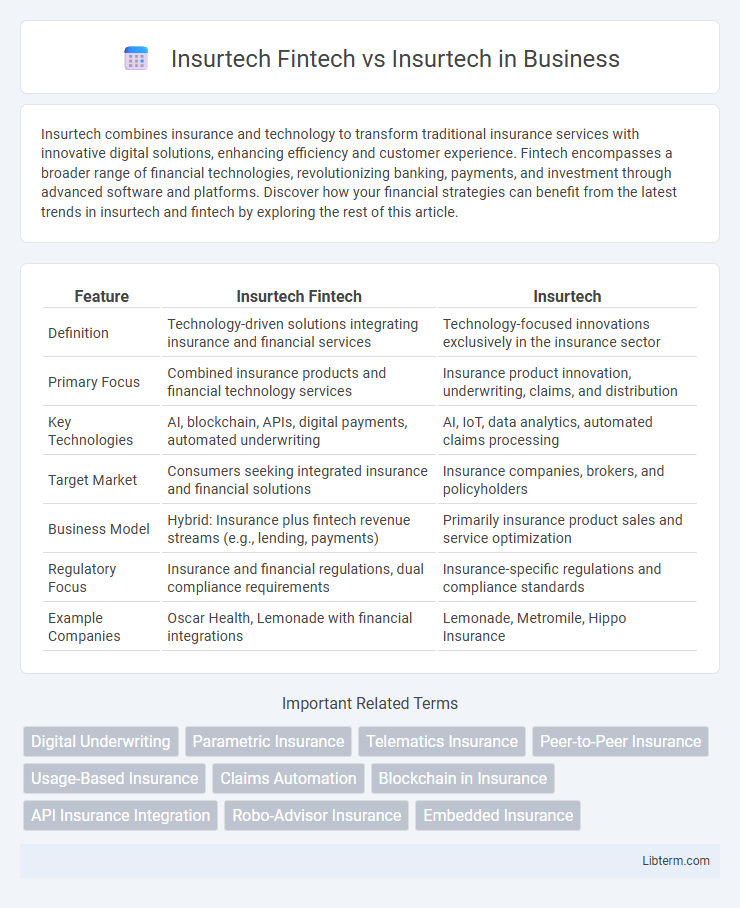

Insurtech combines insurance and technology to transform traditional insurance services with innovative digital solutions, enhancing efficiency and customer experience. Fintech encompasses a broader range of financial technologies, revolutionizing banking, payments, and investment through advanced software and platforms. Discover how your financial strategies can benefit from the latest trends in insurtech and fintech by exploring the rest of this article.

Table of Comparison

| Feature | Insurtech Fintech | Insurtech |

|---|---|---|

| Definition | Technology-driven solutions integrating insurance and financial services | Technology-focused innovations exclusively in the insurance sector |

| Primary Focus | Combined insurance products and financial technology services | Insurance product innovation, underwriting, claims, and distribution |

| Key Technologies | AI, blockchain, APIs, digital payments, automated underwriting | AI, IoT, data analytics, automated claims processing |

| Target Market | Consumers seeking integrated insurance and financial solutions | Insurance companies, brokers, and policyholders |

| Business Model | Hybrid: Insurance plus fintech revenue streams (e.g., lending, payments) | Primarily insurance product sales and service optimization |

| Regulatory Focus | Insurance and financial regulations, dual compliance requirements | Insurance-specific regulations and compliance standards |

| Example Companies | Oscar Health, Lemonade with financial integrations | Lemonade, Metromile, Hippo Insurance |

Introduction to Insurtech and Fintech

Insurtech and fintech both leverage advanced technology to disrupt traditional financial services, with insurtech specifically targeting the insurance industry by optimizing underwriting, claims processing, and policy management through AI, blockchain, and IoT applications. Fintech encompasses a broader spectrum, including digital banking, online lending, payments, and investment platforms, driving financial inclusion and efficiency with innovations like mobile wallets, robo-advisors, and peer-to-peer lending. The convergence of insurtech within fintech highlights the increasing use of data analytics and automation to create personalized, seamless user experiences in financial and insurance services.

Defining Insurtech: Innovations in Insurance

Insurtech, a subset of fintech, specifically targets innovations in the insurance sector by leveraging technologies such as artificial intelligence, blockchain, and data analytics to streamline underwriting, claims processing, and risk assessment. Unlike broader fintech applications that cover payments, lending, and personal finance, insurtech focuses on enhancing customer experience, reducing operational costs, and enabling personalized insurance products through digital platforms. Leading insurtech companies are transforming traditional insurance models by introducing automated policy management, usage-based insurance, and smart contracts, thereby driving efficiency and transparency in the industry.

Fintech Overview: Revolutionizing Financial Services

Fintech revolutionizes financial services by leveraging digital technologies such as AI, blockchain, and big data to enhance payment systems, lending, and wealth management. Insurtech, a subset of fintech, specifically transforms the insurance industry through innovations in underwriting, claims processing, and customer engagement using similar technologies. While fintech covers a broad range of financial sectors, insurtech focuses uniquely on improving insurance products, distribution, and risk assessment.

Key Differences: Fintech vs Insurtech

Fintech encompasses a broad range of financial technologies including payments, lending, and wealth management, while insurtech is a specialized subset focusing solely on innovation within the insurance industry. Key differences include target sectors, with fintech addressing general finance services and insurtech optimizing insurance processes such as underwriting, claims, and risk assessment. Insurtech leverages technologies like AI and IoT specifically to improve policy pricing and customer experience in insurance, contrasting fintech's wider application of blockchain and digital banking solutions.

Overlapping Technologies in Fintech and Insurtech

Insurtech and Fintech share overlapping technologies such as artificial intelligence, blockchain, and big data analytics, enabling enhanced risk assessment, personalized insurance offerings, and streamlined claims processing. Machine learning algorithms are leveraged in both sectors to improve fraud detection and customer experience. Cloud computing facilitates scalable, real-time data processing, driving innovation across digital insurance platforms and financial services alike.

Market Trends: Insurtech within the Fintech Ecosystem

Insurtech, as a specialized segment of the broader fintech ecosystem, leverages advanced technologies such as AI, big data analytics, and blockchain to revolutionize insurance services by enhancing underwriting accuracy, claims processing speed, and customer experience. Market trends reveal a growing convergence between insurtech and fintech, driven by increased digital adoption, regulatory support for innovation, and strategic partnerships between traditional insurers and fintech startups. This integration accelerates the development of personalized insurance products, embedded insurance solutions, and automated risk assessment, positioning insurtech as a dynamic growth sector within the expanding fintech landscape.

Insurtech-Only Solutions: Unique Value Propositions

Insurtech-only solutions specialize in transforming insurance processes through advanced technologies like AI-driven underwriting, automated claims processing, and personalized policy recommendations, delivering enhanced efficiency and customer experience. Unlike broader fintech platforms, insurtech focuses exclusively on insurance industry challenges, enabling deeper domain expertise and tailored innovations such as risk assessment algorithms and fraud detection models. These unique value propositions position insurtech companies to disrupt traditional insurance markets by reducing operational costs and improving accuracy in risk management.

Collaboration and Competition: Fintech vs Insurtech

Fintech and Insurtech sectors increasingly collaborate by integrating advanced financial technologies with insurance products, enhancing customer experience and streamlining claims processing through AI and blockchain solutions. Competition arises as both sectors vie to innovate digital platforms, with Fintech firms expanding into insurance offerings and Insurtech startups improving risk assessment and underwriting via big data analytics. Strategic partnerships between Fintech and Insurtech companies drive market growth by combining financial expertise with insurance-specific innovations, optimizing service delivery and operational efficiencies.

Impact on Customer Experience: Insurtech vs Fintech

Insurtech enhances customer experience by streamlining insurance processes through AI-driven underwriting, personalized policy recommendations, and instant claims processing, reducing friction and increasing transparency. Fintech improves customer experience by offering seamless digital payments, budgeting tools, and real-time financial tracking that empower users to manage their finances efficiently. While both sectors leverage technology to personalize services, insurtech specifically addresses the complexity of insurance products, resulting in more tailored customer journeys and faster service delivery.

The Future of Insurtech in a Fintech-Driven World

The future of insurtech in a fintech-driven world hinges on seamless integration of digital banking, AI-powered underwriting, and blockchain for secure claims processing. Insurtech companies leveraging fintech innovations enhance customer experience through personalized policies and real-time risk assessment. Data analytics and API connectivity enable more agile, scalable insurance solutions that align with evolving consumer demands and regulatory landscapes.

Insurtech Fintech Infographic

libterm.com

libterm.com