A grace period offers you extra time to meet financial obligations without penalties, easing the stress of immediate payments. This temporary extension is commonly applied to credit cards, loans, and insurance premiums, helping maintain your good standing. Explore the article to understand how a grace period can benefit your financial management.

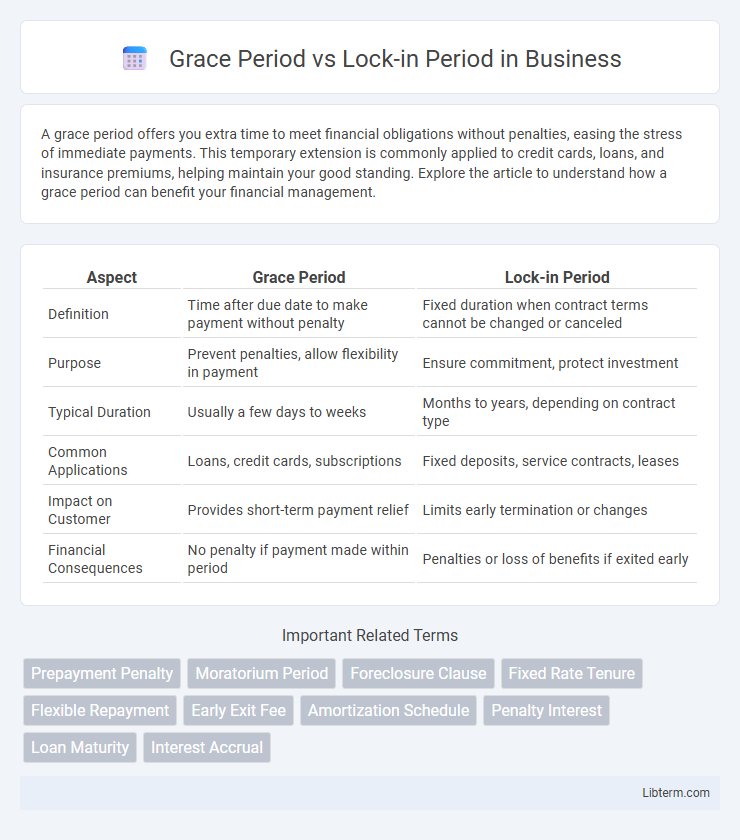

Table of Comparison

| Aspect | Grace Period | Lock-in Period |

|---|---|---|

| Definition | Time after due date to make payment without penalty | Fixed duration when contract terms cannot be changed or canceled |

| Purpose | Prevent penalties, allow flexibility in payment | Ensure commitment, protect investment |

| Typical Duration | Usually a few days to weeks | Months to years, depending on contract type |

| Common Applications | Loans, credit cards, subscriptions | Fixed deposits, service contracts, leases |

| Impact on Customer | Provides short-term payment relief | Limits early termination or changes |

| Financial Consequences | No penalty if payment made within period | Penalties or loss of benefits if exited early |

Introduction to Grace Period and Lock-in Period

Grace period refers to the time frame after a missed loan repayment during which no penalties or additional interest are charged, allowing borrowers to make payments without affecting their credit score. Lock-in period is the duration in a financial product or investment during which withdrawals or repayments are restricted, ensuring stability and commitment to the investment terms. Understanding these periods helps manage loan repayments and investment strategies effectively.

Definition of Grace Period

The grace period refers to a specified time after the due date during which a borrower can make a payment without incurring a penalty or late fee. It provides temporary relief, allowing for flexibility in loan repayments or credit card bills before additional charges apply. This period is distinct from the lock-in period, which restricts withdrawals or payments for a fixed duration.

Definition of Lock-in Period

The lock-in period is a fixed duration during which an investor cannot redeem or sell their investment, designed to encourage long-term commitment and stability in financial products like mutual funds or fixed deposits. This period ensures that investors stay invested to potentially benefit from market growth or interest accrual without premature withdrawals. Unlike the grace period, which offers extra time for payment without penalties, the lock-in period strictly restricts exit to maintain investment discipline.

Key Differences Between Grace Period and Lock-in Period

The grace period in insurance or loans refers to the time after a payment due date during which a policyholder or borrower can make a payment without penalty, whereas the lock-in period is a fixed timeframe during which an investor cannot withdraw or redeem their investment without facing penalties. Grace periods typically apply to recurring payments like premiums or EMIs, providing flexibility and preventing immediate default, while lock-in periods are common in fixed deposits, mutual funds, or retirement plans to ensure investment stability. Understanding these key differences helps in managing financial commitments and investment liquidity effectively.

Importance of Understanding These Financial Terms

Understanding the distinctions between grace period and lock-in period is crucial for effective financial planning and loan management. The grace period allows borrowers temporary relief from payments without penalties, aiding cash flow management, while the lock-in period restricts prepayment or loan closure to prevent penalties, impacting long-term cost savings. Clear knowledge of these terms helps borrowers avoid unexpected charges and optimize loan repayment strategies.

How Grace Periods Work in Loans and Credit

Grace periods in loans and credit refer to the timeframe after a payment due date during which borrowers can make payments without incurring late fees or penalties. This period typically lasts from 10 to 30 days depending on the lender's policies and the type of credit, allowing borrowers flexibility to manage cash flow without damaging their credit score. Unlike lock-in periods, which restrict loan prepayment or refinancing, grace periods provide a temporary relief window without affecting the loan terms.

Implications of Lock-in Periods for Investors

Lock-in periods restrict investors from selling or redeeming their investments within a specified timeframe, impacting liquidity and flexibility in portfolio management. These periods often apply to mutual funds, fixed deposits, and employee stock options, ensuring commitment to long-term growth but limiting access to funds in emergencies. Investors must weigh the trade-off between potential higher returns and reduced short-term financial accessibility when considering products with lock-in periods.

Pros and Cons of Grace Periods

Grace periods allow borrowers extra time to make payments without penalties, providing financial flexibility during unexpected hardships or income fluctuations. However, relying on grace periods can lead to increased overall interest costs and potential disruptions in credit building. While grace periods ease short-term financial strain, careful management is essential to avoid long-term debt consequences.

Pros and Cons of Lock-in Periods

Lock-in periods offer the advantage of disciplined investing by restricting withdrawals, which helps in long-term wealth accumulation and reduces the temptation to prematurely liquidate assets, thereby potentially increasing returns. However, the downside includes reduced liquidity and flexibility, as investors cannot access their funds during this period, which can be problematic during financial emergencies or unexpected expenses. Lock-in periods may also limit the ability to capitalize on other investment opportunities, thereby posing a risk of opportunity cost.

Choosing the Right Option: Grace Period vs Lock-in Period

Choosing the right option between a grace period and a lock-in period depends on your financial goals and investment flexibility. A grace period allows temporary relief from loan payments without penalty, ideal for managing short-term cash flow issues, while a lock-in period restricts withdrawals to ensure long-term commitment and often better returns. Evaluate your need for liquidity against potential gains to decide whether the flexibility of a grace period or the disciplined savings approach of a lock-in period suits your financial strategy.

Grace Period Infographic

libterm.com

libterm.com