Overriding royalty interest grants you a percentage of production revenue without ownership in the mineral rights, allowing for income from oil and gas extraction without operational responsibilities. This legal arrangement is commonly used in energy contracts to provide passive income streams while the principal owner manages the resources. Explore the full article to understand how overriding royalty interests can benefit your investment strategy and risk management.

Table of Comparison

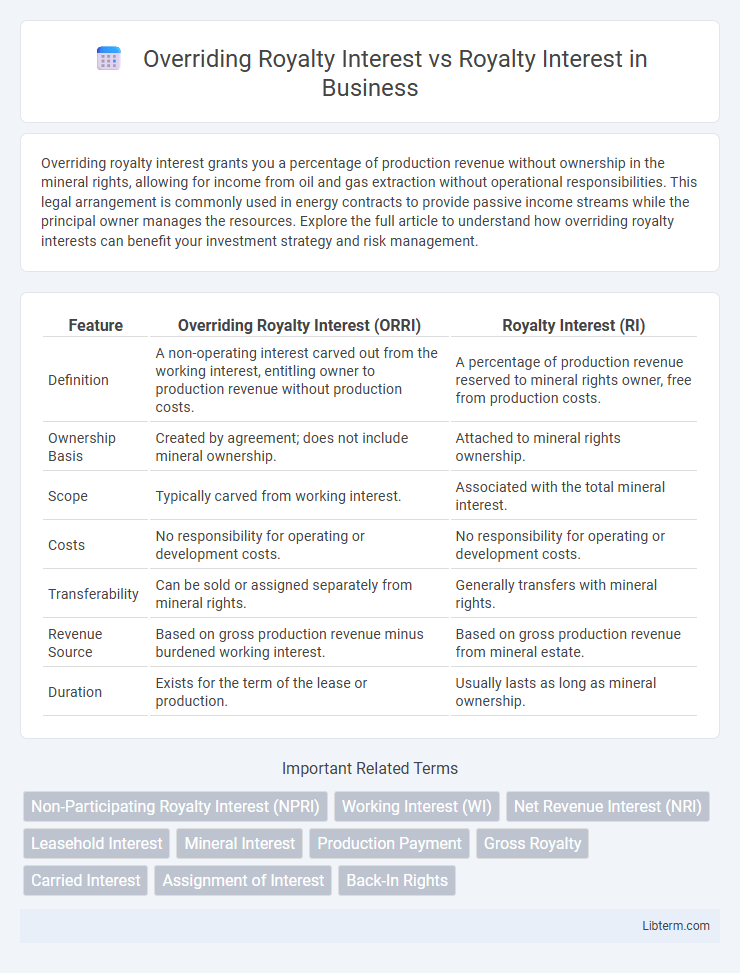

| Feature | Overriding Royalty Interest (ORRI) | Royalty Interest (RI) |

|---|---|---|

| Definition | A non-operating interest carved out from the working interest, entitling owner to production revenue without production costs. | A percentage of production revenue reserved to mineral rights owner, free from production costs. |

| Ownership Basis | Created by agreement; does not include mineral ownership. | Attached to mineral rights ownership. |

| Scope | Typically carved from working interest. | Associated with the total mineral interest. |

| Costs | No responsibility for operating or development costs. | No responsibility for operating or development costs. |

| Transferability | Can be sold or assigned separately from mineral rights. | Generally transfers with mineral rights. |

| Revenue Source | Based on gross production revenue minus burdened working interest. | Based on gross production revenue from mineral estate. |

| Duration | Exists for the term of the lease or production. | Usually lasts as long as mineral ownership. |

Introduction to Oil and Gas Royalties

Overriding Royalty Interest (ORRI) and Royalty Interest are crucial concepts in oil and gas royalties, representing distinct forms of revenue interest without operating responsibilities. Royalty Interest typically refers to a landowner's entitlement to a portion of production or revenue from minerals, often retained after the mineral rights are leased. Overriding Royalty Interest is carved out of the working interest and provides a non-operating party a share of production revenue, created through agreements separate from the original mineral ownership.

What Is a Royalty Interest?

A royalty interest represents the right to receive a percentage of production revenues or lease payments from oil, gas, or mineral extraction without bearing the costs of production. Overriding royalty interest (ORRI) differs as it is carved out of the working interest, granting a share of production revenue free of operating expenses but distinct from the lessor's royalty interest. Understanding that a royalty interest entitles the holder to a portion of revenue generated without operational liability is key to distinguishing it from an overriding royalty interest.

Defining Overriding Royalty Interest

Overriding Royalty Interest (ORRI) is a non-operating interest in oil and gas production carved out of the working interest, entitling the holder to a portion of production revenue free of production costs. Unlike a standard Royalty Interest, which originates from the mineral estate, an ORRI is created through contractual agreements and does not carry ownership in the mineral rights. This interest is paid from the lessee's share, making it a cost-free revenue stream typically reserved for landowners, investors, or service providers.

Key Differences: Overriding Royalty Interest vs Royalty Interest

Overriding Royalty Interest (ORRI) differs from Royalty Interest (RI) primarily in ownership and duration; ORRI is carved out of the working interest and does not involve ownership of the mineral estate, whereas RI is directly tied to mineral ownership. ORRI holders receive a portion of production revenue without bearing operational costs, while RI holders benefit from production revenue linked to the mineral estate and may have broader rights. The key distinction lies in ORRI's limited life, often ceasing after the lease term, contrasted with the perpetual nature of RI as long as minerals are produced.

How Royalty Interests Are Created and Transferred

Royalty Interests are created through mineral leases where landowners retain a percentage of production revenue without bearing extraction costs, established via lease agreements or deeds. Overriding Royalty Interests (ORRIs) arise from subsequent agreements that carve out a portion of the working or royalty interest, often created through assignments or contracts separate from the original lease. Both interests are transferred by formal instruments recorded in county clerks' offices, with precise legal descriptions ensuring proper conveyance and enforceability.

Revenue Streams: How Owners Are Paid

Overriding Royalty Interest (ORI) holders receive a percentage of production revenue after the operating costs have been deducted, creating a revenue stream that is contingent on net profits. In contrast, standard Royalty Interest (RI) owners are paid a fixed percentage of the gross production revenue before any costs are deducted, ensuring a steady income regardless of expenses. This fundamental difference impacts how owners are compensated and influences the overall financial structure of oil and gas revenue streams.

Legal and Tax Implications

Overriding royalty interests (ORRI) differ from standard royalty interests in that ORRIs are created from the working interest owner's share and do not burden the mineral or leasehold estate, affecting ownership rights and tax treatment. Legally, ORRIs are non-cost-bearing interests often documented separately in overriding royalty agreements, while royalty interests are real property interests tied to mineral ownership with distinct conveyance requirements. From a tax perspective, ORRI holders report income as non-operator royalty income subject to ordinary income tax rates, while royalty interest holders may have deductions related to production costs, impacting overall tax liabilities and reporting methods.

Pros and Cons of Each Interest Type

Overriding royalty interest (ORRI) offers the advantage of not requiring capital investment, allowing holders to earn revenue without operational risks, but typically provides a smaller percentage of production revenue compared to working interests. Royalty interest owners benefit from a consistent revenue stream based on production volumes without operational costs, though they are subject to market price volatility and lack control over leasing and development decisions. Both interests provide passive income, but ORRI holders face increased complexity with lease terms while royalty interest owners enjoy more straightforward royalty payment structures.

Common Misconceptions and Risks

Overriding Royalty Interest (ORRI) is often misunderstood as identical to a standard Royalty Interest (RI), but ORRI is carved out of the working interest and does not burden the mineral owner's royalty, leading to different financial implications. A common misconception is that ORRI holders have ownership in the mineral estate, when in fact they hold a non-possessory interest that entitles them only to a fraction of production revenue without operational control. The primary risks associated with ORRI include potential dilution from additional burdens and lack of rights to lease or develop the property, which can significantly impact long-term income stability.

Choosing the Right Interest for Your Investment Goals

Overriding Royalty Interest (ORRI) provides a non-operating revenue stream without ownership in the mineral estate, making it ideal for investors seeking income without bearing production costs. Royalty Interest grants rights to a portion of production revenues but includes ownership in the mineral rights, often involving higher risks and rewards aligned with long-term asset appreciation. Choosing the right interest depends on your investment goals: ORRI suits those prioritizing steady cash flow and minimal operational risk, while Royalty Interests attract investors willing to engage more deeply with the volatility and potential value growth of mineral assets.

Overriding Royalty Interest Infographic

libterm.com

libterm.com