Restricted Stock Units (RSUs) are company shares granted to employees as part of their compensation, subject to vesting schedules and certain restrictions. They offer a way to align employee incentives with company performance while providing potential tax advantages. Explore this article to understand how RSUs can impact your financial planning and career benefits.

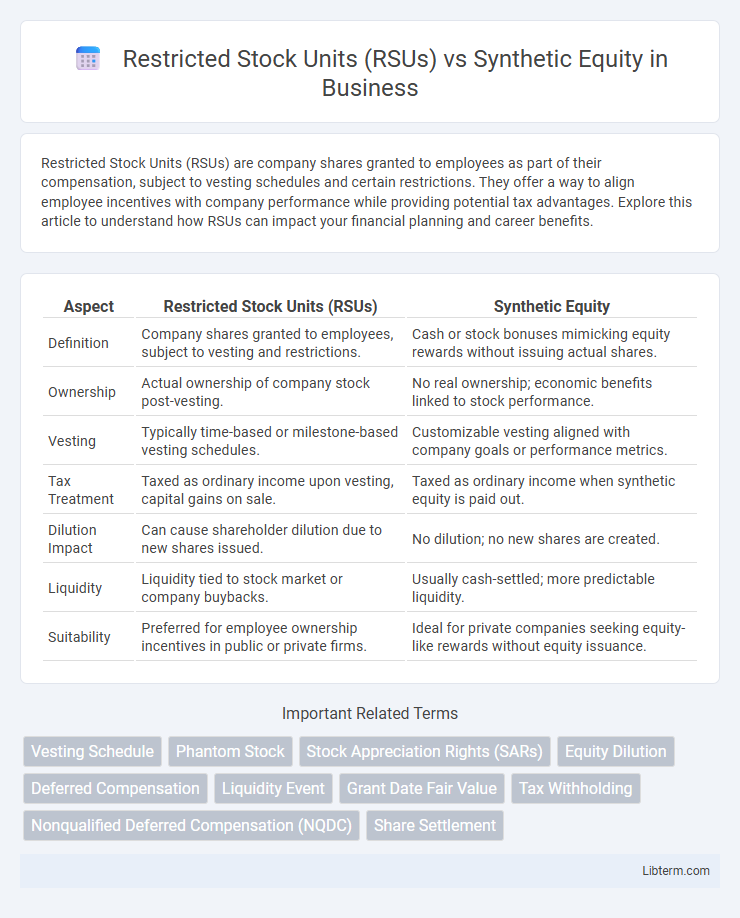

Table of Comparison

| Aspect | Restricted Stock Units (RSUs) | Synthetic Equity |

|---|---|---|

| Definition | Company shares granted to employees, subject to vesting and restrictions. | Cash or stock bonuses mimicking equity rewards without issuing actual shares. |

| Ownership | Actual ownership of company stock post-vesting. | No real ownership; economic benefits linked to stock performance. |

| Vesting | Typically time-based or milestone-based vesting schedules. | Customizable vesting aligned with company goals or performance metrics. |

| Tax Treatment | Taxed as ordinary income upon vesting, capital gains on sale. | Taxed as ordinary income when synthetic equity is paid out. |

| Dilution Impact | Can cause shareholder dilution due to new shares issued. | No dilution; no new shares are created. |

| Liquidity | Liquidity tied to stock market or company buybacks. | Usually cash-settled; more predictable liquidity. |

| Suitability | Preferred for employee ownership incentives in public or private firms. | Ideal for private companies seeking equity-like rewards without equity issuance. |

Introduction to Restricted Stock Units (RSUs)

Restricted Stock Units (RSUs) are company shares granted to employees as part of their compensation, subject to vesting conditions based on time or performance milestones. Unlike stock options, RSUs represent actual ownership once vested, providing tangible equity without requiring upfront payment. This straightforward structure aligns employee incentives with company growth and enhances retention by offering a clear path to stock ownership.

Understanding Synthetic Equity: Key Concepts

Synthetic equity represents a flexible form of employee compensation that mirrors the economic benefits of actual stock ownership without transferring legal ownership or voting rights. It typically includes instruments like stock appreciation rights (SARs) or phantom stock, designed to align employee incentives with company performance by granting value tied to the company's stock price appreciation. Understanding synthetic equity involves recognizing its non-dilutive nature, its role in preserving shareholder control, and its effectiveness in motivating employees through potential financial rewards linked to company growth.

How RSUs Operate: Granting, Vesting, and Taxes

Restricted Stock Units (RSUs) are granted by an employer as a promise to deliver company shares upon meeting specific vesting conditions, typically based on time or performance milestones. Vesting schedules determine when employees gain full ownership, with shares often delivered after taxes are withheld or employees must sell enough shares to cover tax obligations. Taxation of RSUs occurs as ordinary income at vesting based on the fair market value, and subsequent gains are subject to capital gains tax upon sale.

Types and Structures of Synthetic Equity

Synthetic equity includes diverse types such as stock appreciation rights (SARs), phantom stock, and stock options, each designed to mimic real stock ownership benefits without granting actual shares. Structures of synthetic equity can vary between cash-settled and equity-settled arrangements, impacting how employees realize gains and company accounting treatments. Unlike RSUs that grant actual shares upon vesting, synthetic equity offers flexible compensation tied to company performance, often used to motivate employees while minimizing dilution and administrative complexity.

Key Differences Between RSUs and Synthetic Equity

Restricted Stock Units (RSUs) represent actual shares granted to employees, which vest over time and confer ownership rights upon vesting, including voting and dividend rights. Synthetic equity, often structured as stock appreciation rights or phantom stock, provides employees with cash or stock bonuses tied to company valuation without transferring actual shares or ownership rights. The key difference lies in RSUs granting real equity with shareholder rights once vested, whereas synthetic equity offers economic benefits linked to stock performance without dilution or equity control.

Taxation Implications: RSUs vs Synthetic Equity

Restricted Stock Units (RSUs) are taxed as ordinary income upon vesting, based on the fair market value of the shares, with subsequent gains taxed as capital gains when sold. Synthetic equity, such as stock appreciation rights (SARs) or phantom stock, is typically taxed as ordinary income at payout, reflecting the cash or stock value received without requiring upfront share issuance. Employers and employees should consider differing tax timing and treatment impacts in compensation planning to optimize overall tax liabilities.

Benefits of RSUs for Employees and Employers

Restricted Stock Units (RSUs) offer employees clear ownership stakes with tangible shares upon vesting, promoting retention and aligning their interests with company performance. Employers benefit from RSUs through straightforward administration and favorable accounting treatment, as RSUs are expensed based on fair market value at grant, minimizing dilution compared to issuing stock options. This alignment fosters motivation and long-term commitment while controlling equity dilution and financial reporting impacts for the company.

Advantages and Limitations of Synthetic Equity

Synthetic equity provides employees ownership-like benefits without diluting company shares, making it attractive for startups seeking to preserve equity. It allows flexible structuring, aligning employee incentives with company performance through cash-settled appreciation rights or stock appreciation rights. Limitations include complex valuation, potential tax complexities, and lack of actual shareholder voting rights, which may reduce perceived employee engagement compared to traditional RSUs.

Factors to Consider When Choosing Between RSUs and Synthetic Equity

Evaluating tax implications is crucial when choosing between Restricted Stock Units (RSUs) and Synthetic Equity, as RSUs typically trigger income tax upon vesting while Synthetic Equity may offer more flexible tax deferral options. Consider company stage and liquidity; RSUs are more common in established companies with public shares, whereas Synthetic Equity suits private firms seeking to mimic stock benefits without issuing actual shares. Assess shareholder rights and dilution potential, since RSUs grant actual shares with voting rights, while Synthetic Equity typically provides cash or stock value equivalent without shareholder voting privileges.

Conclusion: Which Equity Compensation is Right for Your Company?

Choosing between Restricted Stock Units (RSUs) and Synthetic Equity depends on your company's stage, employee retention goals, and financial strategy; RSUs offer clear ownership and tax benefits suited for established firms, while Synthetic Equity provides flexible, cash-settled incentives ideal for startups seeking to conserve equity. Consider liquidity events, tax implications, and administrative complexity when deciding. Tailoring the equity compensation plan to align with company culture and growth trajectory ensures optimal employee motivation and organizational success.

Restricted Stock Units (RSUs) Infographic

libterm.com

libterm.com