An Initial Public Offering (IPO) marks the first sale of a company's shares to the public, enabling it to raise capital and increase market visibility. Successful IPOs can provide significant growth opportunities while introducing new regulatory requirements and market pressures. Discover more about how an IPO can impact your investment strategy and what to watch for in this comprehensive guide.

Table of Comparison

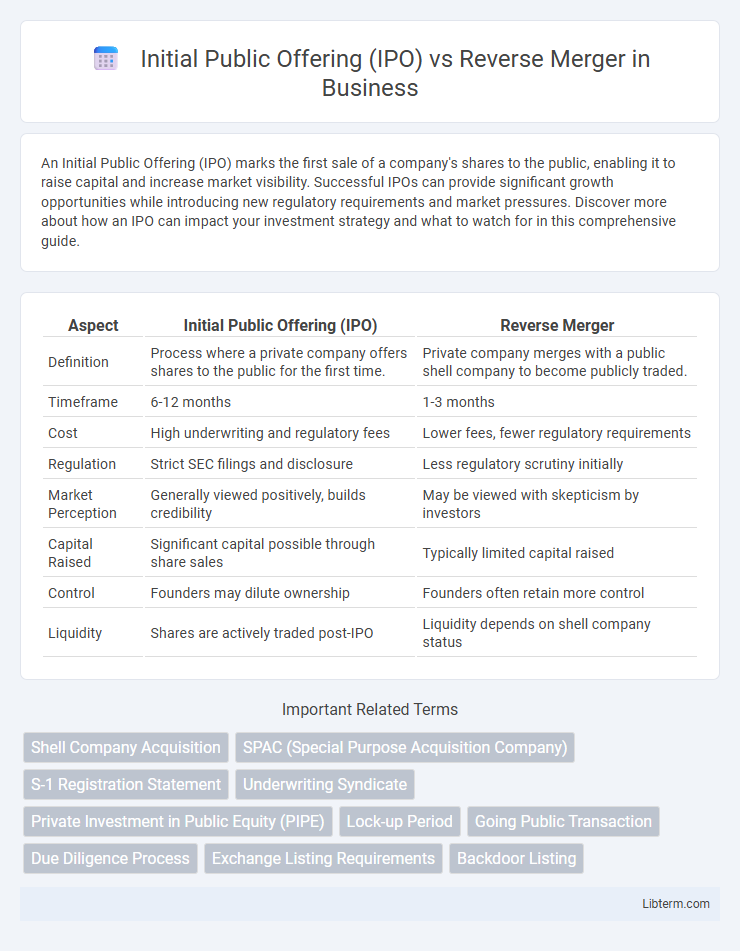

| Aspect | Initial Public Offering (IPO) | Reverse Merger |

|---|---|---|

| Definition | Process where a private company offers shares to the public for the first time. | Private company merges with a public shell company to become publicly traded. |

| Timeframe | 6-12 months | 1-3 months |

| Cost | High underwriting and regulatory fees | Lower fees, fewer regulatory requirements |

| Regulation | Strict SEC filings and disclosure | Less regulatory scrutiny initially |

| Market Perception | Generally viewed positively, builds credibility | May be viewed with skepticism by investors |

| Capital Raised | Significant capital possible through share sales | Typically limited capital raised |

| Control | Founders may dilute ownership | Founders often retain more control |

| Liquidity | Shares are actively traded post-IPO | Liquidity depends on shell company status |

Understanding IPOs: Definition and Process

An Initial Public Offering (IPO) is the process by which a private company offers shares to the public for the first time, raising capital by listing on a stock exchange. The IPO process involves regulatory filings with the Securities and Exchange Commission (SEC), due diligence, underwriting by investment banks, and a roadshow to attract investors. This traditional method contrasts with Reverse Merger, where a private company merges with an existing public entity to bypass the extensive IPO procedures.

What is a Reverse Merger? Key Concepts Explained

A reverse merger is a process where a private company acquires a publicly traded shell company to bypass the traditional Initial Public Offering (IPO) process and gain quick access to public markets. This method allows companies to become publicly listed without undergoing extensive regulatory scrutiny and lengthy timelines associated with IPOs. Key concepts include the use of an existing public entity, cost-effectiveness, and the ability to raise capital faster compared to an IPO.

Major Differences Between IPOs and Reverse Mergers

Initial Public Offerings (IPOs) involve a company offering its shares to the public through a formal, regulated process with underwriters, extensive disclosures, and regulatory scrutiny, often taking months to complete. Reverse mergers enable a private company to become publicly traded quickly by merging with an existing public shell company, bypassing much of the traditional IPO regulatory and underwriting processes. Key differences include the time to market, costs involved, regulatory requirements, and the level of investor confidence, with IPOs generally seen as more transparent and credible but more expensive and time-consuming than reverse mergers.

Advantages of Choosing an IPO

An Initial Public Offering (IPO) offers greater transparency and regulatory oversight, enhancing investor confidence and market credibility. It provides access to a broader capital base and can significantly improve a company's public profile and valuation. IPOs often result in better liquidity for shareholders compared to reverse mergers, facilitating smoother stock trading on major exchanges.

Benefits of Using a Reverse Merger

A reverse merger offers companies faster access to public markets compared to the lengthy IPO process, reducing time-to-market significantly. It lowers costs by avoiding extensive underwriting fees and regulatory hurdles commonly associated with traditional IPOs. Additionally, reverse mergers provide greater certainty of execution and allow private companies to retain more control over the timing and terms of going public.

Key Risks and Challenges of IPOs

Initial Public Offerings (IPOs) involve significant regulatory scrutiny and high costs, including underwriting fees and compliance expenses, posing financial challenges for companies. The market volatility and timing risks can impact the IPO pricing and investor demand, leading to potential undervaluation or failed offerings. Furthermore, IPOs require extensive disclosure, increasing transparency but also exposing the company to litigation risks and operational pressures to meet shareholder expectations.

Common Pitfalls in Reverse Mergers

Reverse mergers often face common pitfalls such as inadequate due diligence leading to undisclosed liabilities and regulatory scrutiny. Unlike initial public offerings (IPOs), reverse mergers may lack thorough vetting by underwriters, increasing the risk of fraud and financial misstatements. Market perception challenges and limited investor confidence frequently hinder the long-term success of companies pursuing reverse mergers.

Cost and Time Considerations: IPO vs Reverse Merger

Initial Public Offerings (IPOs) typically involve higher costs and longer timelines, often exceeding $2 million and taking six months to over a year due to regulatory requirements and underwriting processes. Reverse mergers offer a cost-effective alternative, frequently under $500,000, with significantly reduced timeframes, often completing within three months by acquiring a shell company. Companies seeking faster market entry and lower upfront expenses often prefer reverse mergers despite potential trade-offs in market perception and liquidity.

Recent Market Trends in IPOs and Reverse Mergers

Recent market trends reveal a slowdown in traditional Initial Public Offerings (IPOs) due to regulatory complexities and volatile market conditions, prompting companies to explore alternative routes like reverse mergers for faster, cost-effective public listings. Reverse mergers have gained traction as a strategic option, especially among smaller firms seeking to bypass extensive IPO procedures while accessing public capital markets. Data from 2023 shows a 15% increase in reverse merger transactions compared to the previous year, highlighting shifting preferences in capital-raising strategies.

Choosing the Right Path: IPO or Reverse Merger?

Choosing between an Initial Public Offering (IPO) and a Reverse Merger depends on factors such as time, cost, and regulatory scrutiny. IPOs often provide greater capital and market visibility but involve extensive disclosure and longer timelines, while reverse mergers offer a faster, less expensive route to public markets with potentially higher risk of lower investor confidence. Evaluating a company's financial health, growth prospects, and readiness for public reporting helps determine whether the traditional IPO or the streamlined reverse merger is the optimal path.

Initial Public Offering (IPO) Infographic

libterm.com

libterm.com