A commitment letter serves as a formal agreement outlining the terms and conditions between parties involved in a contract, often used in real estate, loans, or business deals. It specifies the obligations each party agrees to uphold, offering clarity and legal assurance to protect your interests throughout the transaction. Discover the key components and importance of a commitment letter by reading the rest of the article.

Table of Comparison

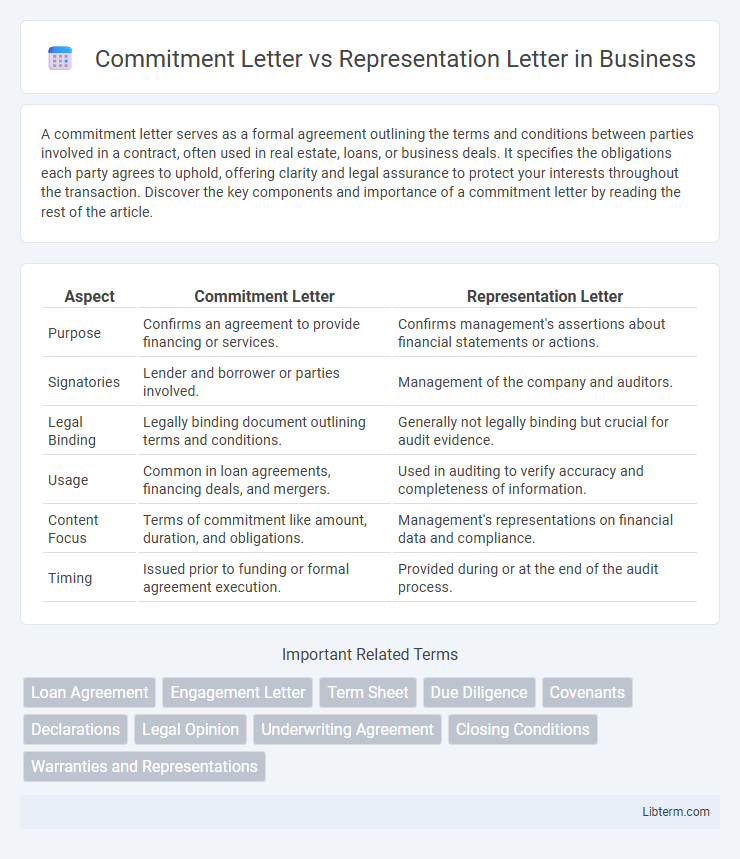

| Aspect | Commitment Letter | Representation Letter |

|---|---|---|

| Purpose | Confirms an agreement to provide financing or services. | Confirms management's assertions about financial statements or actions. |

| Signatories | Lender and borrower or parties involved. | Management of the company and auditors. |

| Legal Binding | Legally binding document outlining terms and conditions. | Generally not legally binding but crucial for audit evidence. |

| Usage | Common in loan agreements, financing deals, and mergers. | Used in auditing to verify accuracy and completeness of information. |

| Content Focus | Terms of commitment like amount, duration, and obligations. | Management's representations on financial data and compliance. |

| Timing | Issued prior to funding or formal agreement execution. | Provided during or at the end of the audit process. |

Introduction to Commitment and Representation Letters

Commitment letters outline the terms and conditions under which a party agrees to provide specific services or financial resources, serving as a formal agreement that establishes responsibilities and expectations. Representation letters are written assurances from management to auditors, affirming the accuracy and completeness of financial statements and compliance with relevant regulations. Both letters play crucial roles in legal and financial transactions by providing clarity and accountability between involved parties.

Definition of Commitment Letter

A Commitment Letter is a formal document issued by a lender outlining the terms and conditions under which financing will be provided to a borrower, serving as a guarantee of loan approval subject to specified requirements. It typically includes loan amount, interest rates, repayment schedule, and covenants, providing legal assurance during transaction processes. Unlike a Representation Letter, which details assertions made by one party to another, the Commitment Letter primarily functions as a binding agreement from the lender to the borrower.

Definition of Representation Letter

A representation letter is a formal document provided by management to auditors, affirming the accuracy and completeness of financial statements and disclosures during an audit. It serves as evidence of management's responsibilities and assertions, confirming that all relevant information has been disclosed. In contrast, a commitment letter typically outlines obligations and promises between parties, often related to financing or project agreements.

Purpose and Importance of Each Letter

A Commitment Letter outlines a formal agreement between parties, typically detailing the terms and obligations for financing or business transactions, ensuring clarity and legal enforceability. A Representation Letter, primarily used in auditing or legal contexts, confirms the accuracy and completeness of information provided by management to auditors or stakeholders, serving as a crucial accountability tool. Both letters are essential for establishing trust, defining responsibilities, and minimizing risks in financial and business processes.

Key Components of a Commitment Letter

A Commitment Letter outlines the key terms of a loan or business agreement, including the amount, interest rate, repayment schedule, and conditions for funding. It defines the obligations of both parties, timelines for execution, and any contingencies required to finalize the agreement. Clear articulation of these components ensures transparency and sets expectations for the contractual relationship.

Key Elements of a Representation Letter

A representation letter contains key elements such as management's assertions about the accuracy and completeness of financial statements, confirmation of compliance with laws and regulations, and disclosures related to liabilities, contingencies, and related party transactions. It serves as a formal acknowledgment by management that the information provided to auditors is truthful and complete. This letter is crucial for auditors to obtain written evidence supporting the financial statements and management's responsibilities.

Main Differences Between Commitment and Representation Letters

Commitment letters outline a lender's formal promise to provide financing under specified terms, establishing binding obligations for the loan disbursement. Representation letters are written statements from management to auditors, confirming the accuracy and truthfulness of financial information during an audit. The main difference lies in their purpose: commitment letters secure financing agreements, while representation letters provide assurance on financial statements.

When to Use a Commitment Letter vs Representation Letter

A Commitment Letter is used before a transaction or agreement to confirm the intent and terms agreed upon by involved parties, often in financing or real estate deals. A Representation Letter is provided after an audit or transaction, where management asserts the accuracy and completeness of financial statements or other information. Use a Commitment Letter to secure agreements upfront, while a Representation Letter is used to confirm and document representations post-event.

Legal Implications and Risks

A Commitment Letter outlines the contractual obligations between parties, establishing enforceable legal duties that, if breached, can lead to litigation or financial penalties. In contrast, a Representation Letter typically consists of statements or assurances made by one party about facts or conditions, and inaccuracies can result in misrepresentation claims or undermine legal defenses. Understanding the distinct roles and legal risks of each document is crucial for mitigating liability and ensuring compliance in corporate transactions.

Best Practices for Drafting Effective Commitment and Representation Letters

Effective commitment and representation letters require clear, concise language that explicitly outlines the obligations and assurances involved, minimizing ambiguity and potential disputes. Incorporating specific timelines, conditions, and scope of responsibilities ensures that all parties have a precise understanding of their roles and expectations. Regularly updating templates to reflect current legal standards and industry practices enhances the reliability and enforceability of both commitment and representation letters.

Commitment Letter Infographic

libterm.com

libterm.com