Merger processes combine two or more companies to form a single entity, aiming to enhance market share, reduce costs, and increase operational efficiency. Understanding the strategic, financial, and legal aspects of mergers is essential for successful integration and value creation. Explore the rest of the article to discover how a well-executed merger can transform your business landscape.

Table of Comparison

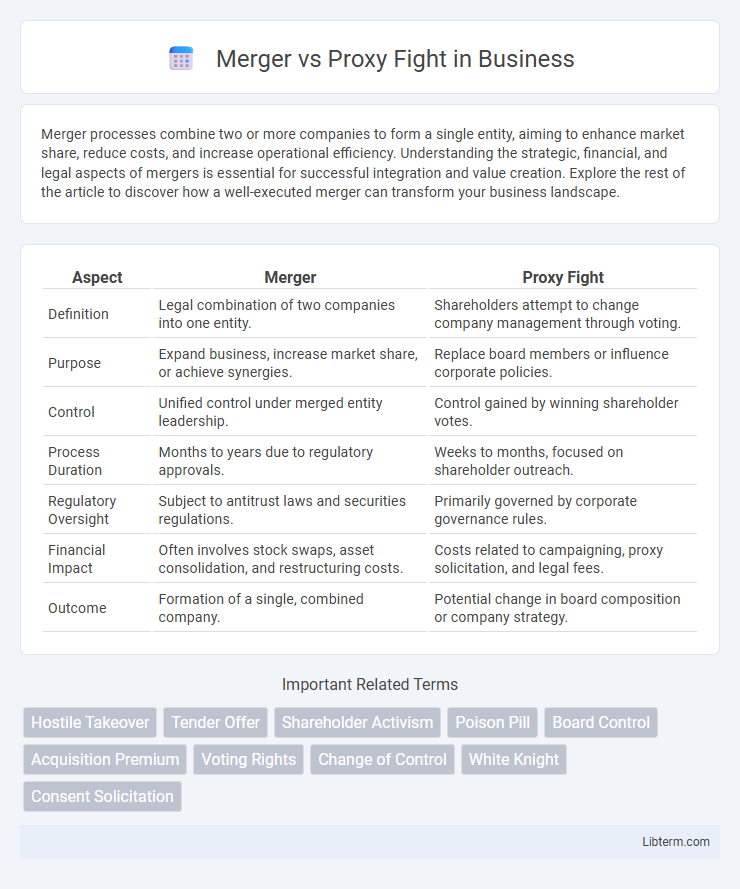

| Aspect | Merger | Proxy Fight |

|---|---|---|

| Definition | Legal combination of two companies into one entity. | Shareholders attempt to change company management through voting. |

| Purpose | Expand business, increase market share, or achieve synergies. | Replace board members or influence corporate policies. |

| Control | Unified control under merged entity leadership. | Control gained by winning shareholder votes. |

| Process Duration | Months to years due to regulatory approvals. | Weeks to months, focused on shareholder outreach. |

| Regulatory Oversight | Subject to antitrust laws and securities regulations. | Primarily governed by corporate governance rules. |

| Financial Impact | Often involves stock swaps, asset consolidation, and restructuring costs. | Costs related to campaigning, proxy solicitation, and legal fees. |

| Outcome | Formation of a single, combined company. | Potential change in board composition or company strategy. |

Introduction to Mergers and Proxy Fights

Mergers involve the combination of two or more companies into a single entity to achieve strategic growth, efficiency, or market expansion, often requiring shareholder approval. Proxy fights occur when shareholders seek control over a company by persuading other stakeholders to vote for their proposed board members during elections, typically to challenge existing management decisions. Both mechanisms reflect different approaches to corporate control and governance, heavily influencing shareholder value and company direction.

Defining Mergers: Key Concepts and Types

Mergers involve the combination of two or more companies to form a single entity, aiming to achieve synergies and increase market share. Key types of mergers include horizontal mergers, where companies in the same industry combine; vertical mergers, involving firms at different stages of production; and conglomerate mergers, which unite unrelated businesses to diversify operations. Understanding these types is essential for grasping how mergers reshape corporate strategies and industry dynamics.

What is a Proxy Fight? An Overview

A proxy fight is a corporate battle where opposing factions compete to gain control over a company's board of directors by persuading shareholders to vote for their proposed slate. Shareholders are solicited to grant proxy votes to influence key decisions without attending the annual meeting personally. This strategic maneuver is commonly used during hostile takeover attempts or significant internal disputes to sway governance outcomes.

Motivations Behind Mergers and Proxy Fights

Mergers are primarily motivated by strategic goals such as market expansion, cost synergies, and enhanced competitive positioning, aiming to create long-term shareholder value. Proxy fights arise when dissident shareholders challenge management decisions, often driven by dissatisfaction with company performance or strategic direction. Both mechanisms reflect attempts to influence control and maximize financial returns, but mergers typically pursue cooperative growth while proxy fights embody confrontational governance disputes.

Legal and Regulatory Framework

Mergers are governed by comprehensive legal frameworks such as the Hart-Scott-Rodino Antitrust Improvements Act, requiring pre-merger notifications and regulatory approval to prevent monopolistic practices. Proxy fights, primarily regulated under the Securities Exchange Act of 1934, involve shareholders contesting board control through proxy solicitations subject to SEC disclosure rules to ensure transparency and protect shareholder rights. Both mechanisms must navigate complex compliance requirements from federal entities like the FTC, SEC, and occasionally state regulators to mitigate risks of fraud, market manipulation, and antitrust violations.

Advantages and Disadvantages: Mergers vs Proxy Fights

Mergers offer advantages such as streamlined operations, increased market share, and potential cost synergies but can lead to complexity in integration and cultural clashes. Proxy fights enable shareholders to contest management decisions and influence corporate governance without full acquisitions, though they often consume significant resources and can create shareholder divisions. Mergers provide long-term strategic alignment while proxy fights serve as tactical tools for immediate shareholder activism.

Impact on Shareholders and Corporate Governance

Mergers often enhance shareholder value by combining resources and streamlining operations, leading to potential stock price appreciation and improved corporate governance through unified management. Proxy fights involve shareholders actively challenging current management, which can lead to significant changes in board composition and strategic direction, directly empowering shareholders but sometimes causing short-term instability. Both mechanisms impact corporate governance differently; mergers tend to centralize control while proxy fights increase shareholder influence and accountability.

Case Studies: Notable Mergers and Proxy Battles

Case studies like the 2015 Dell-EMC merger highlight strategic consolidation to enhance market competitiveness, whereas proxy fights such as the 2018 Icahn vs. Herbalife battle illustrate shareholder activism influencing corporate governance. The Verizon-Yahoo merger in 2017 exemplifies high-profile mergers shaping the telecommunications and tech industries. Proxy contests like the 2013 Netflix shareholder dispute emphasize the power of investors challenging executive decisions to drive company value.

How to Navigate a Merger or Proxy Fight

Navigating a merger requires meticulous due diligence, clear communication with stakeholders, and alignment on strategic goals to ensure a smooth integration of operations and cultures. In a proxy fight, securing shareholder support through persuasive messaging, effective proxy solicitation, and legal compliance is critical to influencing the outcome. Both scenarios demand robust legal counsel and strategic planning to manage risks and achieve desired corporate objectives.

Future Trends in Corporate Control Strategies

Future trends in corporate control strategies indicate a shift towards more sophisticated proxy fights driven by increased shareholder activism and digital voting platforms. Mergers remain a critical mechanism for growth but face higher scrutiny from regulators focusing on antitrust and market competition. Technology-enabled transparency and real-time shareholder engagement are expected to redefine the dynamics of both mergers and proxy battles, influencing control outcomes.

Merger Infographic

libterm.com

libterm.com