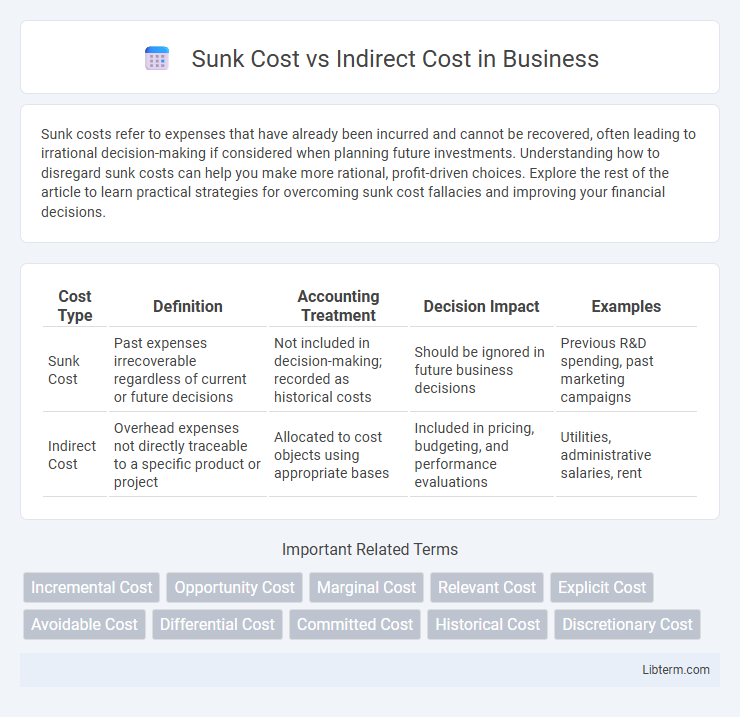

Sunk costs refer to expenses that have already been incurred and cannot be recovered, often leading to irrational decision-making if considered when planning future investments. Understanding how to disregard sunk costs can help you make more rational, profit-driven choices. Explore the rest of the article to learn practical strategies for overcoming sunk cost fallacies and improving your financial decisions.

Table of Comparison

| Cost Type | Definition | Accounting Treatment | Decision Impact | Examples |

|---|---|---|---|---|

| Sunk Cost | Past expenses irrecoverable regardless of current or future decisions | Not included in decision-making; recorded as historical costs | Should be ignored in future business decisions | Previous R&D spending, past marketing campaigns |

| Indirect Cost | Overhead expenses not directly traceable to a specific product or project | Allocated to cost objects using appropriate bases | Included in pricing, budgeting, and performance evaluations | Utilities, administrative salaries, rent |

Understanding Sunk Cost: Definition and Examples

Sunk cost refers to expenses that have already been incurred and cannot be recovered, such as past investments in equipment or marketing campaigns. Unlike indirect costs, which are ongoing and allocated to multiple projects like rent or utilities, sunk costs should not influence current financial decisions. Examples include the money spent on non-refundable deposits or obsolete inventory that holds no salvage value.

What Are Indirect Costs? Key Concepts Explained

Indirect costs, also known as overhead costs, are expenses that are not directly attributable to a specific project, product, or activity but are necessary for the general operation of a business. These costs include utilities, rent, administrative salaries, and depreciation, which support multiple projects or departments simultaneously. Unlike sunk costs, which are past expenses that cannot be recovered, indirect costs continue to influence budgeting and financial planning across ongoing and future organizational activities.

Fundamental Differences Between Sunk and Indirect Costs

Sunk costs represent past expenditures that cannot be recovered and should not influence future decision-making, while indirect costs are ongoing expenses not directly tied to a specific project but allocated across multiple activities. The fundamental difference lies in sunk costs being historical and irreversible, whereas indirect costs are operational and subject to allocation methods. Understanding this distinction is critical for effective budgeting, financial analysis, and strategic planning.

The Role of Sunk Cost in Business Decision-Making

Sunk costs are expenses that have already been incurred and cannot be recovered, making them irrelevant to future business decisions, unlike indirect costs which are ongoing and can influence budgeting. Companies must avoid considering sunk costs when evaluating new projects to prevent escalation of commitment and optimize resource allocation. Ignoring sunk costs helps managers focus on marginal costs and benefits, improving strategic decision-making and financial performance.

How Indirect Costs Impact Organizational Budgets

Indirect costs, often comprising overhead expenses like utilities, administrative salaries, and facility maintenance, significantly influence organizational budgets by allocating shared resources across multiple projects or departments, thus affecting overall financial planning and cost control strategies. Unlike sunk costs, which are past expenditures that cannot be recovered, indirect costs continuously impact budgeting decisions, requiring precise allocation methods such as activity-based costing to ensure accurate financial reporting and efficient resource distribution. Effective management of indirect costs enhances the organization's ability to forecast expenses, optimize operational efficiency, and maintain fiscal responsibility.

Common Mistakes: Misclassifying Sunk and Indirect Costs

Misclassifying sunk costs as indirect costs often leads to erroneous budgeting and financial analysis because sunk costs represent past expenses that cannot be recovered, while indirect costs are ongoing expenses essential for operations. A common mistake is treating sunk costs as relevant for future decision-making, which distorts cost-benefit evaluations and resource allocation. Correct classification ensures accurate cost tracking, enabling better strategic planning and cost control.

Sunk Cost Fallacy: Avoiding Financial Pitfalls

Sunk cost refers to money already spent and irrecoverable, while indirect cost involves expenses not directly tied to a specific project but necessary for overall operations. The sunk cost fallacy occurs when individuals irrationally continue investing in a losing endeavor due to past expenditures, leading to poor financial decisions. Avoiding this fallacy requires recognizing sunk costs as irrelevant to future choices and focusing on incremental costs and benefits instead.

Calculating Indirect Costs: Methods and Best Practices

Calculating indirect costs involves allocating expenses such as utilities, rent, and administrative salaries that support multiple projects but are not directly traceable to a single cost object. Common methods include the allocation base approach, where costs are distributed based on a measurable factor like labor hours or machine usage, and the activity-based costing method, which assigns costs according to actual activities driving resource consumption. Best practices emphasize accurate identification of cost drivers, regular review of allocation bases, and transparent documentation to ensure precise and fair indirect cost distribution.

Practical Scenarios: Sunk Cost vs Indirect Cost in Real Life

Sunk costs represent expenses already incurred and irrecoverable, such as research and development funds spent on a failed product, and should not influence future decisions. Indirect costs, like utilities or administrative salaries, support operations but cannot be directly tied to a specific project, impacting budgeting and pricing strategies. In practical scenarios, businesses avoid factoring sunk costs into new investments while carefully allocating indirect costs to ensure accurate financial analysis and resource management.

Strategic Financial Planning: Leveraging Cost Insights for Success

Sunk costs refer to expenses that have already been incurred and cannot be recovered, while indirect costs are ongoing expenses not directly tied to a specific project but essential for overall operations. Strategic financial planning leverages insights from both sunk and indirect costs to optimize budgeting, improve resource allocation, and enhance decision-making processes. Understanding the impact of sunk costs prevents irrational investment continuation, while accurately accounting for indirect costs ensures sustainable financial management and competitive advantage.

Sunk Cost Infographic

libterm.com

libterm.com