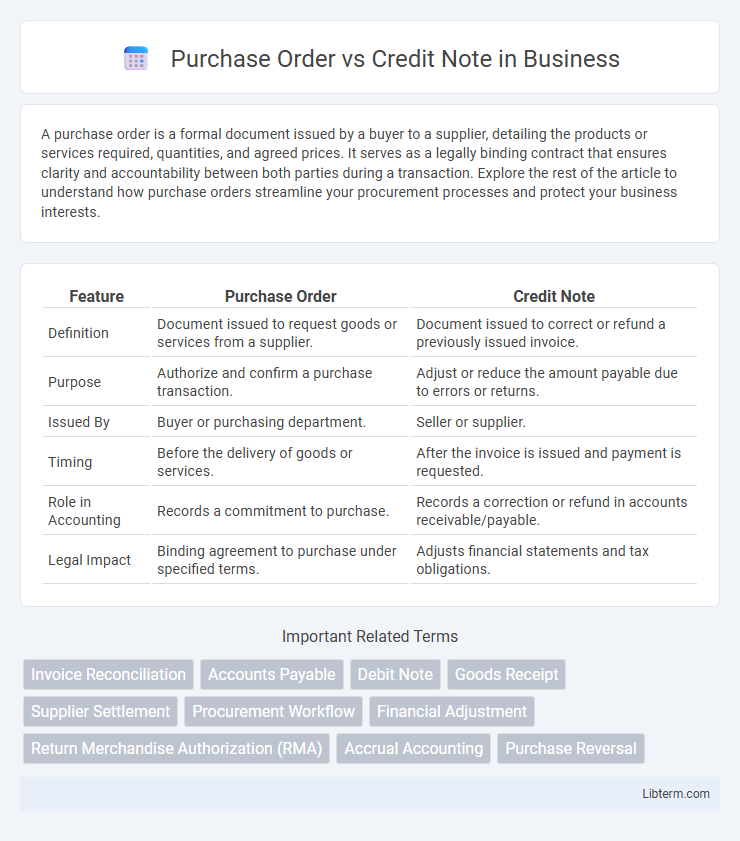

| Feature | Purchase Order | Credit Note |

|---|---|---|

| Definition | Document issued to request goods or services from a supplier. | Document issued to correct or refund a previously issued invoice. |

| Purpose | Authorize and confirm a purchase transaction. | Adjust or reduce the amount payable due to errors or returns. |

| Issued By | Buyer or purchasing department. | Seller or supplier. |

| Timing | Before the delivery of goods or services. | After the invoice is issued and payment is requested. |

| Role in Accounting | Records a commitment to purchase. | Records a correction or refund in accounts receivable/payable. |

| Legal Impact | Binding agreement to purchase under specified terms. | Adjusts financial statements and tax obligations. |

Introduction to Purchase Orders and Credit Notes

Purchase orders are formal documents issued by a buyer to a supplier, detailing products or services, quantities, prices, and agreed terms for a transaction. Credit notes serve as official acknowledgments issued by sellers to buyers, indicating a reduction in the amount owed due to returned goods, overbilling, or other adjustments. Both purchase orders and credit notes play essential roles in maintaining accurate financial records and ensuring transparent communication between trading partners.

Definition of Purchase Order

A Purchase Order (PO) is a formal document issued by a buyer to a seller, specifying the types, quantities, and agreed prices for products or services. It serves as a legal contract that authorizes the purchase and helps track order fulfillment. In contrast, a Credit Note is issued by the seller to the buyer to correct billing errors or return goods, reducing the amount payable.

Definition of Credit Note

A credit note is a document issued by a seller to the buyer, acknowledging a return of goods, a reduction in the amount owed, or an adjustment due to errors in the original invoice. Unlike a purchase order, which is a buyer's formal request to purchase goods or services, a credit note serves as evidence of a credit granted to the buyer's account. It effectively reduces the amount payable and maintains accurate financial records between the trading parties.

Key Differences Between Purchase Order and Credit Note

A Purchase Order (PO) is a document issued by a buyer to a seller indicating the type, quantity, and agreed price for products or services, serving as a formal offer to purchase. In contrast, a Credit Note is issued by the seller to the buyer to acknowledge a return, refund, or adjustment, reducing the amount owed by the buyer. Key differences include their purpose--with Purchase Orders initiating a transaction and Credit Notes rectifying or adjusting it--and their timing, as POs occur before delivery while Credit Notes follow after invoicing or receipt of goods.

Purpose and Use Cases of Purchase Orders

Purchase orders serve as formal documents issued by a buyer to request goods or services from a supplier, ensuring clarity in terms, quantities, and delivery schedules. They help companies manage procurement processes, control budgets, and create legally binding agreements before transactions occur. Common use cases include inventory replenishment, project-based purchases, and bulk ordering, streamlining supplier communication and financial tracking.

Purpose and Use Cases of Credit Notes

Credit notes serve as official documents issued by sellers to buyers to acknowledge a reduction in the amount owed, typically due to returned goods, pricing errors, or adjustments in invoices. Their primary purpose is to correct billing discrepancies, facilitate refunds, or provide future purchase credits, ensuring accurate financial records and customer satisfaction. Common use cases for credit notes include product returns, damaged item compensation, pricing disputes, and cancellation of previously issued invoices.

Essential Components of a Purchase Order

A purchase order includes essential components such as the buyer and seller details, item descriptions, quantities, agreed prices, delivery schedule, and payment terms, which establish a clear contractual agreement for goods or services. It serves as a formal document authorizing a purchase, ensuring accuracy and accountability in the procurement process. Unlike a credit note, which is issued to correct or refund a previously invoiced amount, the purchase order initiates the transaction by specifying requirements upfront.

Essential Components of a Credit Note

A credit note includes essential components such as a unique credit note number, date of issuance, reference to the original purchase order or invoice, and a detailed description of the returned or refunded items. It specifies the quantity, unit price, and total amount credited, along with the reason for issuance, such as returned goods or billing errors. Buyer and seller information, including company names and contact details, are also critical for accurate record-keeping and reconciliation.

Impact on Accounting and Financial Records

Purchase orders initiate the procurement process by formally authorizing purchases, directly affecting accounts payable and inventory records, ensuring accurate tracking of liabilities and asset inflows. Credit notes adjust or reverse previous invoices, reducing accounts receivable or payable balances and correcting financial discrepancies without altering the original purchase order. Both documents are critical for maintaining accurate financial records, impacting cash flow projections, audit trails, and compliance with accounting standards.

Choosing the Right Document for Your Business Transactions

Selecting the appropriate document for business transactions depends on the nature of the transaction: a purchase order serves as an official authorization for goods or services, detailing quantities, prices, and terms, ensuring clear communication with suppliers. A credit note is issued after a transaction to correct or adjust invoices, reflecting returned goods, errors, or discounts, crucial for maintaining accurate financial records. Proper use of purchase orders prevents disputes by confirming order details upfront, while credit notes facilitate efficient resolution of billing discrepancies, supporting transparent and compliant accounting practices.

Purchase Order Infographic

libterm.com

libterm.com