Conglomerate integration involves merging companies from unrelated industries to diversify business operations and reduce risks. This strategy can enhance market presence and create new growth opportunities by combining distinct products or services. Explore the full article to understand how conglomerate integration can impact your business strategy.

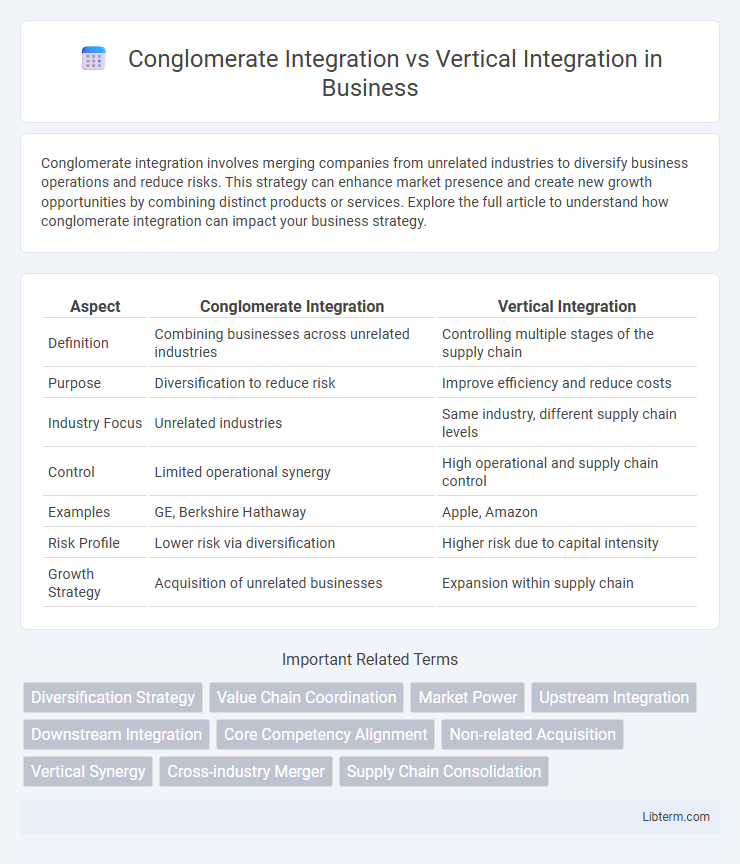

Table of Comparison

| Aspect | Conglomerate Integration | Vertical Integration |

|---|---|---|

| Definition | Combining businesses across unrelated industries | Controlling multiple stages of the supply chain |

| Purpose | Diversification to reduce risk | Improve efficiency and reduce costs |

| Industry Focus | Unrelated industries | Same industry, different supply chain levels |

| Control | Limited operational synergy | High operational and supply chain control |

| Examples | GE, Berkshire Hathaway | Apple, Amazon |

| Risk Profile | Lower risk via diversification | Higher risk due to capital intensity |

| Growth Strategy | Acquisition of unrelated businesses | Expansion within supply chain |

Introduction to Business Integration Strategies

Conglomerate integration involves the expansion of a company into entirely unrelated businesses, enhancing diversification and reducing market risk through the acquisition of firms in different industries. Vertical integration focuses on controlling multiple stages of the supply chain within the same industry, aiming to improve efficiency, reduce costs, and secure supply sources by merging with suppliers or distributors. Both strategies represent key approaches in business integration, enabling firms to increase market power and achieve sustainable competitive advantage.

Defining Conglomerate Integration

Conglomerate integration involves the merger or acquisition of companies operating in unrelated industries, aiming to diversify risk and expand market presence across different sectors. This strategy contrasts with vertical integration, which focuses on controlling multiple stages of the supply chain within the same industry. Conglomerate integration enables firms to leverage financial resources and management expertise to enter new markets without relying on supply chain control.

Understanding Vertical Integration

Vertical integration involves a company expanding its operations into different stages of production within the same industry, such as a manufacturer acquiring suppliers or distributors. This strategy enhances control over the supply chain, reduces costs, and improves operational efficiency by streamlining production and distribution processes. Unlike conglomerate integration, which diversifies businesses across unrelated industries, vertical integration strengthens a firm's market position through industry-specific consolidation.

Key Differences Between Conglomerate and Vertical Integration

Conglomerate integration involves merging companies from unrelated industries to diversify business operations and reduce risk, while vertical integration combines companies within the same supply chain to enhance control over production and distribution processes. Key differences include the scope of operations, where conglomerates expand into distinct markets and vertical integration strengthens control over successive stages of the value chain. Conglomerate integration emphasizes diversification and risk spreading, whereas vertical integration focuses on efficiency and reducing dependency on suppliers or distributors.

Advantages of Conglomerate Integration

Conglomerate integration diversifies a company's portfolio, reducing overall business risk by entering unrelated industries and markets. This strategy enhances financial stability by balancing profits and losses across distinct sectors, enabling more efficient capital allocation. Conglomerate integration also fosters innovation through cross-sector collaboration and leverages varied market expertise to drive growth opportunities.

Benefits of Vertical Integration

Vertical integration enhances supply chain control, reducing costs and improving efficiency by owning multiple production stages within the same industry. It strengthens market position through better coordination, quicker response to market changes, and improved product quality. Companies gain increased competitive advantage by securing access to critical inputs and reducing dependence on external suppliers.

Challenges Faced in Conglomerate Integration

Conglomerate integration faces challenges such as cultural clashes between diverse business units, difficulties in achieving synergies across unrelated industries, and complex management structures that hinder efficient decision-making. Financial risks increase due to varying market dynamics and regulatory environments across sectors, complicating performance monitoring and resource allocation. Furthermore, aligning strategic goals and maintaining shareholder value can be problematic because of the lack of operational overlap among conglomerate subsidiaries.

Risks and Limitations of Vertical Integration

Vertical integration carries inherent risks including significant capital investment and reduced operational flexibility, which can strain financial resources and limit a company's ability to adapt quickly to market changes. Dependence on internal suppliers or distributors may lead to inefficiencies and increased vulnerability if one segment underperforms. Furthermore, vertical integration can provoke antitrust scrutiny and regulatory challenges, especially in industries with high barriers to entry or dominant market players.

Real-World Examples: Conglomerate vs Vertical Integration

Conglomerate integration involves a corporation expanding by acquiring businesses in unrelated industries, exemplified by Berkshire Hathaway's diverse holdings ranging from insurance to railroads and consumer goods. Vertical integration occurs when a company controls multiple stages of its supply chain, such as Tesla manufacturing batteries, electric vehicles, and owning charging infrastructure to streamline production and distribution. The contrast highlights conglomerates' risk diversification against vertical integration's focus on operational efficiency and cost reduction within a single industry.

Choosing the Right Integration Strategy for Business Growth

Choosing the right integration strategy hinges on aligning business goals with market dynamics; conglomerate integration diversifies risk by acquiring unrelated businesses, fostering broad market presence, while vertical integration secures control over the supply chain, enhancing efficiency and reducing costs. Evaluating industry competition, resource capabilities, and long-term growth objectives guides decision-making--vertical integration suits companies aiming for operational control and cost leadership, whereas conglomerate integration benefits firms targeting market expansion and diversification. Strategic alignment with financial capacity and competitive advantage ensures sustainable growth and maximizes shareholder value.

Conglomerate Integration Infographic

libterm.com

libterm.com