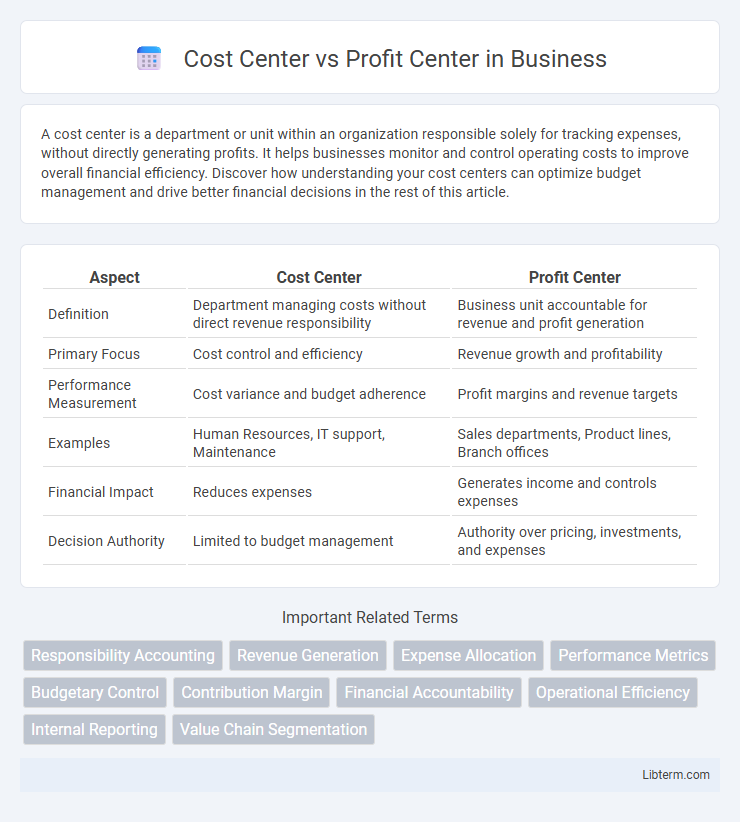

A cost center is a department or unit within an organization responsible solely for tracking expenses, without directly generating profits. It helps businesses monitor and control operating costs to improve overall financial efficiency. Discover how understanding your cost centers can optimize budget management and drive better financial decisions in the rest of this article.

Table of Comparison

| Aspect | Cost Center | Profit Center |

|---|---|---|

| Definition | Department managing costs without direct revenue responsibility | Business unit accountable for revenue and profit generation |

| Primary Focus | Cost control and efficiency | Revenue growth and profitability |

| Performance Measurement | Cost variance and budget adherence | Profit margins and revenue targets |

| Examples | Human Resources, IT support, Maintenance | Sales departments, Product lines, Branch offices |

| Financial Impact | Reduces expenses | Generates income and controls expenses |

| Decision Authority | Limited to budget management | Authority over pricing, investments, and expenses |

Introduction to Cost Centers and Profit Centers

Cost centers are organizational units responsible for controlling costs without directly generating revenue, primarily focused on efficiency and expense management. Profit centers function as business units accountable for both revenues and expenses, aiming to maximize profitability and contribute directly to the company's bottom line. Understanding the distinctions between cost centers and profit centers is essential for effective financial management and strategic decision-making.

Key Differences Between Cost Centers and Profit Centers

Cost centers are organizational units primarily responsible for controlling expenses without generating direct revenue, focusing on cost efficiency and budget adherence. Profit centers, in contrast, are accountable for both revenues and costs, aiming to maximize profitability and contribute directly to the company's bottom line. The key difference lies in performance measurement: cost centers evaluate success based on cost control, while profit centers assess outcomes through net profit contribution.

Functions and Responsibilities of Cost Centers

Cost centers primarily focus on controlling and minimizing costs while maintaining efficient operations within a specific department or unit, without directly generating revenue. Their responsibilities include budgeting, tracking expenses, and ensuring compliance with financial policies to support profit centers and overall organizational goals. By emphasizing cost efficiency, cost centers contribute to the profitability and sustainability of the company through detailed financial monitoring and resource management.

Roles and Objectives of Profit Centers

Profit centers are organizational units responsible for generating revenue and profits by managing both costs and sales, with a primary role of driving business growth and profitability. They focus on maximizing income through effective decision-making related to pricing, product mix, and market strategies. Unlike cost centers, profit centers are evaluated based on their ability to contribute to the company's bottom line and overall financial performance.

Financial Impact: Cost Centers vs Profit Centers

Cost centers primarily focus on controlling and minimizing expenses, directly influencing an organization's operational efficiency and cost management. Profit centers are accountable for generating revenue and managing both costs and profits, thereby driving overall financial performance and business growth. Understanding the financial impact of each helps organizations allocate resources effectively and optimize profitability strategies.

Performance Measurement in Cost Centers & Profit Centers

Cost centers measure performance primarily through cost control and efficiency metrics, evaluating how well expenses are managed relative to budgeted costs. Profit centers assess performance based on both revenue generation and cost management, focusing on net profit as a key indicator of financial success. Performance measurement in profit centers requires tracking sales growth, profit margins, and return on investment to ensure profitability and strategic alignment.

Examples of Cost Centers in Business Operations

Cost centers in business operations include departments like human resources, accounting, maintenance, and customer support, where expenses are tracked without direct revenue generation. Manufacturing units and IT support teams also function as cost centers by managing operational costs essential to overall productivity. These units help monitor and control expenditures while enabling profit centers, such as sales and marketing, to focus on revenue growth.

Real-world Scenarios for Profit Centers

Profit centers are business units or departments responsible for generating revenue and profits, making them essential for evaluating real-world performance and strategic decision-making. In retail, individual store locations act as profit centers, being accountable for sales targets, cost management, and customer experience to drive profitability. Technology companies often designate product lines or regional operations as profit centers, enabling targeted investment and resource allocation to maximize returns.

Advantages and Disadvantages of Each Center

Cost centers enhance financial control by tracking expenses, allowing organizations to manage operational efficiency and reduce unnecessary costs; however, they do not directly generate revenue, which can limit their strategic impact. Profit centers drive revenue growth by holding managers accountable for both costs and income, fostering entrepreneurship and performance, but they may encourage short-term gains over long-term value or lead to inter-departmental competition. Balancing cost control with profit accountability is essential for integrated business management and sustainable organizational success.

Choosing Between Cost Center and Profit Center for Your Business

Choosing between a cost center and a profit center depends on your business objectives and financial management strategy. Cost centers focus on controlling expenses and optimizing operational efficiency without generating direct revenue, making them ideal for support functions like HR or IT. Profit centers are accountable for both revenues and costs, driving business growth and profitability, suitable for sales departments or product lines with clearly measurable financial performance.

Cost Center Infographic

libterm.com

libterm.com