Excise tax is a government-imposed fee on specific goods such as alcohol, tobacco, and fuel, designed to generate revenue and discourage consumption. It is typically included in the price of the product, making it an indirect tax paid by consumers. Explore the rest of this article to understand how excise tax impacts your purchases and the economy.

Table of Comparison

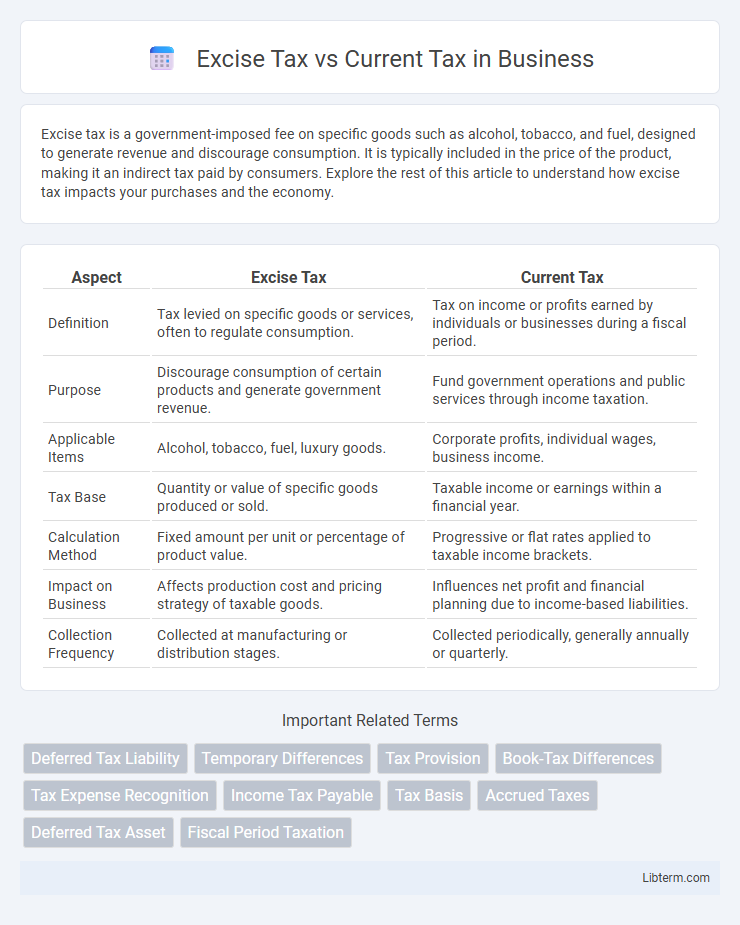

| Aspect | Excise Tax | Current Tax |

|---|---|---|

| Definition | Tax levied on specific goods or services, often to regulate consumption. | Tax on income or profits earned by individuals or businesses during a fiscal period. |

| Purpose | Discourage consumption of certain products and generate government revenue. | Fund government operations and public services through income taxation. |

| Applicable Items | Alcohol, tobacco, fuel, luxury goods. | Corporate profits, individual wages, business income. |

| Tax Base | Quantity or value of specific goods produced or sold. | Taxable income or earnings within a financial year. |

| Calculation Method | Fixed amount per unit or percentage of product value. | Progressive or flat rates applied to taxable income brackets. |

| Impact on Business | Affects production cost and pricing strategy of taxable goods. | Influences net profit and financial planning due to income-based liabilities. |

| Collection Frequency | Collected at manufacturing or distribution stages. | Collected periodically, generally annually or quarterly. |

Introduction to Excise Tax and Current Tax

Excise tax is a specific tax imposed on the manufacture, sale, or consumption of goods such as alcohol, tobacco, and fuel, often aimed at influencing consumer behavior or generating government revenue. Current tax refers to the income tax liability for a given accounting period, calculated based on taxable income and applicable tax rates, reflecting the company's legal obligation to tax authorities. Understanding the distinction between excise tax and current tax is essential for accurate financial reporting and compliance with tax regulations.

Defining Excise Tax

Excise tax is a specific form of indirect tax imposed on the manufacture, sale, or consumption of particular goods, typically including alcohol, tobacco, and fuel, designed to discourage consumption or raise government revenue. Unlike current tax, which refers broadly to taxes levied on income, profits, or wealth within a fiscal period, excise taxes target specific products and activities. Understanding excise tax is essential for businesses and consumers due to its impact on pricing, regulatory compliance, and government taxation policies.

Defining Current Tax

Current tax refers to the amount of income tax payable or recoverable for a specific period based on taxable profit or loss assessed by tax authorities. It represents the actual tax liability calculated using applicable tax rates and regulations, reflecting obligations for the current fiscal year. Excise tax, in contrast, is a specific tax levied on the production or sale of certain goods, separate from income-based current tax assessments.

Key Differences Between Excise Tax and Current Tax

Excise tax is a specific tax levied on the manufacture, sale, or consumption of particular goods such as alcohol, tobacco, and fuel, often included in the product price and aimed at regulating consumption or generating revenue. Current tax refers to income tax or corporate tax assessed on an entity's taxable income within a fiscal year, reflecting the entity's tax liability for that period without deferral or future adjustments. The key differences lie in their application: excise tax targets specific goods with a fixed or variable rate per unit, while current tax is based on overall income or profits with rates defined by tax brackets or corporate tax laws.

Purpose and Application of Excise Tax

Excise tax is imposed on specific goods and services, such as tobacco, alcohol, and fuel, to generate revenue while discouraging consumption that may harm public health or the environment. Its purpose is both regulatory and fiscal, targeting products perceived as non-essential or harmful, unlike current tax, which broadly applies to general income or sales. Excise tax is primarily applied at the manufacturing or distribution level, influencing production costs and consumer prices to achieve policy objectives.

Purpose and Application of Current Tax

The purpose of current tax is to fund government operations and public services by taxing individual and corporate income within a specific fiscal period. It is applied directly on earned income, profits, and gains, reflecting the taxpayer's financial activity during the reporting year. Unlike excise tax, which targets specific goods and services, current tax ensures broad revenue generation for budgetary expenditures and social programs.

Impact on Consumers and Businesses

Excise tax directly increases the cost of specific goods such as gasoline, alcohol, and tobacco, leading consumers to face higher retail prices and altered purchasing behavior. For businesses, excise taxes raise production expenses, potentially reducing profit margins or driving price adjustments that affect competitiveness. Current tax, encompassing income and sales taxes, influences disposable income for consumers and operational costs for businesses, shaping spending power and investment decisions.

Revenue Generation for Governments

Excise tax and current tax both serve as critical revenue sources for governments, with excise taxes imposed on specific goods like alcohol, tobacco, and fuel, generating substantial targeted income. Current tax encompasses broader taxation measures such as income tax and corporate tax, providing a more stable and significant portion of government revenue. Efficient administration of both excise and current taxes enhances fiscal capacity and supports public expenditure.

Compliance and Reporting Requirements

Excise tax compliance requires detailed tracking of specific goods such as alcohol, tobacco, and fuel, with stringent reporting to regulatory authorities on production volumes and tax liabilities. Current tax compliance involves timely calculation and payment of income tax based on financial statements, adhering to jurisdictional deadlines and accurate tax return submissions. Both taxes demand thorough documentation and adherence to evolving regulatory standards to ensure accurate reporting and avoid penalties.

Conclusion: Choosing Between Excise and Current Tax

Selecting between excise tax and current tax depends on the specific goods or services involved and the regulatory objectives. Excise taxes target particular products like alcohol, tobacco, or fuel to discourage consumption or address externalities, while current taxes encompass broader income or corporate taxes affecting overall financial obligations. Businesses must analyze compliance costs, tax incidence, and sector-specific impacts to optimize tax strategy effectively.

Excise Tax Infographic

libterm.com

libterm.com