A partnership agreement clearly outlines the roles, responsibilities, and profit-sharing arrangements between business partners to ensure smooth collaboration and prevent conflicts. This legal document protects all parties by specifying decision-making processes and dispute resolution methods. Explore the rest of the article to learn how to draft an effective partnership agreement tailored to your needs.

Table of Comparison

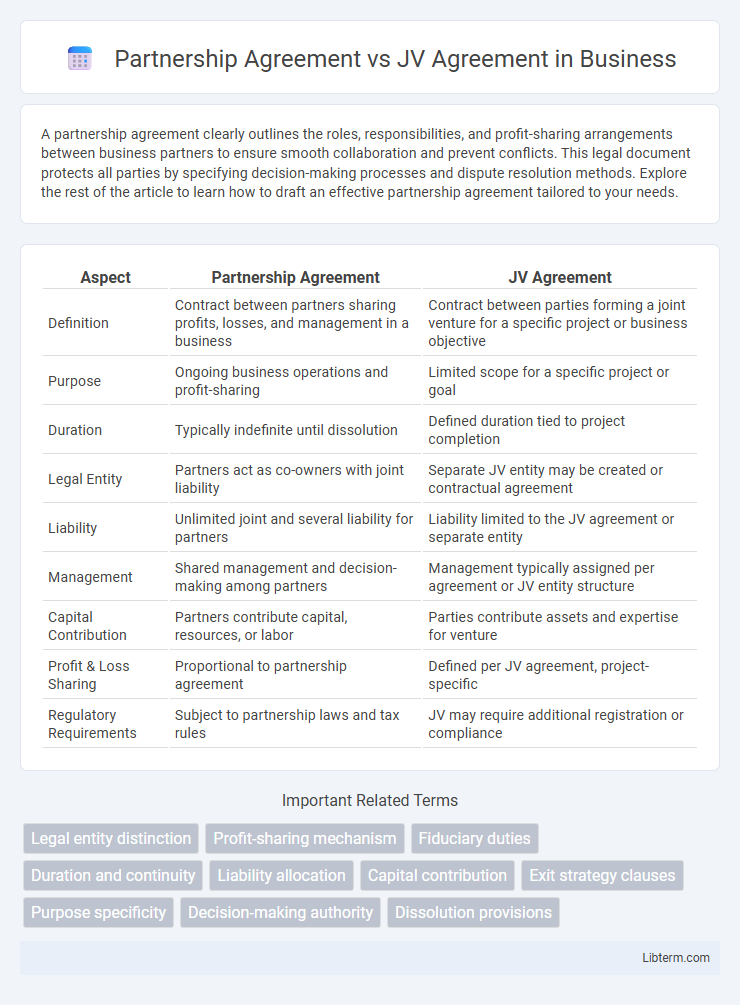

| Aspect | Partnership Agreement | JV Agreement |

|---|---|---|

| Definition | Contract between partners sharing profits, losses, and management in a business | Contract between parties forming a joint venture for a specific project or business objective |

| Purpose | Ongoing business operations and profit-sharing | Limited scope for a specific project or goal |

| Duration | Typically indefinite until dissolution | Defined duration tied to project completion |

| Legal Entity | Partners act as co-owners with joint liability | Separate JV entity may be created or contractual agreement |

| Liability | Unlimited joint and several liability for partners | Liability limited to the JV agreement or separate entity |

| Management | Shared management and decision-making among partners | Management typically assigned per agreement or JV entity structure |

| Capital Contribution | Partners contribute capital, resources, or labor | Parties contribute assets and expertise for venture |

| Profit & Loss Sharing | Proportional to partnership agreement | Defined per JV agreement, project-specific |

| Regulatory Requirements | Subject to partnership laws and tax rules | JV may require additional registration or compliance |

Understanding Partnership Agreements

A Partnership Agreement establishes the roles, responsibilities, profit-sharing, and decision-making framework among individual partners operating a business collectively. It outlines legal obligations, capital contributions, management structure, and dispute resolution mechanisms, ensuring clarity and preventing conflicts. Unlike a Joint Venture Agreement, which governs collaboration for a specific project or limited time, a Partnership Agreement typically supports ongoing business operations and shared ownership.

Key Features of JV Agreements

Joint Venture (JV) agreements outline the key features such as shared ownership, profit and loss distribution, and clearly defined roles and responsibilities among parties collaborating on a specific project or business objective. These agreements emphasize the creation of a separate legal entity or contractual arrangement, detailing governance structures, decision-making processes, and exit strategies to protect each party's interests. Unlike general partnership agreements, JV agreements often include comprehensive clauses on resource contribution, risk allocation, and confidentiality to support the joint enterprise's success.

Legal Definition: Partnership vs JV

A Partnership Agreement legally creates a business relationship where two or more individuals share ownership, profits, and liabilities under a unified business entity governed by partnership law. In contrast, a Joint Venture (JV) Agreement establishes a temporary collaboration between parties to undertake a specific project or business activity, maintaining their separate legal identities without forming a new entity. The key legal distinction lies in the partnership's ongoing joint ownership and liability, whereas a JV is a limited-purpose alliance with contractual obligations but independent legal status.

Structure and Formation Differences

Partnership agreements establish a legal relationship where partners share management responsibilities, profits, and losses, often with flexible terms tailored to their contributions and roles. Joint venture (JV) agreements typically form a distinct entity or contractual arrangement for a specific project or business goal, with predefined scopes, limited duration, and clear boundaries on profit sharing and decision-making. The formation of partnerships usually involves registering the partnership and agreement among all partners, whereas JV agreements require detailed collaboration terms often documented through separate contracts or incorporation of a new entity.

Liability in Partnerships and JVs

Partnership agreements impose joint and several liability on partners, meaning each partner is personally responsible for the debts and obligations of the business. In contrast, joint venture agreements typically limit liability to the scope of the venture, and parties are liable only for their agreed contributions and actions within the JV. Understanding these liability distinctions is crucial for risk management and legal protection in collaborative business structures.

Capital Contribution and Profit Sharing

A Partnership Agreement typically involves partners contributing capital, skills, or assets, with profit sharing based on the agreed ratio reflecting each partner's input, often outlined explicitly to ensure clarity. In a Joint Venture (JV) Agreement, capital contributions are usually project-specific and can include cash, property, or intellectual property, with profit sharing strictly tied to the JV's performance and predefined terms. Both agreements require detailed provisions on capital infusion and profit distribution to protect stakeholder interests and maintain operational transparency.

Duration and Termination

Partnership agreements typically have flexible or indefinite durations, allowing partners to continue the business until they mutually decide to terminate the arrangement or specific conditions trigger dissolution. In contrast, joint venture (JV) agreements often specify a fixed duration tied to the completion of a particular project or objective, automatically ending when the goal is achieved or upon reaching the pre-agreed term. Termination clauses in partnership agreements usually require unanimous consent or cause-based triggers such as bankruptcy, while JV agreements may include detailed exit strategies, performance milestones, and conditions for early termination to protect the parties' investment and interests.

Governance and Decision-Making

A Partnership Agreement typically outlines equal management rights and shared decision-making responsibilities among partners, often requiring unanimous consent for significant decisions, reflecting a more flexible governance structure. In contrast, a Joint Venture (JV) Agreement establishes a distinct entity with a formal governance framework, including a Board of Directors or a management committee, where decision-making authority is often proportional to equity contributions. JV Agreements emphasize specific roles, voting thresholds, and dispute resolution mechanisms to balance control between parties and ensure structured oversight.

Tax Implications Compared

Partnership agreements are generally taxed as pass-through entities, meaning profits and losses flow directly to partners' personal tax returns, avoiding corporate tax but requiring self-employment tax on earnings. Joint venture (JV) agreements often involve separate legal entities, which may be subject to corporate income tax, potentially resulting in double taxation if profits are distributed as dividends. Understanding these tax implications helps businesses choose the optimal structure for minimizing tax liabilities and maximizing operational efficiency.

Choosing the Right Agreement: Factors to Consider

Choosing between a Partnership Agreement and a Joint Venture Agreement depends largely on the duration, scope, and legal implications of the collaboration. Partnership Agreements typically suit long-term business relationships with shared profits and liabilities, while Joint Venture Agreements are ideal for specific projects or limited-time collaborations, emphasizing clear roles and exit strategies. Careful consideration of tax treatment, liability exposure, and operational control ensures the selected agreement aligns with the business goals and risk tolerance.

Partnership Agreement Infographic

libterm.com

libterm.com