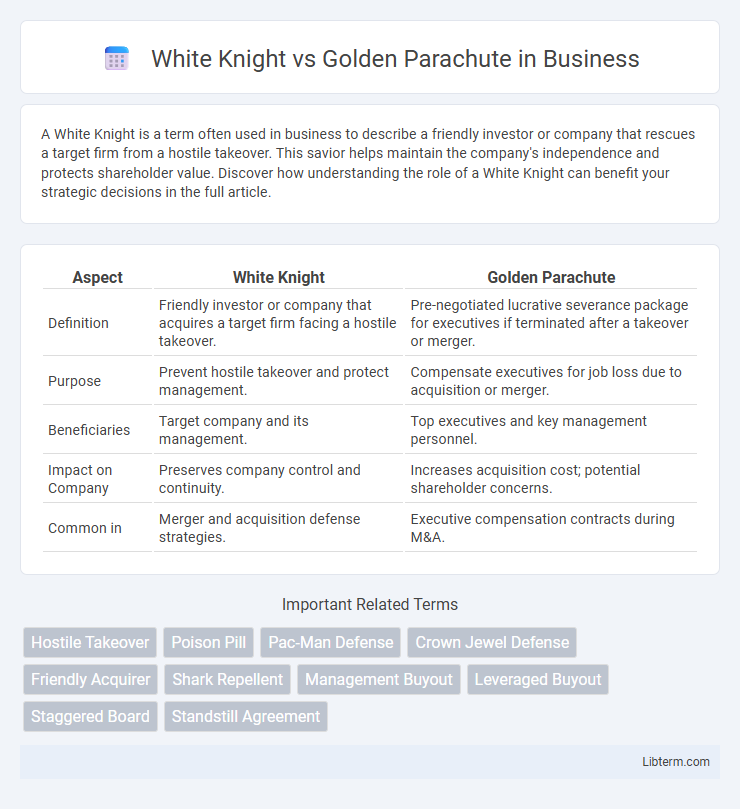

A White Knight is a term often used in business to describe a friendly investor or company that rescues a target firm from a hostile takeover. This savior helps maintain the company's independence and protects shareholder value. Discover how understanding the role of a White Knight can benefit your strategic decisions in the full article.

Table of Comparison

| Aspect | White Knight | Golden Parachute |

|---|---|---|

| Definition | Friendly investor or company that acquires a target firm facing a hostile takeover. | Pre-negotiated lucrative severance package for executives if terminated after a takeover or merger. |

| Purpose | Prevent hostile takeover and protect management. | Compensate executives for job loss due to acquisition or merger. |

| Beneficiaries | Target company and its management. | Top executives and key management personnel. |

| Impact on Company | Preserves company control and continuity. | Increases acquisition cost; potential shareholder concerns. |

| Common in | Merger and acquisition defense strategies. | Executive compensation contracts during M&A. |

Understanding the White Knight Strategy

The White Knight strategy involves a friendly company stepping in to acquire a target firm to prevent a hostile takeover, preserving the existing management's vision and stakeholder interests. This approach contrasts with the Golden Parachute, a defensive mechanism offering lucrative benefits to executives if they are ousted after a takeover. White Knight transactions often result in more favorable terms for shareholders and employees compared to hostile takeovers or reliance on Golden Parachute provisions.

Defining the Golden Parachute Concept

A Golden Parachute refers to a financial agreement that provides lucrative severance packages to top executives in the event of a company takeover or merger. These agreements typically include substantial cash bonuses, stock options, and other benefits designed to protect leadership during corporate transitions. The concept aims to ease executive anxiety over job security while often drawing criticism for incentivizing costly management decisions.

Key Differences Between White Knight and Golden Parachute

A White Knight is an investor or company that rescues a target firm from a hostile takeover by purchasing a controlling stake, whereas a Golden Parachute is a financial agreement guaranteeing lucrative benefits to top executives if they lose their jobs due to a merger or acquisition. The key difference lies in their purpose: White Knights aim to protect the target company and its shareholders, while Golden Parachutes primarily safeguard executives' financial interests during corporate upheavals. White Knight transactions often involve active ownership changes, whereas Golden Parachutes are pre-arranged contractual provisions triggered by takeover events.

How White Knight Defenses Work in M&A

White Knight defenses in M&A involve a friendly third-party company stepping in to acquire a target firm facing a hostile takeover, thereby preventing an undesirable acquirer from gaining control. This strategy enables the target company to negotiate more favorable terms and maintain better management stability compared to a hostile bidder. White Knights often offer higher purchase prices or more attractive deals, effectively preserving shareholder value and deterring aggressive takeover attempts.

The Role of Golden Parachutes in Executive Protection

Golden parachutes serve as contractual agreements that provide executives with substantial financial compensation and benefits if their employment is terminated following a merger or acquisition. These provisions act as a safety net, discouraging hostile takeovers by increasing the cost for acquiring companies and making the prospect less attractive. While white knights intervene by offering more favorable acquisition terms to defend a target company, golden parachutes primarily focus on protecting executives' interests during corporate control changes.

Pros and Cons of the White Knight Approach

The White Knight approach involves a friendly third party acquiring a struggling company to prevent a hostile takeover, offering advantages such as preserving existing management, maintaining company culture, and potentially securing better terms for shareholders. However, drawbacks include the risk of overpaying by the White Knight, potential conflicts with original management, and the possibility that the rescue may not address underlying financial or operational issues. This strategy often provides a more cooperative alternative to hostile bids but requires careful evaluation of the White Knight's long-term strategic fit and financial stability.

Advantages and Disadvantages of Golden Parachutes

Golden parachutes provide key advantages such as financial security for executives during mergers or acquisitions, attracting top talent by offering lucrative exit packages, and reducing resistance to hostile takeovers by easing leadership transitions. However, disadvantages include potential misalignment of executive incentives, as generous payouts may encourage risky behavior, increased costs to the company that can affect shareholder value, and negative public perception that may harm corporate reputation. Balancing these factors is crucial for companies weighing golden parachute agreements against defensive strategies like white knight interventions.

Impact on Shareholder Value: White Knight vs Golden Parachute

White Knight interventions often enhance shareholder value by providing a financially stable acquirer that preserves company operations and market confidence during hostile takeovers. Golden Parachute agreements can have a mixed impact; while they protect executives and assure managerial stability, excessive payouts may trigger shareholder dissatisfaction and perceived misalignment of interests. Empirical studies show that White Knights tend to lead to more positive shareholder returns compared to the often controversial financial safeguards embedded in Golden Parachutes.

Famous Examples of White Knight Interventions

White Knight interventions have famously occurred in cases like Disney's rescue of Pixar in 2006, where Disney emerged as a friendly investor to counter hostile acquisition attempts, preserving Pixar's creative independence. Another notable example is when Microsoft acted as a White Knight for Yahoo! in 2008, proposing a friendly acquisition bid to fend off hostile suitors. These interventions highlight how strategic alliances through White Knights can protect companies from hostile takeovers and ensure mutually beneficial outcomes.

Legal and Ethical Considerations in Using These Strategies

White Knight and Golden Parachute strategies both raise significant legal considerations, including compliance with securities laws and fiduciary duties to shareholders during mergers and acquisitions. Ethically, deploying a White Knight involves weighing the protection of company stakeholders against the potential disruption to existing management, while Golden Parachutes may provoke shareholder concerns over executive compensation and potential moral hazard. Ensuring transparency, fairness, and alignment with shareholder interests is critical to balancing legal obligations and ethical responsibilities in these takeover defense tactics.

White Knight Infographic

libterm.com

libterm.com