Deferred Net Settlement (DNS) is a financial process where transactions between parties are accumulated over a specific period and settled collectively at a predetermined time, reducing the number of individual payments and associated costs. This system enhances liquidity management and minimizes settlement risk by consolidating multiple obligations into a single net payment. Explore the rest of the article to discover how DNS can optimize Your transaction efficiency and risk control.

Table of Comparison

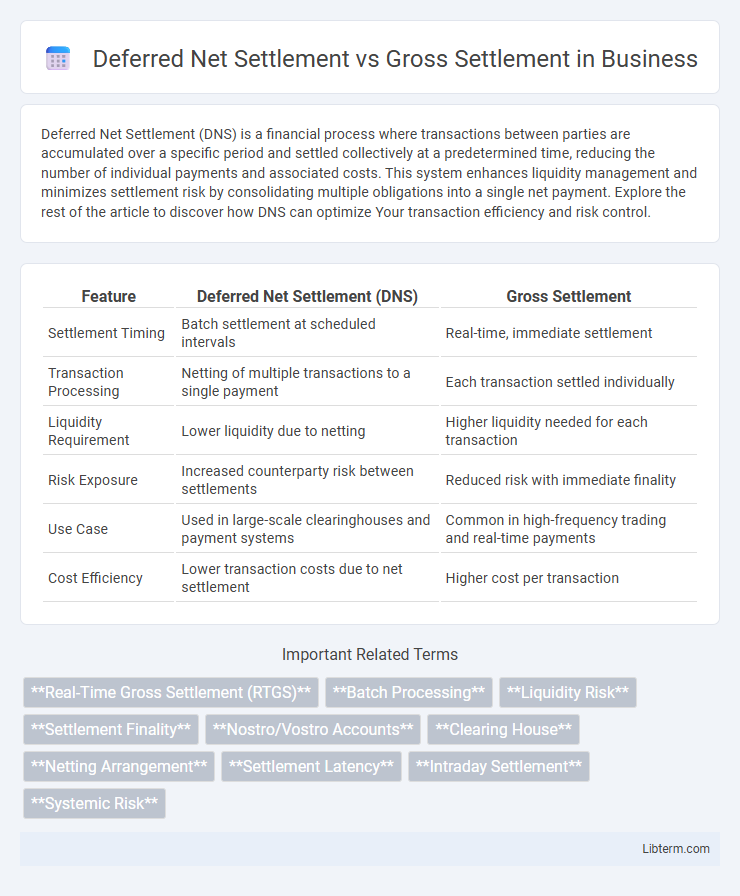

| Feature | Deferred Net Settlement (DNS) | Gross Settlement |

|---|---|---|

| Settlement Timing | Batch settlement at scheduled intervals | Real-time, immediate settlement |

| Transaction Processing | Netting of multiple transactions to a single payment | Each transaction settled individually |

| Liquidity Requirement | Lower liquidity due to netting | Higher liquidity needed for each transaction |

| Risk Exposure | Increased counterparty risk between settlements | Reduced risk with immediate finality |

| Use Case | Used in large-scale clearinghouses and payment systems | Common in high-frequency trading and real-time payments |

| Cost Efficiency | Lower transaction costs due to net settlement | Higher cost per transaction |

Introduction to Payment Settlement Systems

Payment settlement systems involve the process of transferring funds between parties, primarily using deferred net settlement (DNS) or gross settlement methods. Deferred net settlement aggregates multiple transactions over a set period and settles the net amount at once, optimizing liquidity and reducing settlement risk. Gross settlement processes each transaction individually and immediately, offering finality and minimizing credit risk but requiring higher liquidity.

What is Deferred Net Settlement (DNS)?

Deferred Net Settlement (DNS) is a payment system where transactions between financial institutions are accumulated and settled collectively at specific intervals, reducing the number of individual payments processed. It enhances liquidity management by netting the obligations of participants, lowering settlement risk and operational costs compared to Gross Settlement systems. DNS is commonly used in retail payment systems and interbank transfers to optimize efficiency and minimize the need for immediate fund transfers.

What is Gross Settlement?

Gross settlement refers to the process where individual payment instructions are settled one by one without netting them against other transactions, ensuring immediate and final transfer of funds. This method provides higher settlement certainty and reduces credit risk since each transaction is settled separately in real time. Gross settlement is commonly used in real-time gross settlement systems (RTGS), which support high-value or time-critical payments.

Key Differences Between DNS and Gross Settlement

Deferred Net Settlement (DNS) consolidates multiple transactions between parties into a single net payment, reducing the number and value of funds transferred, while Gross Settlement processes each transaction individually on a real-time basis, ensuring immediate and final transfer of funds. DNS offers operational efficiency and lower liquidity requirements but introduces settlement risk due to delayed netting, whereas Gross Settlement eliminates settlement risk by settling in real time, supporting high-value and time-critical payments like those in Real-Time Gross Settlement (RTGS) systems. The choice between DNS and Gross Settlement depends on factors such as transaction volume, risk tolerance, liquidity availability, and the need for immediacy in payment finality.

Process Flow of Deferred Net Settlement

Deferred Net Settlement processes transactions by aggregating multiple individual payments between parties over a defined period and calculating net obligations. This approach reduces the total number of transactions by offsetting credits and debits, resulting in a single net payment per participant. The net settlement occurs at a scheduled time, minimizing liquidity requirements and enhancing operational efficiency compared to Gross Settlement, where each transaction is settled individually and immediately.

Process Flow of Gross Settlement

Gross settlement processes involve the individual and immediate transfer of securities or funds between parties on a transaction-by-transaction basis. Each payment or transfer is settled in real-time or within a very short timeframe, minimizing counterparty risk and enhancing liquidity management. This method contrasts with deferred net settlement, where multiple transactions are aggregated and settled at scheduled intervals.

Advantages of Deferred Net Settlement

Deferred Net Settlement (DNS) reduces the volume of transactions by consolidating multiple payments into a single net amount, significantly lowering operational costs and settlement risks compared to Gross Settlement. By allowing netting of transactions, DNS improves liquidity management for financial institutions, as only the net positions are settled rather than full transaction values. The system enhances efficiency in payment networks, minimizes systemic risk, and supports smoother cash flow forecasting across banks and clearinghouses.

Advantages of Gross Settlement

Gross settlement offers immediate finality by processing each transaction individually, significantly reducing credit risk and enhancing liquidity management for financial institutions. It ensures higher transparency and reduces systemic risk by eliminating the accumulation of unsettled payments, which is critical in fast-paced payment environments. This real-time processing framework supports faster clearance times and aligns with regulatory requirements promoting secure and efficient payment infrastructures.

Risks and Security Implications

Deferred Net Settlement (DNS) reduces transaction volume by aggregating payments, exposing participants to credit risk and settlement delays if a party defaults, impacting liquidity and creating systemic risk. In contrast, Gross Settlement processes each payment individually and immediately, minimizing credit risk and ensuring finality, but requiring higher liquidity and operational capacity. Security implications favor Gross Settlement for critical transactions due to real-time settlement finality, while DNS demands robust risk management frameworks to mitigate settlement exposure.

Choosing the Right Settlement Method

Choosing the right settlement method hinges on factors such as transaction volume, risk tolerance, and liquidity requirements, where Deferred Net Settlement (DNS) minimizes credit risk by consolidating payments into net obligations, reducing settlement amounts and operational costs. Gross Settlement processes transactions individually in real-time, offering higher security and reduced settlement risk at the expense of increased liquidity demands and operational complexity. Financial institutions must balance the efficiency and risk management benefits of DNS against the immediacy and finality of Gross Settlement to optimize payment system performance.

Deferred Net Settlement Infographic

libterm.com

libterm.com