Strategic alliances enable businesses to combine resources and expertise to achieve shared goals more efficiently while reducing risks. These partnerships can enhance market reach, accelerate innovation, and improve competitive advantage in rapidly evolving industries. Discover how your company can leverage strategic alliances to drive growth and stay ahead by exploring the full article.

Table of Comparison

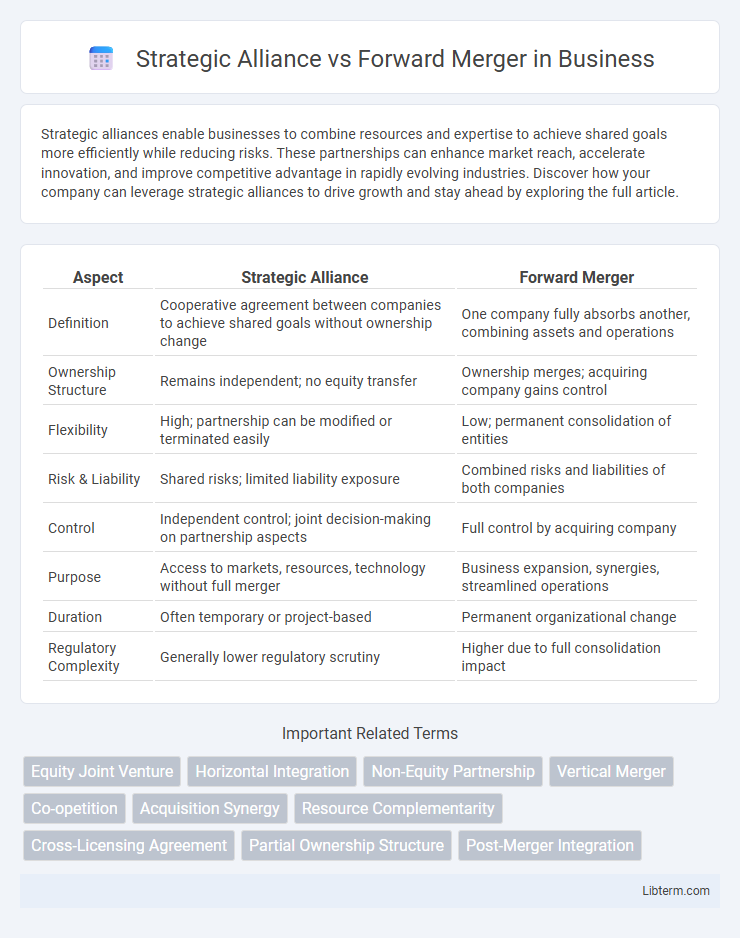

| Aspect | Strategic Alliance | Forward Merger |

|---|---|---|

| Definition | Cooperative agreement between companies to achieve shared goals without ownership change | One company fully absorbs another, combining assets and operations |

| Ownership Structure | Remains independent; no equity transfer | Ownership merges; acquiring company gains control |

| Flexibility | High; partnership can be modified or terminated easily | Low; permanent consolidation of entities |

| Risk & Liability | Shared risks; limited liability exposure | Combined risks and liabilities of both companies |

| Control | Independent control; joint decision-making on partnership aspects | Full control by acquiring company |

| Purpose | Access to markets, resources, technology without full merger | Business expansion, synergies, streamlined operations |

| Duration | Often temporary or project-based | Permanent organizational change |

| Regulatory Complexity | Generally lower regulatory scrutiny | Higher due to full consolidation impact |

Understanding Strategic Alliances

Strategic alliances involve two or more companies collaborating while remaining independent organizations to achieve specific goals, such as entering new markets or sharing resources, without the complexities of full integration. These partnerships allow firms to leverage each other's strengths, reduce risks, and maintain flexibility compared to forward mergers, where one company fully absorbs another, resulting in a single legal entity. Understanding strategic alliances highlights their role in fostering cooperative growth and innovation without losing operational autonomy.

Defining Forward Mergers

Forward mergers involve the absorption of a target company into an acquiring company, resulting in a single surviving entity under the acquirer's name. This type of merger streamlines operations and consolidates resources, often enhancing market share and operational efficiency. Unlike strategic alliances, forward mergers create a unified corporate structure with full integration of assets and liabilities.

Key Differences Between Strategic Alliances and Forward Mergers

Strategic alliances involve two or more companies collaborating while remaining independent entities, focusing on shared objectives, resource exchange, and reduced market entry risk. Forward mergers entail one company acquiring or merging with a downstream business to enhance control over distribution, supply chain efficiency, and market access. Key differences include the level of integration, with strategic alliances maintaining autonomy and forward mergers resulting in complete organizational unification.

Strategic Alliance: Benefits and Drawbacks

Strategic alliances offer businesses the advantage of accessing new markets, sharing resources, and leveraging complementary strengths without the complexities of full integration. These partnerships reduce financial risk and increase operational flexibility while allowing companies to maintain their independence and culture. However, strategic alliances can face challenges such as conflicts of interest, misaligned goals, and less control over partner actions, potentially hindering long-term success.

Forward Merger: Advantages and Challenges

A forward merger involves one company absorbing another to create a single legal entity, streamlining operations and enhancing market share. Advantages include improved resource allocation, expanded customer base, and increased competitive advantage due to unified management and reduced redundancies. Challenges encompass integration difficulties such as cultural clashes, regulatory approval complexities, and potential loss of brand identity.

Factors to Consider Before Choosing a Strategy

Evaluating the compatibility of company goals and corporate cultures is crucial when deciding between a strategic alliance and a forward merger. Financial resources and risk tolerance play significant roles, as strategic alliances typically require less capital commitment and offer more flexibility compared to the full integration and higher investment needed in forward mergers. Market control and regulatory implications must also be assessed, with forward mergers potentially providing stronger market presence but involving complex legal approval processes.

Impact on Organizational Structure

Strategic alliances maintain independent organizational structures while fostering collaboration through shared resources, expertise, and joint decision-making frameworks. Forward mergers result in a unified organizational structure where the acquiring company absorbs the target's assets, personnel, and operational systems, streamlining management layers. The impact on organizational structure in strategic alliances emphasizes flexibility and coexistence, whereas forward mergers focus on integration and centralization.

Financial Implications of Both Approaches

Strategic alliances typically require lower upfront financial investment as companies share resources and risks without full integration, helping preserve liquidity and minimize debt. Forward mergers often involve significant capital outlay and potential assumption of liabilities, leading to increased financial burdens but offering stronger control over combined assets and operations. The financial implications of strategic alliances are characterized by flexibility and reduced exposure, whereas forward mergers present opportunities for economies of scale alongside heightened financial commitment.

Case Studies: Successful Strategic Alliances and Forward Mergers

Strategic alliances have been exemplified by the collaboration between Starbucks and PepsiCo, leveraging combined distribution networks to boost product reach without full integration, while forward mergers like Facebook's acquisition of Instagram demonstrate full consolidation to enhance market dominance and innovation capacity. Case studies reveal that strategic alliances often excel in flexibility and shared resources, whereas forward mergers provide unified control and streamlined operations, as seen in the Disney-Fox deal expanding content portfolio and market share. Evaluating these approaches highlights the importance of aligning strategic goals, with alliances favoring cooperative growth and forward mergers driving direct ownership and integration.

Making the Right Choice: Which Strategy Fits Your Business?

Choosing between a strategic alliance and a forward merger depends on your business goals, resource availability, and desired level of integration. A strategic alliance offers flexibility and shared resources without losing autonomy, ideal for testing market compatibility and leveraging complementary strengths. In contrast, a forward merger involves a deeper integration, combining two entities to streamline operations, enhance market presence, and achieve long-term growth through unified management and assets.

Strategic Alliance Infographic

libterm.com

libterm.com