Credit cards offer a convenient and secure way to manage your purchases while building a positive credit history. Understanding the differences between interest rates, fees, and rewards can help you choose the best card for your financial needs. Explore the rest of the article to learn how to maximize the benefits of your credit card effectively.

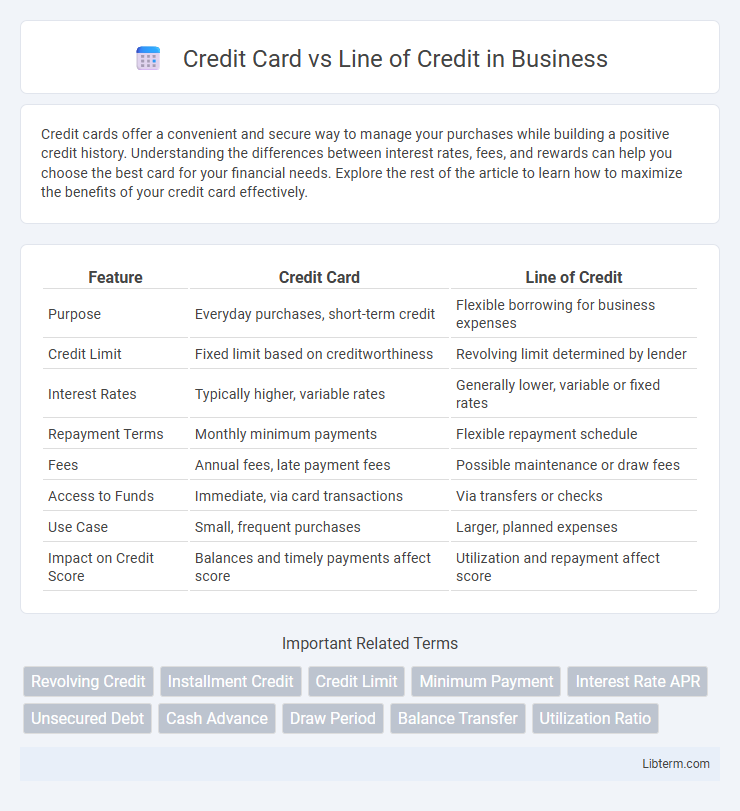

Table of Comparison

| Feature | Credit Card | Line of Credit |

|---|---|---|

| Purpose | Everyday purchases, short-term credit | Flexible borrowing for business expenses |

| Credit Limit | Fixed limit based on creditworthiness | Revolving limit determined by lender |

| Interest Rates | Typically higher, variable rates | Generally lower, variable or fixed rates |

| Repayment Terms | Monthly minimum payments | Flexible repayment schedule |

| Fees | Annual fees, late payment fees | Possible maintenance or draw fees |

| Access to Funds | Immediate, via card transactions | Via transfers or checks |

| Use Case | Small, frequent purchases | Larger, planned expenses |

| Impact on Credit Score | Balances and timely payments affect score | Utilization and repayment affect score |

Introduction: Credit Card vs Line of Credit

Credit cards and lines of credit both offer revolving credit but differ in purpose and usage. Credit cards provide a preset spending limit for everyday purchases with built-in rewards and fraud protection. Lines of credit offer flexible borrowing options with typically lower interest rates, ideal for larger expenses or ongoing cash flow needs.

Definition of Credit Card

A credit card is a plastic financial tool issued by banks or credit institutions allowing users to borrow funds up to a predetermined limit for purchases, cash advances, or balance transfers. It involves revolving credit where cardholders must repay at least the minimum amount each billing cycle, with interest charged on outstanding balances. Credit cards offer convenience, fraud protection, and rewards programs, making them distinct from lines of credit that typically provide flexible loans with variable interest rates and repayment terms.

Definition of Line of Credit

A line of credit is a flexible loan from a financial institution that allows borrowers to withdraw funds up to a predetermined limit and repay them over time, similar to a credit card but typically with lower interest rates and more customizable terms. Unlike a credit card, which is primarily used for everyday purchases with revolving credit, a line of credit can be used for larger expenses, cash flow management, or consolidating debt. Access to a line of credit is based on the borrower's creditworthiness and can be secured or unsecured, offering a versatile financing option.

Key Differences Between Credit Card and Line of Credit

A credit card offers a revolving credit limit primarily used for purchases with fixed or variable interest rates, while a line of credit provides flexible borrowing up to a preset limit that can be used for various expenses including cash withdrawals. Payments on credit cards typically require minimum monthly amounts, whereas lines of credit allow for interest-only payments or principal repayment depending on the agreement. Credit cards often include rewards and fraud protection benefits, whereas lines of credit generally have lower interest rates and are secured or unsecured based on the borrower's creditworthiness.

Application and Approval Process

The application process for credit cards typically involves a quick online or in-person submission with minimal documentation, and approval is often based on credit score, income, and existing debt levels. In contrast, applying for a line of credit requires more extensive financial documentation, such as income verification, credit history, and sometimes collateral, making the approval process longer and more stringent. Credit cards offer instant access upon approval, whereas lines of credit may involve additional underwriting before funds become available.

Interest Rates and Fees Comparison

Credit cards typically have higher interest rates, ranging from 15% to 25%, compared to lines of credit, which often feature lower rates between 7% and 15%. Fees on credit cards include annual fees, late payment fees, and cash advance fees, whereas lines of credit usually charge fewer fees but may have maintenance or draw fees. Understanding these cost differences is crucial for selecting the most cost-effective borrowing option based on individual credit needs and repayment ability.

Credit Limit and Accessibility

Credit cards offer a fixed credit limit determined by the issuer based on creditworthiness, typically allowing immediate access to funds for purchases and cash advances within that limit. Lines of credit provide a flexible credit limit that can be adjusted over time, granting borrowers ongoing access to funds up to the approved amount, often used for larger or variable expenses. Both credit options impact credit utilization ratios, but credit cards generally facilitate quicker, more convenient transactions through physical or digital payment methods.

Repayment Terms and Flexibility

Credit cards typically require minimum monthly payments based on a percentage of the outstanding balance, with interest rates varying widely and compounding daily, offering flexible repayment but potentially higher long-term costs. Lines of credit usually have more structured repayment terms with fixed monthly payments or interest-only options, often featuring lower interest rates and greater flexibility in borrowing and repayment amounts. Both financial tools provide revolving credit, but lines of credit generally offer more predictable repayment schedules and cost advantages for larger or longer-term borrowing needs.

Pros and Cons of Credit Card

Credit cards offer convenient, widely accepted payment methods with rewards programs and fraud protection, making them ideal for everyday expenses and short-term borrowing. However, high interest rates and fees can lead to significant debt if balances are not paid in full each month, and the temptation to overspend may negatively impact credit scores. Unlike lines of credit, credit cards typically have lower borrowing limits and less flexible repayment options, which can restrict financial management strategies.

Pros and Cons of Line of Credit

A line of credit offers flexible borrowing with generally lower interest rates compared to credit cards, making it ideal for larger expenses or ongoing cash flow needs. However, it often requires a more stringent approval process and may include variable interest rates that can increase over time. Unlike credit cards, lines of credit usually lack rewards programs and may have withdrawal limits or fees that impact overall cost.

Credit Card Infographic

libterm.com

libterm.com