Core competency refers to a company's unique strengths and capabilities that provide a competitive advantage in the marketplace. These skills or technologies enable organizations to deliver distinctive value to customers, setting them apart from competitors. Discover how identifying and leveraging your core competency can drive business success by exploring the rest of this article.

Table of Comparison

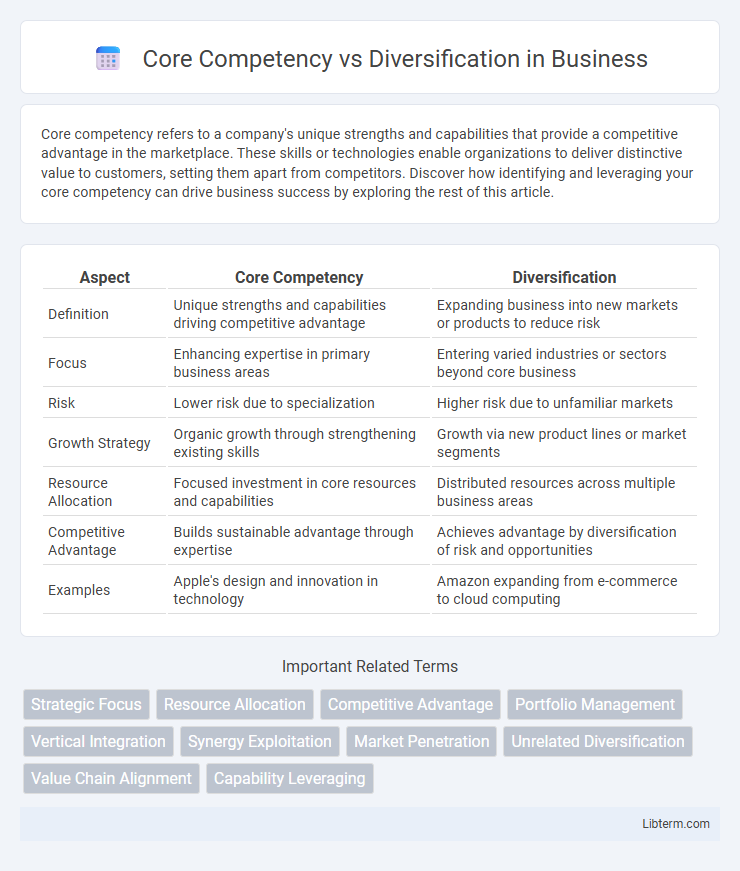

| Aspect | Core Competency | Diversification |

|---|---|---|

| Definition | Unique strengths and capabilities driving competitive advantage | Expanding business into new markets or products to reduce risk |

| Focus | Enhancing expertise in primary business areas | Entering varied industries or sectors beyond core business |

| Risk | Lower risk due to specialization | Higher risk due to unfamiliar markets |

| Growth Strategy | Organic growth through strengthening existing skills | Growth via new product lines or market segments |

| Resource Allocation | Focused investment in core resources and capabilities | Distributed resources across multiple business areas |

| Competitive Advantage | Builds sustainable advantage through expertise | Achieves advantage by diversification of risk and opportunities |

| Examples | Apple's design and innovation in technology | Amazon expanding from e-commerce to cloud computing |

Understanding Core Competency

Core competency refers to a company's unique strengths and capabilities that provide competitive advantage and value creation, often rooted in specialized knowledge, technology, or processes. Understanding core competency allows firms to focus on areas where they excel, optimizing resources and enhancing innovation, leading to sustainable growth. In contrast, diversification involves expanding into new markets or products, which may dilute core strengths if not aligned with these core competencies.

Defining Diversification

Diversification is a strategic approach where a company expands its operations into new markets or product lines distinct from its core business, aiming to reduce risks and capitalize on new opportunities. It involves entering industries or sectors that differ from the existing capabilities and resources of the firm, contrasting with core competency strategy, which emphasizes strengthening existing skills and expertise. Effective diversification can enhance resilience against market fluctuations by broadening revenue streams beyond primary competencies.

Key Differences Between Core Competency and Diversification

Core competency refers to a company's unique strengths and capabilities that provide competitive advantage in its primary market, while diversification involves expanding into new markets or products to spread risk and pursue growth opportunities. Core competencies are centered on skills, technologies, and processes that create value and differentiation, whereas diversification focuses on broadening business scope beyond existing core areas. The key difference lies in core competency emphasizing specialization and mastery, whereas diversification emphasizes expansion and risk management.

Strategic Importance of Core Competency

Core competency represents a company's unique strengths and capabilities that provide a competitive advantage in the marketplace, driving innovation and customer value. It is strategically important because it enables firms to allocate resources effectively, differentiate their products or services, and build barriers to entry against competitors. Unlike diversification, which spreads risk across different markets or industries, focusing on core competency ensures sustained growth by deepening expertise in areas critical to long-term success.

Benefits of Diversification Strategies

Diversification strategies enhance business resilience by spreading risks across various industries or markets, reducing dependency on a single revenue source. They provide opportunities for sustainable growth by tapping into new customer bases and capitalizing on emerging trends. This approach also facilitates innovation and resource utilization, enabling companies to leverage their existing capabilities in new ways.

Risks Associated with Over-Diversification

Over-diversification can dilute a company's core competencies, leading to inefficiencies and increased operational complexity that undermine competitive advantage. It introduces risks such as resource misallocation, reduced focus, and management challenges that may result in lower profitability and brand confusion. Companies must evaluate the trade-off between expansion and maintaining strategic focus to avoid value destruction associated with over-diversification.

Case Studies: Success Through Core Competency

Case studies of companies like Apple and Toyota illustrate the success achieved by focusing on core competencies such as innovative product design and efficient manufacturing processes. Apple's mastery in user-centric technology and seamless ecosystem integration has driven sustained growth and market leadership. Toyota's expertise in lean production and quality management exemplifies how concentrating on core strengths enhances competitive advantage and operational excellence.

When to Pursue Diversification

Diversification becomes strategic when a company's core competencies face market saturation, declining growth, or increased competition, necessitating new avenues for revenue. Firms often pursue diversification to exploit synergies, enter high-growth industries, or mitigate risks associated with dependence on a single market. Evaluating resource capabilities and market opportunities ensures diversification aligns with long-term corporate objectives and shareholder value creation.

Balancing Core Competency and Diversification

Balancing core competency and diversification involves leveraging a company's key strengths while exploring new markets to mitigate risks and drive sustainable growth. Effective strategies integrate core capabilities with carefully selected diversification efforts that complement existing expertise, maximizing resource efficiency and competitive advantage. Firms that maintain focus on their core competencies while diversifying strategically achieve long-term resilience and enhanced value creation.

Future Trends in Business Strategy

Core competency remains a critical driver in future business strategies by enabling companies to leverage unique strengths for sustained competitive advantage. Diversification will increasingly be guided by data analytics and AI to identify synergies and mitigate risks in dynamic markets. Businesses adopting hybrid models that balance core focus with strategic diversification are positioned to thrive amid technological disruption and evolving consumer demands.

Core Competency Infographic

libterm.com

libterm.com