Private equity involves investing in private companies or buying out public companies to improve their value before eventually selling them for a profit. Firms use various strategies, including leveraged buyouts, venture capital, and growth capital, to drive operational improvements and financial restructuring. Discover how private equity can impact your investment portfolio and the broader financial market in the rest of this article.

Table of Comparison

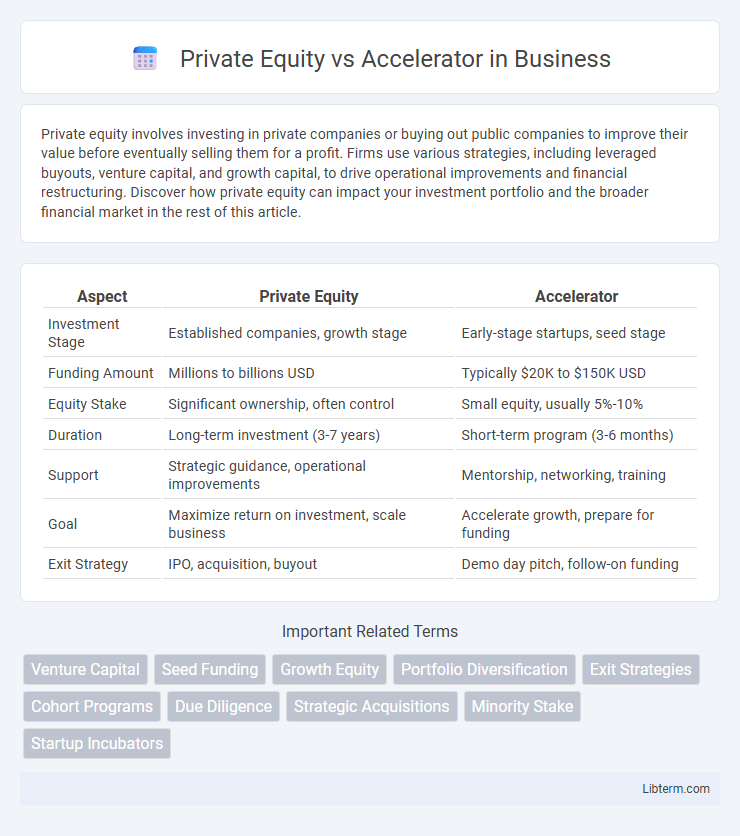

| Aspect | Private Equity | Accelerator |

|---|---|---|

| Investment Stage | Established companies, growth stage | Early-stage startups, seed stage |

| Funding Amount | Millions to billions USD | Typically $20K to $150K USD |

| Equity Stake | Significant ownership, often control | Small equity, usually 5%-10% |

| Duration | Long-term investment (3-7 years) | Short-term program (3-6 months) |

| Support | Strategic guidance, operational improvements | Mentorship, networking, training |

| Goal | Maximize return on investment, scale business | Accelerate growth, prepare for funding |

| Exit Strategy | IPO, acquisition, buyout | Demo day pitch, follow-on funding |

Introduction to Private Equity and Accelerators

Private equity involves investment firms acquiring significant ownership stakes in established companies to drive growth, restructure operations, and generate high returns over several years. Accelerators are programs that provide startups with mentorship, resources, and often seed funding over a fixed period, aiming to accelerate early-stage business development and market entry. While private equity targets mature businesses with proven revenue streams, accelerators focus on nurturing nascent companies with high growth potential.

Key Differences Between Private Equity and Accelerators

Private equity firms invest large sums of capital into established companies, acquiring significant ownership stakes to drive long-term growth and value creation, whereas accelerators provide early-stage startups with smaller funding rounds combined with mentorship and resources for rapid development over a fixed program duration. Private equity typically targets mature businesses with proven revenue streams, aiming for strategic transformations or buyouts, while accelerators focus on high-potential, innovative startups seeking initial market validation and scaling support. The investment horizon also differs significantly, with private equity focusing on multi-year returns and accelerators often expecting quicker exit opportunities through follow-on funding or acquisitions.

Investment Size and Stage Comparison

Private equity firms typically invest larger amounts, often ranging from $10 million to several hundred million dollars, focusing on mature companies seeking expansion or restructuring. In contrast, accelerators provide smaller investments, usually between $25,000 and $150,000, targeting early-stage startups in seed or pre-seed phases. The investment stage and size distinguish private equity's emphasis on scaling established businesses, whereas accelerators aim to nurture and validate nascent ventures.

Ownership Structure and Control

Private equity firms typically acquire significant or majority ownership stakes in portfolio companies, granting them substantial control over management decisions and strategic direction. Accelerators, by contrast, offer seed funding in exchange for a small equity percentage, usually between 5% and 10%, which results in limited ownership and influence over startups. This difference makes private equity suitable for established companies seeking operational control, while accelerators focus on early-stage ventures benefiting from mentorship with minimal ownership dilution.

Typical Investor Profiles

Private equity investors typically include institutional entities such as pension funds, insurance companies, and high-net-worth individuals seeking long-term capital appreciation through substantial equity stakes in mature companies. Accelerator investors often consist of angel investors, venture capitalists, and early-stage funding entities aiming to support startups with high growth potential in exchange for equity and active mentorship. These distinct profiles influence investment strategies, risk tolerance, and expected return horizons in private equity versus accelerator environments.

Value Creation Approaches

Private equity firms drive value creation by leveraging capital infusion, strategic restructuring, and operational improvements in mature companies to enhance profitability and market position. Accelerators focus on early-stage startups by providing mentorship, intensive training, networking opportunities, and seed funding to accelerate growth and innovation. The fundamental difference lies in private equity's emphasis on optimizing existing assets versus accelerators' approach to rapidly scaling nascent business models.

Duration of Involvement

Private equity firms typically engage with portfolio companies over a multi-year horizon, often ranging from 4 to 7 years, to drive significant growth and achieve a profitable exit. Accelerators, by contrast, offer short-term programs lasting around 3 to 6 months, focusing on rapid development and market validation for early-stage startups. The extended duration of private equity allows for deeper operational involvement, whereas accelerators emphasize accelerated growth and mentorship within a brief timeframe.

Exit Strategies and Outcomes

Private equity firms typically pursue exit strategies such as initial public offerings (IPOs), mergers and acquisitions (M&A), or secondary buyouts, aiming for significant control and long-term value creation in mature companies. Accelerators focus on rapid scaling and short-term exits, often through early-stage venture capital rounds or acquisitions, with the goal of boosting startup valuation quickly. Outcomes in private equity tend to result in substantial capital gains over years, whereas accelerators emphasize quick growth and frequent, smaller liquidity events.

Pros and Cons of Private Equity

Private equity offers significant capital infusion and strategic guidance for mature companies seeking growth or restructuring but involves relinquishing some control and facing high expectations for financial returns. It provides long-term investment horizons and access to experienced management teams, yet often requires extensive due diligence and can impose restrictive covenants. While private equity supports scalability and market expansion, the pressure to achieve rapid profitability and exit strategies may limit operational flexibility.

Pros and Cons of Accelerators

Accelerators offer startups intensive mentorship, access to a network of investors, and seed funding, which can significantly boost early-stage growth but often require equity dilution that founders must consider. The fixed-term programs help rapidly validate business models and refine pitch strategies, yet the accelerated pace may pressure teams unprepared for rapid scaling. Unlike private equity, accelerators primarily target early-stage ventures with high growth potential rather than mature companies seeking capital infusion.

Private Equity Infographic

libterm.com

libterm.com