A Merchant Cash Advance (MCA) provides businesses with quick access to funds based on future credit card sales or receivables. This financing option suits businesses needing fast capital without traditional loan requirements or fixed monthly payments. Discover how a Merchant Cash Advance can support your business growth by reading the rest of the article.

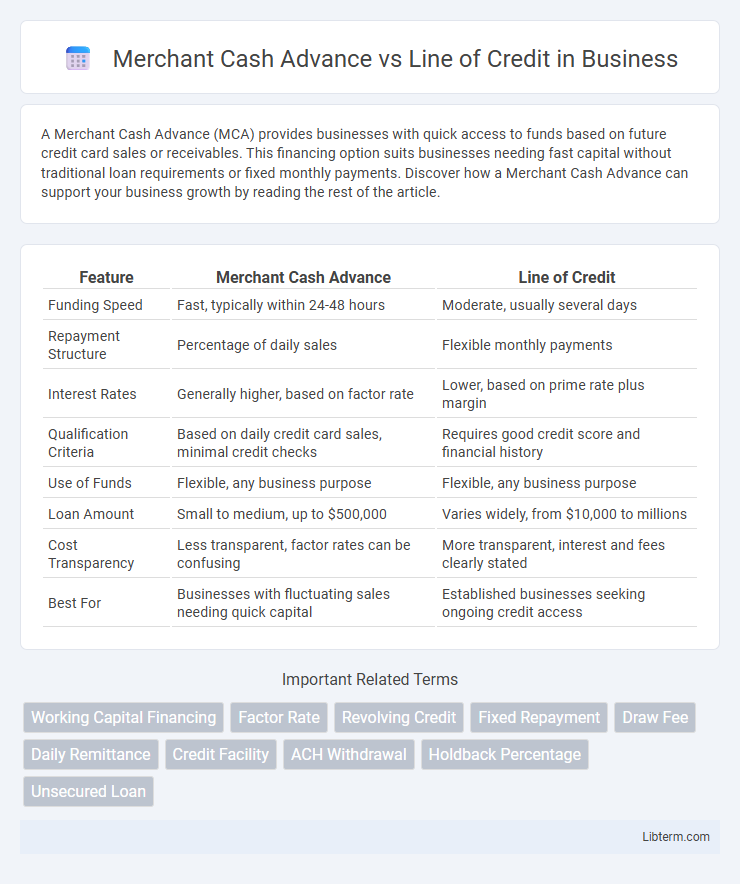

Table of Comparison

| Feature | Merchant Cash Advance | Line of Credit |

|---|---|---|

| Funding Speed | Fast, typically within 24-48 hours | Moderate, usually several days |

| Repayment Structure | Percentage of daily sales | Flexible monthly payments |

| Interest Rates | Generally higher, based on factor rate | Lower, based on prime rate plus margin |

| Qualification Criteria | Based on daily credit card sales, minimal credit checks | Requires good credit score and financial history |

| Use of Funds | Flexible, any business purpose | Flexible, any business purpose |

| Loan Amount | Small to medium, up to $500,000 | Varies widely, from $10,000 to millions |

| Cost Transparency | Less transparent, factor rates can be confusing | More transparent, interest and fees clearly stated |

| Best For | Businesses with fluctuating sales needing quick capital | Established businesses seeking ongoing credit access |

Introduction: Understanding Financing Options

Merchant cash advance provides businesses with a lump sum based on future credit card sales, offering quick access to funds but typically at higher costs. A line of credit delivers flexible borrowing up to a set limit with interest charged only on the amount used, supporting ongoing cash flow management. Choosing between these financing options depends on evaluating cost structures, repayment terms, and the specific cash flow needs of the business.

What is a Merchant Cash Advance?

A Merchant Cash Advance (MCA) is a financing option where a business receives a lump sum payment in exchange for a percentage of future credit card sales or daily bank deposits. Unlike traditional loans, MCAs do not have fixed monthly payments; repayment fluctuates based on business revenue, providing flexibility during slow periods. This funding method is ideal for businesses needing quick capital without collateral or extensive credit checks.

What is a Line of Credit?

A line of credit is a flexible financing option that allows businesses to borrow funds up to a predetermined limit, repaying and re-borrowing as needed. It provides ongoing access to capital, with interest charged only on the amount used, making it ideal for managing cash flow fluctuations. Unlike a merchant cash advance, which involves fixed repayments based on sales, a line of credit offers more control over borrowing and repayment schedules.

Key Differences Between Merchant Cash Advance and Line of Credit

Merchant cash advances provide businesses with a lump sum upfront in exchange for a percentage of future credit card sales, offering fast access to funds but often higher costs and flexible repayment based on sales volume. Lines of credit allow businesses to borrow up to a predetermined limit with interest charged only on the amount used, providing revolving access to capital with generally lower rates and fixed repayment terms. Key differences include repayment structure, cost, and eligibility, where merchant cash advances rely on sales performance without fixed monthly payments, while lines of credit require regular payments and typically have stricter credit requirements.

Eligibility Requirements

Merchant Cash Advance eligibility primarily depends on the business's daily credit card sales and a minimum time in operation, typically around six months to a year. Line of Credit requirements emphasize strong personal and business credit scores, financial statements, and sometimes collateral, with lenders often requiring a time in business of at least one to two years. Both financing options assess cash flow but differ in credit score thresholds, with merchant cash advances being more accessible to lower-credit businesses.

Application and Approval Process

Merchant Cash Advances typically feature a faster application and approval process, requiring minimal documentation and relying primarily on daily credit card sales or receivables for qualification. In contrast, Lines of Credit often demand more comprehensive financial documentation, such as tax returns and credit reports, leading to longer approval times but offering greater flexibility in fund usage. Both financing options cater to different business needs, with MCA providing quick access to capital, while Lines of Credit support ongoing liquidity management.

Costs and Repayment Structures

Merchant Cash Advances (MCAs) typically involve higher costs with factor rates ranging from 1.1 to 1.5, resulting in effective APRs that can exceed 70%, and repayment is based on a fixed percentage of daily sales, creating variable payment amounts. Lines of credit generally offer lower interest rates, often between 7% and 25%, with flexible monthly repayments based on the amount borrowed, allowing businesses to control their cash flow more effectively. The variable daily payments of MCAs can strain cash flow during slower sales periods, whereas lines of credit provide consistent, predictable repayment schedules tied to the drawn balance.

Pros and Cons of Merchant Cash Advance

Merchant Cash Advance (MCA) offers quick access to funds based on future credit card sales, making it ideal for businesses with fluctuating revenue. The pros include fast approval, flexible repayment tied to daily sales, and minimal qualification requirements, while the cons involve higher effective interest rates and potential strain on cash flow due to daily deductions. Unlike a Line of Credit, MCAs lack long-term funding benefits and can be more expensive, limiting their suitability for sustained business financing.

Pros and Cons of Line of Credit

A line of credit offers flexible access to funds with interest charged only on the amount used, making it ideal for managing cash flow and short-term expenses. However, it often requires good credit scores and may involve variable interest rates, which can increase borrowing costs unpredictably. Unlike merchant cash advances, lines of credit provide a revolving borrowing option without fixed daily repayments, offering more control over repayment schedules.

Choosing the Right Financing Solution for Your Business

Merchant Cash Advance provides quick access to funds with repayments tied to daily sales, ideal for businesses with fluctuating revenue. A Line of Credit offers flexible borrowing with interest charged only on the drawn amount, suited for managing cash flow and unexpected expenses. Evaluating your business's cash flow stability, repayment preferences, and funding urgency helps determine the optimal financing option.

Merchant Cash Advance Infographic

libterm.com

libterm.com